Kroger 2015 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.36

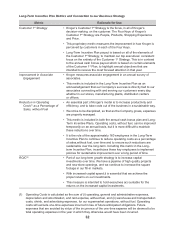

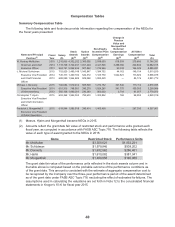

Process for Establishing Executive Compensation

The Compensation Committee of the Board has the primary responsibility for establishing the

compensation of our executive officers, including the NEOs, with the exception of the Chief Executive Officer.

The Compensation Committee’s role regarding the CEO’s compensation is to make recommendations to

the independent members of the Board; those members of the Board establish the CEO’s compensation.

The Compensation Committee directly engages a compensation consultant from Mercer Human

Resource Consulting to advise the Compensation Committee in the design of compensation for executive

officers.

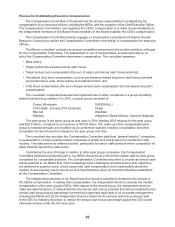

The Mercer consultant conducts an annual competitive assessment of executive positions at Kroger

for the Compensation Committee. The assessment is one of several bases, as described above, on

which the Compensation Committee determines compensation. The consultant assesses:

• Base salary;

• Target performance-based annual cash bonus;

• Target annual cash compensation (the sum of salary and annual cash bonus potential);

• Annualized long-term compensation, such as performance-based long-term cash bonus potential

and performance units, stock options and restricted stock; and

• Total direct compensation (the sum of target annual cash compensation and annualized long-term

compensation).

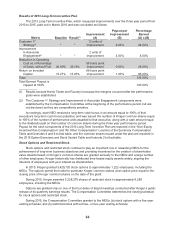

The consultant compares these elements against those of other companies in a group of publicly-

traded food and drug retailers. For 2015, our peer group consisted of:

Costco Wholesale SUPERVALU

CVS Health, formerly CVS Caremark Target

Rite Aid Wal-Mart

Safeway Walgreens Boots Alliance, formerly Walgreen

This peer group is the same group as was used in 2014. Median 2015 revenue for the peer group

was $92.5 billion, compared to our revenue of $109.8 billion. The make-up of the compensation peer

group is reviewed annually and modified as circumstances warrant. Industry consolidation and other

competitive forces will result in changes to the peer group over time.

The consultant also provides the Compensation Committee data from “general industry” companies,

a representation of major publicly-traded companies of similar size and scope from outside the retail

industry. This data serves as reference points, particularly for senior staff positions where competition for

talent extends beyond the retail sector.

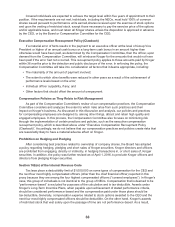

Considering the size of Kroger in relation to other peer group companies, the Compensation

Committee believes that salaries paid to our NEOs should be at or above the median paid by peer group

companies for comparable positions. The Compensation Committee also aims to provide an annual cash

bonus potential to our NEOs that, if the increasingly more challenging annual business plan objectives

are achieved at superior levels, would cause total cash compensation to be meaningfully above the

median. Actual payouts may be as low as zero if performance does not meet the baselines established

by the Compensation Committee.

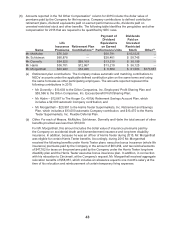

The independent members of the Board have the exclusive authority to determine the amount of

the CEO’s compensation. In setting total compensation, the independent directors consider the median

compensation of the peer group’s CEOs. With respect to the annual bonus, the independent directors

make two determinations: (1) they determine the annual cash bonus potential that will be multiplied by the

annual cash bonus payout percentage earned that is generally applicable to all corporate management,

including the NEOs and (2) the independent directors determine the annual cash bonus amount paid

to the CEO by retaining discretion to reduce the annual cash bonus percentage payout the CEO would

otherwise receive under the formulaic plan.