Kroger 2015 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-26

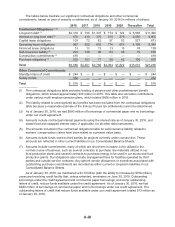

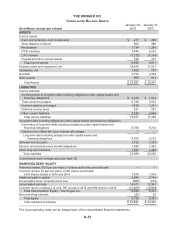

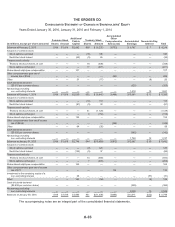

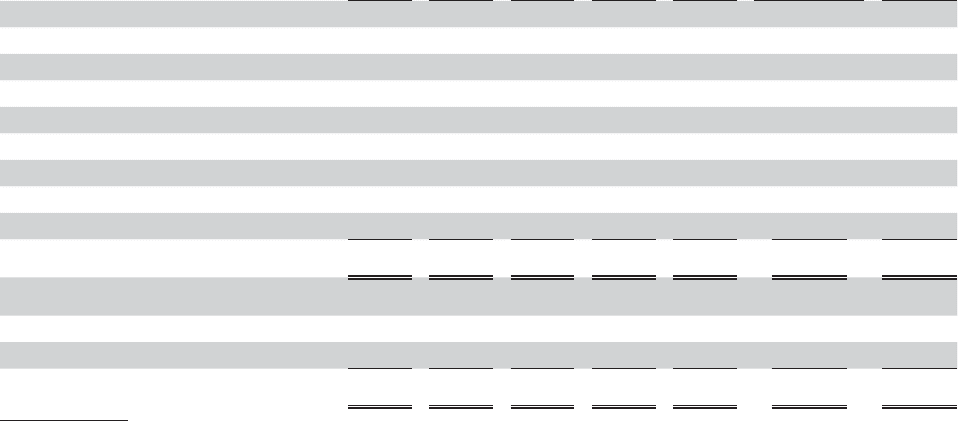

The tables below illustrate our significant contractual obligations and other commercial

commitments, based on year of maturity or settlement, as of January 30, 2016 (in millions of dollars):

2016 2017 2018 2019 2020 Thereafter Total

Contractual Obligations (1) (2)

Long-term debt (3) $2,318 $ 735 $1,307 $ 774 $ 724 $ 5,538 $ 11,396

Interest on long-term debt (4) 476 410 375 315 279 2,550 4,405

Capital lease obligations 103 72 62 57 52 527 873

Operating lease obligations 967 922 853 774 674 4,199 8,389

Financed lease obligations 1313131313 74 139

Self-insurance liability (5) 223 138 98 63 38 79 639

Construction commitments (6) 418———— — 418

Purchase obligations (7) 532 161 77 58 42 106 976

Total $5,050 $2,451 $2,786 $2,054 $1,822 $13,072 $27,235

Other Commercial Commitments

Standby letters of credit $244$—$—$—$— $ — $244

Surety bonds 332———— — 332

Total $576$—$—$—$— $ — $576

(1) The contractual obligations table excludes funding of pension and other postretirement benefit

obligations, which totaled approximately $30 million in 2015. This table also excludes contributions

under various multi-employer pension plans, which totaled $426 million in 2015.

(2) The liability related to unrecognized tax benefits has been excluded from the contractual obligations

table because a reasonable estimate of the timing of future tax settlements cannot be determined.

(3) As of January 30, 2016, we had $990 million of borrowings of commercial paper and no borrowings

under our credit agreement.

(4) Amounts include contractual interest payments using the interest rate as of January 30, 2016, and

stated fixed and swapped interest rates, if applicable, for all other debt instruments.

(5) The amounts included in the contractual obligations table for self-insurance liability related to

workers’ compensation claims have been stated on a present value basis.

(6) Amounts include funds owed to third parties for projects currently under construction. These

amounts are reflected in other current liabilities in our Consolidated Balance Sheets.

(7) Amounts include commitments, many of which are short-term in nature, to be utilized in the

normal course of business, such as several contracts to purchase raw materials utilized in our

food production plants and several contracts to purchase energy to be used in our stores and food

production plants. Our obligations also include management fees for facilities operated by third

parties and outside service contracts. Any upfront vendor allowances or incentives associated with

outstanding purchase commitments are recorded as either current or long-term liabilities in our

Consolidated Balance Sheets.

As of January 30, 2016, we maintained a $2.75 billion (with the ability to increase by $750 million),

unsecured revolving credit facility that, unless extended, terminates on June 30, 2019. Outstanding

borrowings under the credit agreement and commercial paper borrowings, and some outstanding

letters of credit, reduce funds available under the credit agreement. As of January 30, 2016, we had

$990 million of borrowings of commercial paper and no borrowings under our credit agreement. The

outstanding letters of credit that reduce funds available under our credit agreement totaled $13 million as

of January 30, 2016.