Kroger 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

PROXY STATEMENT

AND

2014 ANNUAL REPORT

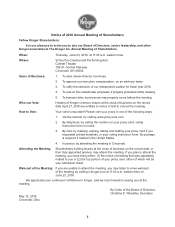

NOTICE OF 2016 ANNUAL MEETING OF SHAREHOLDERS

PROXY STATEMENT

AND

2015 ANNUAL REPORT

Table of contents

-

Page 1

A6N N M ET NTG AR NON T IO CT EIC OE F O 2F 01 AU NA NL UA L EM EIE I NO G F OS FH S HE AH RO EL HD OE LR DS ERS ST PR RO OX XY S TA AT E EM ME EN NT AND 2 014 5 A AN NN NUAL REP PO OR RT T -

Page 2

Kroger Supermarkets Price-Impact Stores Multi-Department Stores Bring it all home. Convenience Stores Convenience Stores Jewelry Stores Jewelry Stores Secialty Specialty Retailer Retailer Services Services -

Page 3

... year. Growth in identical supermarket sales and net earnings per diluted share, FIFO operating profit margin expansion and return on invested capital were all better than our long-term guidance. We also achieved our eleventh consecutive year of market share growth. In 2015, we continued to return... -

Page 4

... investing in markets with growth potential so we can serve more customers every day. In 2015 we merged with Milwaukee-based Roundy's, Inc. Roundy's brought to Kroger more than 22,000 talented associates and outstanding Pick 'n Save, Copps and Metro Market store locations in new markets in the state... -

Page 5

... grocery store chain focused on natural, organic and locally-grown products. Our interest and investment in Lucky's is fueled by the company's great people and unique go-to-market strategy - with a 30,000 square foot store format that resembles an indoor farmers market and a culinary department that... -

Page 6

... of them started their Kroger careers as part-time clerks. We are very proud of our opportunity culture, where associates can turn a job into a career. As our business expands we are creating new jobs and new opportunities for current associates. We added 9,000 jobs in 2015 and have created more... -

Page 7

... long-term sales and earnings goals, sustainable long-term shareholder value, execute on our growth strategy and business plan, ability to increase dividends, ability to grow market share, and our ability to develop new brands and implement new technologies, among other statements. These statements... -

Page 8

Congratulations to the winners of The Kroger Co. Community Service Award for 2015: 2015 Community Service Award Winners Division Atlanta Central Cincinnati City Market Columbus Delta Dillon Stores Food 4 Less Fred Meyer Fry's Jay C Stores King Soopers Louisville Michigan Mid-Atlantic Nashville QFC ... -

Page 9

... you to join our Board of Directors, senior leadership, and other Kroger associates at The Kroger Co. Annual Meeting of Shareholders. When: Where: Thursday, June 23, 2016, at 11:00 a.m. eastern time. School for Creative and Performing Arts Corbett Theater 108 W. Central Parkway Cincinnati, OH 45202... -

Page 10

... written notice to Kroger's Secretary at 1014 Vine Street, Cincinnati, Ohio 45202-1100, in person at the meeting or by executing and sending us a subsequent proxy. How many shares are outstanding? As of the close of business on April 27, 2016, the record date, our outstanding voting securities... -

Page 11

...7, Shareholder Proposals See pages 64-70 Board Recommendation FOR FOR FOR AGAINST Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on June 23, 2016 The Notice of 2016 Annual Meeting, Proxy Statement and 2015 Annual Report and the means to vote by... -

Page 12

... lead director with clearly defined roles and responsibilities. 3 Annual Board and Committee self-assessments. 3 Annual evaluation of the Chairman and CEO by the independent directors. 3 High degree of Board interaction with management to ensure successful oversight and succession planning. 3 Stock... -

Page 13

... three years in financial services working in corporate finance and investment banking. She is a member of the Board of Directors of The Bank of Nova Scotia, The Neiman Marcus Group, and Cadillac Fairview, one of North America's largest owners, operators and developers of commercial real estate. Ms... -

Page 14

..., having led a major, publicly-traded retailer of beauty and related consumer products. She has extensive experience in manufacturing, marketing, supply chain operations, customer service, and product development, all of which assist her in her role as a member of Kroger's Board. Ms. Kropf has... -

Page 15

... Chief Executive Officer of First Service Networks from 2000 to 2014. Clyde R. Moore Age 62 Director Since 1997 Committees: Mr. Moore has over 30 years of general management experience in public and Compensation private companies. He has sound experience as a corporate leader overseeing Corporate... -

Page 16

... to Kroger's Board a strong financial background, having led a major financial services provider. He has served on the compensation committee of a major corporation. Mr. Sargent is Chairman and Chief Executive Officer of Staples, Inc., a business products retailer, where he has been employed since... -

