Kroger 2015 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-57

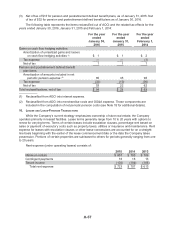

(3) Net of tax of $13 for pension and postretirement defined benefit plans, as of January 31, 2015. Net

of tax of $32 for pension and postretirement defined benefit plans as of January 30, 2016.

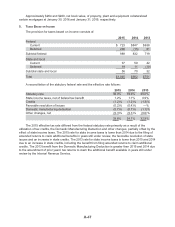

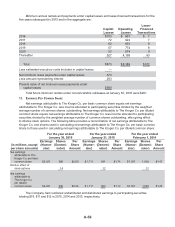

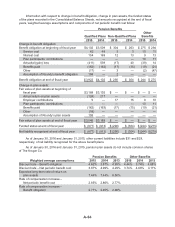

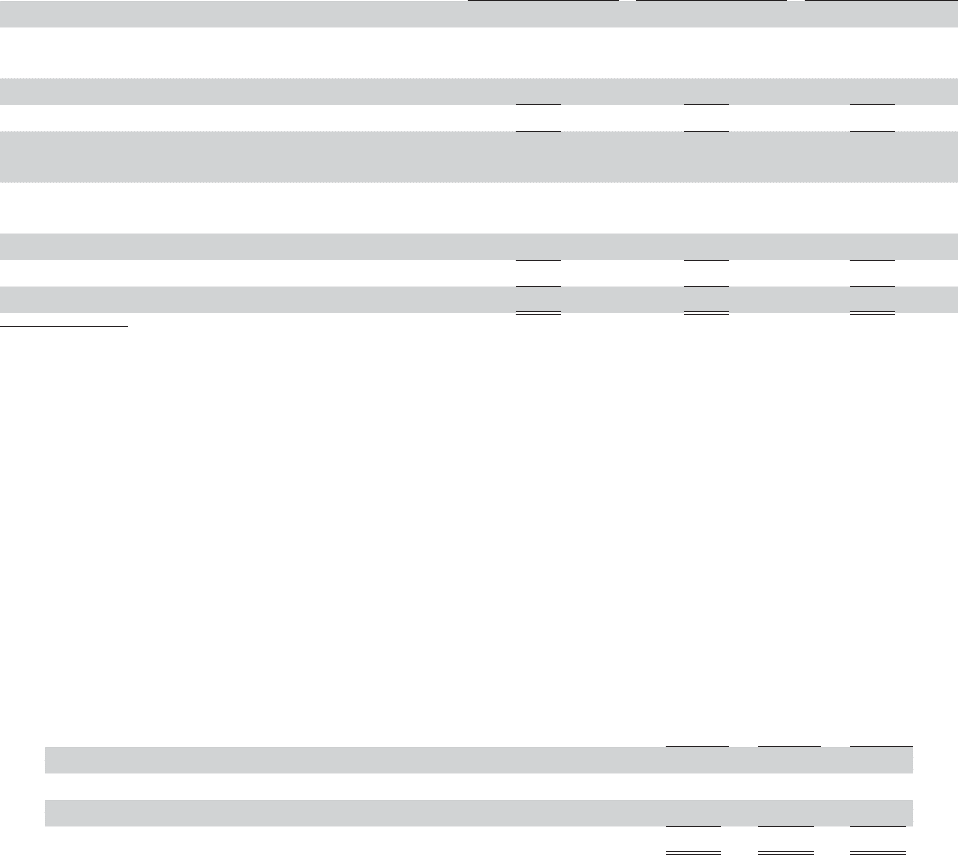

The following table represents the items reclassified out of AOCI and the related tax effects for the

years ended January 30, 2016, January 31, 2015 and February 1, 2014:

For the year

ended

January 30,

2016

For the year

ended

January 31,

2015

For the year

ended

February 1,

2014

Gains on cash flow hedging activities

Amortization of unrealized gains and losses

on cash flow hedging activities (1) $1 $1 $2

Tax expense — — (1)

Net of tax 1 1 1

Pension and postretirement defined benefit

plan items

Amortization of amounts included in net

periodic pension expense (2) 85 35 98

Tax expense (32) (13) (36)

Net of tax 53 22 62

Total reclassifications, net of tax $ 54 $ 23 $ 63

(1) Reclassified from AOCI into interest expense.

(2) Reclassified from AOCI into merchandise costs and OG&A expense. These components are

included in the computation of net periodic pension costs (see Note 15 for additional details).

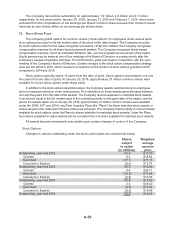

10. LEASES AND LEASE-FINANCED TRANSACTIONS

While the Company’s current strategy emphasizes ownership of store real estate, the Company

operates primarily in leased facilities. Lease terms generally range from 10 to 20 years with options to

renew for varying terms. Terms of certain leases include escalation clauses, percentage rent based on

sales or payment of executory costs such as property taxes, utilities or insurance and maintenance. Rent

expense for leases with escalation clauses or other lease concessions are accounted for on a straight-

line basis beginning with the earlier of the lease commencement date or the date the Company takes

possession. Portions of certain properties are subleased to others for periods generally ranging from one

to 20 years.

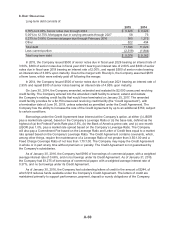

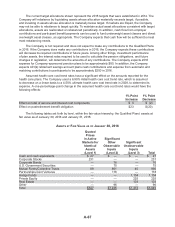

Rent expense (under operating leases) consists of:

2015 2014 2013

Minimum rentals $ 807 $ 795 $ 706

Contingent payments 18 16 13

Tenant income (102) (104) (106)

Total rent expense $ 723 $ 707 $ 613