Kroger 2015 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A-74

Based on the most recent information available to it, the Company believes the present value of

actuarial accrued liabilities in most of these multi-employer plans substantially exceeds the value of the

assets held in trust to pay benefits. Moreover, if the Company were to exit certain markets or otherwise

cease making contributions to these funds, the Company could trigger a substantial withdrawal liability.

Any adjustment for withdrawal liability will be recorded when it is probable that a liability exists and can

be reasonably estimated.

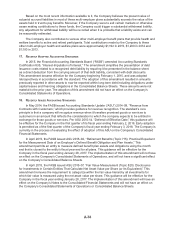

The Company also contributes to various other multi-employer benefit plans that provide health and

welfare benefits to active and retired participants. Total contributions made by the Company to these

other multi-employer health and welfare plans were approximately $1,192 in 2015, $1,200 in 2014 and

$1,100 in 2013.

17. RECENTLY ADOPTED ACCOUNTING STANDARDS

In 2015, the Financial Accounting Standards Board (“FASB”) amended Accounting Standards

Codification 835, “Interest-Imputation of Interest.” The amendment simplifies the presentation of debt

issuance costs related to a recognized debt liability by requiring it be presented in the balance sheet

as a direct deduction from the carrying amount of that debt liability, consistent with debt discounts.

This amendment became effective for the Company beginning February 1, 2015, and was adopted

retrospectively in accordance with the standard. The adoption of this amendment resulted in amounts

previously reported in other assets to now be reported within long-term debt including obligations under

capital leases and financing obligations in the Consolidated Balance Sheets. These amounts were not

material to the prior year. The adoption of this amendment did not have an effect on the Company’s

Consolidated Statements of Operations.

18. RECENTLY ISSUED ACCOUNTING STANDARDS

In May 2014, the FASB issued Accounting Standards Update (“ASU”) 2014-09, “Revenue from

Contracts with Customers,” which provides guidance for revenue recognition. The standard’s core

principle is that a company will recognize revenue when it transfers promised goods or services to

customers in an amount that reflects the consideration to which the company expects to be entitled in

exchange for those goods or services. Per ASU 2015-14, “Deferral of Effective Date,” this guidance will

be effective for the Company in the first quarter of its fiscal year ending February 2, 2019. Early adoption

is permitted as of the first quarter of the Company’s fiscal year ending February 3, 2018. The Company is

currently in the process of evaluating the effect of adoption of this ASU on the Company’s Consolidated

Financial Statements.

In April 2015, the FASB issued ASU 2015-04, “Retirement Benefits (Topic 715): Practical Expedient

for the Measurement Date of an Employer’s Defined Benefit Obligation and Plan Assets.” This

amendment permits an entity to measure defined benefit plan assets and obligations using the month

end that is closest to the entity’s fiscal year end for all plans. This guidance will be effective for the

Company in the fiscal year ending January 28, 2017. The implementation of this amendment will not have

an effect on the Company’s Consolidated Statements of Operations, and will not have a significant effect

on the Company’s Consolidated Balance Sheets.

In April 2015, the FASB issued ASU 2015-07, “Fair Value Measurement (Topic 820): Disclosures

for Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent).” This

amendment removes the requirement to categorize within the fair value hierarchy all investments for

which fair value is measured using the net asset value per share. This guidance will be effective for the

Company in the fiscal year ending January 28, 2017. The implementation of this amendment will have an

effect on the Company’s Notes to the Consolidated Financial Statements and will not have an effect on

the Company’s Consolidated Statements of Operations or Consolidated Balance Sheets.