Page 17

... Lead Director works with the Chairman to share governance responsibilities, facilitate the development of Kroger's strategy and grow shareholder value. The Lead Director serves a variety of roles, consistent with current best practices, including: • reviewing and approving Board meeting agendas... -

Page 18

... committees: Audit, Compensation, Corporate Governance, Financial Policy and Public Responsibilities. All committees are composed exclusively of independent directors, as determined under the NYSE listing standards. The current charter of each Board committee is available on our website at ir.kroger... -

Page 19

... directors, the performance of the CEO • Reviews and recommends financial policies and practices • Oversees management of the Company's financial resources • Reviews the Company's annual financial plan, significant capital investments, plans for major acquisitions or sales, issuance of new... -

Page 20

... less than 0.06% of Staples' annual consolidated gross revenue. Kroger periodically employs a bidding process or negotiations following a benchmarking of costs of products from various vendors for the items purchased from Staples and awards the business based on the results of that process. 18 -

Page 21

... of Ethics The Board has adopted The Kroger Co. Policy on Business Ethics, applicable to all officers, employees and directors, including Kroger's principal executive, financial and accounting officers. The Policy is available on our website at ir.kroger.com under Corporate Governance - Highlights... -

Page 22

... has or had executive officers serving as a member of Kroger's Board of Directors or Compensation Committee of the Board. Board Oversight of Enterprise Risk While risk management is primarily the responsibility of Kroger's management team, the Board is responsible for strategic planning and overall... -

Page 23

...and Fiscal Year 2015 Results Kroger's growth plan includes four key performance indicators: positive identical supermarket sales without fuel ("ID Sales") growth, slightly expanding non-fuel first in, first out ("FIFO") operating margin, growing return on invested capital ("ROIC"), and annual market... -

Page 24

...time-based equity awards) • Stock options vest over 5 years • Exercise price of stock options is closing price on day of grant • Restricted stock vests over 3 or 5 years What we do not do: 8 No employment contracts with executives 8 No special severance or change of control programs applicable... -

Page 25

...the stock price annual NEOs, for appreciation performance long-term on key financial performance and operational on key financial measures and operational measures • Drives sustainable performance that ties to long-term value creation for shareholders Average of Other NEOs Not at Risk 18% CEO Not... -

Page 26

... our business and financial goals. Kroger's incentive plans are designed to reward the actions that lead to long-term value creation. The Compensation Committee believes that there is a strong link between our business strategy, the performance metrics in our short-term and long-term incentive... -

Page 27

...-Term Compensation: ¾ Performance-Based Long-Term Incentive Plan (consisting of a long-term cash bonus and performance units) ¾ Non-qualified stock options ¾ Restricted stock • Retirement and other benefits • Limited perquisites The annual and long-term performance-based compensation awards... -

Page 28

... associates are eligible for an annual cash bonus plan of which 40% is based on the Kroger corporate plan and 60% is based on the metrics and targets for their respective supermarket division or operating unit of the Company. Over time, the Compensation Committee and our independent directors... -

Page 29

...total compensation awarded by our peer group. The annual cash bonus potential in effect at the end of the fiscal year for each NEO is shown below. Actual annual cash bonus payouts are prorated to reflect changes, if any, to bonus potentials during the year. Annual Cash Bonus Potential 2013 2014 2015... -

Page 30

...part of Kroger's model is to increase productivity and efficiency, and to take costs out of the business in a sustainable way. • We strive to be disciplined, so that as the Company grows, expenses are properly managed. Total Operating Costs as a Percentage of Sales, without Fuel(2) 10% Total of... -

Page 31

... of sales for fiscal year 2015. An additional 5% is earned if Kroger achieves three goals with respect to its supermarket fuel operations: achievement of the targeted fuel EBITDA of $242 million, an increase in total gallons sold of 3%,and achievement of 50 additional fuel centers placed in service... -

Page 32

... not achieve all of our business plan objectives. A comparison of actual annual cash bonus percentage payouts in prior years demonstrates the variability of annual cash bonus incentive compensation and its strong link to our performance: Fiscal Year 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006... -

Page 33

... wealth by supporting the Company's long-term strategic goals. Stock options and restricted stock are linked to stock performance creating alignment between executives and company shareholders. Options have no initial value and recipients only realize benefits if the value of our stock increases... -

Page 34

... our Company's success is directly tied to our associates connecting with and serving our customers every day, whether in our stores, manufacturing plants, distribution centers or offices. Reduction in Operating Costs(1) as a Percentage of Sales, without Fuel • An essential part of Kroger's model... -

