Kroger 2015 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

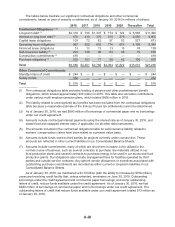

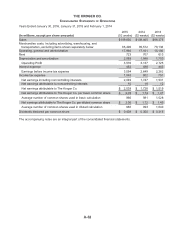

A-34

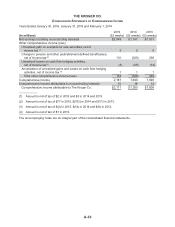

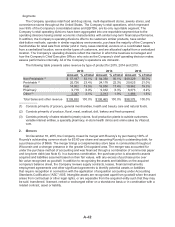

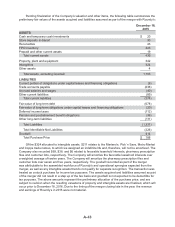

THE KROGER CO.

CONSOLIDATED STATEMEN TS oF CASH FLOWS

Years Ended January 30, 2016, January 31, 2015 and February 1, 2014

(In millions)

2015

(52 weeks)

2014

(52 weeks)

2013

(52 weeks)

Cash Flows From Operating Activities:

Net earnings including noncontrolling interests $ 2,049 $ 1,747 $ 1,531

Adjustments to reconcile net earnings to net cash provided by operating activities:

Depreciation and amortization 2,089 1,948 1,703

Asset impairment charge 46 37 39

LIFO charge 28 147 52

Stock-based employee compensation 165 155 107

Expense for Company-sponsored pension plans 103 55 74

Deferred income taxes 317 73 72

Other 54 72 47

Changes in operating assets and liabilities net of effects from mergers

of businesses:

Store deposits in-transit 95 (27) 25

Receivables (59) (141) (8)

Inventories (184) (147) (131)

Prepaid and other current assets (28) 2 (49)

Trade accounts payable 440 135 196

Accrued expenses 191 197 77

Income taxes receivable and payable (359) (68) (47)

Contribution to Company-sponsored pension plans (5) — (100)

Other (109) (22) (15)

Net cash provided by operating activities 4,833 4,163 3,573

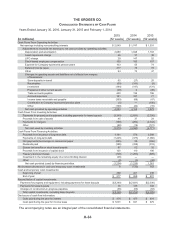

Cash Flows From Investing Activities:

Payments for property and equipment, including payments for lease buyouts (3,349) (2,831) (2,330)

Proceeds from sale of assets 45 37 24

Payments for mergers (168) (252) (2,344)

Other (98) (14) (121)

Net cash used by investing activities (3,570) (3,060) (4,771)

Cash Flows From Financing Activities:

Proceeds from issuance of long-term debt 1,181 576 3,548

Payments on long-term debt (1,245) (375) (1,060)

Net (payments) borrowings on commercial paper (285) 25 (395)

Dividends paid (385) (338) (319)

Excess tax benefits on stock based awards 97 52 32

Proceeds from issuance of capital stock 120 110 196

Treasury stock purchases (703) (1,283) (609)

Investment in the remaining equity of a noncontrolling interest (26) — —

Other (8) (3) (32)

Net cash provided (used) by financing activities (1,254) (1,236) 1,361

Net increase (decrease) in cash and temporary cash investments 9 (133) 163

Cash and temporary cash investments:

Beginning of year 268 401 238

End of year $ 277 $ 268 $ 401

Reconciliation of capital investments:

Payments for property and equipment, including payments for lease buyouts $(3,349) $(2,831) $(2,330)

Payments for lease buyouts 35 135 108

Changes in construction-in-progress payables (35) (56) (83)

Total capital investments, excluding lease buyouts $(3,349) $(2,752) $(2,305)

Disclosure of cash flow information:

Cash paid during the year for interest $ 474 $ 477 $ 401

Cash paid during the year for income taxes $ 1,001 $ 941 $ 679

The accompanying notes are an integral part of the consolidated financial statements.