Kroger 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

The Board of Directors Recommends a Vote Against This Proposal for the Following Reasons:

Kroger believes that the policy advocated by the shareholder proposal is not in the best interests of

our shareholders as it reduces long-term flexibility in the allocation of capital. In a rapidly evolving capital

market, this flexibility is an essential element in the careful management of shareholder capital, which the

Board thoughtfully oversees and reviews on a regular basis.

Our long-term financial strategy continues to be to use cash flow from operations, in a balanced

manner, to repurchase shares, fund dividends, and increase capital investments, all while maintaining our

current investment grade debt rating. Our balanced approach gives us the flexibility to pursue long-term

growth strategies while returning capital to our shareholders.

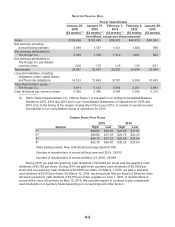

Kroger is proud of our strong history of capital return to shareholders. We have made significant

commitments over time to return capital to shareholders both through repurchases of our common shares

and payment of cash dividends. We repurchased $703 million of Kroger common shares in 2015, as

well as $1.1 billion in 2014, $338 million in 2013 and $1.2 billion in 2012. Additionally, we paid dividends

totaling $385 million in 2015, $338 million in 2014, $319 million in 2013 and $267 million in 2012. We are

also committed to growing long-term shareholder value through significant capital investments. Excluding

acquisitions, we invested $3.38 billion, $2.89 billion, $2.46 billion and $2.06 billion in capital projects

in 2015, 2014, 2013, and 2012, respectively. Many of our shareholders view both dividends and share

repurchases as an important component of Kroger’s investment profile, especially in light of our balanced

capital return strategy that contributes to a healthy TSR (total shareholder return), which outperforms

both our peers and the S&P 500 over time.

When contemplating capital returns, the Board engages in a thorough analysis and oversight

process. Before the Board approves any share repurchase program or declares a cash dividend, it

takes into account a wide range of factors, including Kroger’s short and long-term growth strategies,

liquidity needs and capital requirements, cash flows, net earnings, debt obligations, and leverage ratios.

The Board also considers how the then-current capital market conditions affect Kroger’s policies and

strategies. There is no one-size-fits-all policy or strategy in returning capital to shareholders that would

satisfy each market condition over the course of time. Balanced capital allocation decisions, overseen by

an effective Board, remain the most effective and flexible strategy to continuously deliver healthy value to

shareholders over the long-term.

This proposal requests that Kroger adopt a general policy that gives preference to share

repurchases relative to cash dividends. We urge you to vote AGAINST this proposal.