Page 35

... of fiscal year 2012* 2014 Plan 2014 to 2016 March 2017 Salary at end of fiscal year 2013* 2015 Plan 2015 to 2017 March 2018 Salary at end of fiscal year 2014* Performance Period Payout Date Long-term Cash Bonus Potential Performance Metrics Customer 1st Strategy Improvement in Associate Engagement... -

Page 36

... point improvement 66 basis point improvement Payout per Improvement (B) 2.00% Percentage Earned (A) x (B) 24.00% Metric Customer 1st Strategy(2) Improvement in Associate Engagement(2) Reduction in Operating Cost as a Percentage of Sales, without Fuel Return on Invested Capital Total Total Earned... -

Page 37

...to pay the exercise price of the options and/or applicable taxes, until applicable stock ownership guidelines are met, unless the disposition is approved in advance by the CEO, or by the Board or Compensation Committee for the CEO. Retirement and Other Benefits Kroger maintains a defined benefit and... -

Page 38

... reviewed annually and modified as circumstances warrant. Industry consolidation and other competitive forces will result in changes to the peer group over time. The consultant also provides the Compensation Committee data from "general industry" companies, a representation of major publicly-traded... -

Page 39

...and contribution to our management team. In considering each of the factors above, the Compensation Committee does not make use of a formula, but rather quantitatively reviews each factor in setting compensation. Advisory Vote to Approve Executive Compensation At the 2015 annual meeting, we held our... -

Page 40

... those necessary to pay the exercise price of the options and/or applicable taxes, and must retain all Kroger shares unless the disposition is approved in advance by the CEO, or by the Board or Compensation Committee for the CEO. Executive Compensation Recoupment Policy (Clawback) If a material... -

Page 41

...and supports Kroger's compensation philosophy, the Compensation Committee also will attempt to maximize the amount of compensation expense that is deductible by Kroger. Compensation Committee Report The Compensation Committee has reviewed and discussed with management of the Company the Compensation... -

Page 42

... became NEOs in 2015. Amounts reflect the grant date fair value of restricted stock and performance units granted each fiscal year, as computed in accordance with FASB ASC Topic 718. The following table reflects the value of each type of award granted to the NEOs in 2015: Name Mr. McMullen Mr... -

Page 43

... fiscal year 2015. Non-equity incentive plan compensation earned for 2015 consists of amounts earned under the 2015 performance-based annual cash bonus program and the 2013 Long-Term Incentive Plan. The amount reported for Mr. Morganthall also includes the 2015 amount earned under the Harris Teeter... -

Page 44

... year depending on a number of factors, including age, years of service, average annual earnings and the assumptions used to determine the present value, such as the discount rate. The change in the actuarial present value of accumulated pension benefits for 2014 was significantly greater than 2013... -

Page 45

... the Harris Teeter long-term disability plan and the Harris Teeter executive bonus insurance plan. In addition, in connection with his relocation to Cincinnati, at the Company's request, Mr. Morganthall received aggregate relocation benefits of $58,851, which includes an allowance equal to one month... -

Page 46

...All Other Option Stock Awards: Exercise Awards: Estimated Future Number of Number of or Base Payouts Under Shares of Securities Price of Equity Incentive Stock or Underlying Option Plan Awards Options Units Awards Target Maximum (#)(5) ($/Sh 4) Grant Date Fair Value of Stock and Option Awards Name... -

Page 47

... the "Stock Awards" column and described in footnote 2 to that table. These amounts represent the number of stock options granted in 2015. Options are granted with an exercise price equal to the closing price of Kroger common shares on the grant date. The aggregate grant date fair value reported in... -

Page 48

...performance units is based on the closing price of Kroger's common shares of $38.81 on January 29, 2016, the last trading day of 2015. Option Awards Stock Awards Equity Incentive Plan Awards: Number of Market Value Unearned of Shares Shares, or Units of Units or Stock That Other Rights Have Not That... -

Page 49

...of fiscal year-end. (17) Performance units granted under the 2015 Long-Term Incentive Plan are earned as of the last day of fiscal 2017, to the extent performance conditions are achieved. Because the awards earned are not currently determinable, the number of units and the corresponding market value... -

Page 50

... Excess Benefit Plan Kroger Consolidated Retirement Benefit Plan Harris Teeter Employees' Pension Plan Harris Teeter Supplemental Executive Retirement Plan (1) The discount rate used to determine the present values was 4.66% for the Kroger and Dillon plans, 4.65% for the Harris Teeter Supermarkets... -

Page 51

...of credited service multiplied by the average of the highest five years of total earnings (base salary and annual cash bonus) during the last ten calendar years of employment, reduced by 1¼% times years of credited service multiplied by the primary social security benefit; • normal retirement age... -

Page 52

... annual retirement benefit under the HT Pension Plan at age 65 is an amount equal to 0.8% of his final average earnings multiplied by years of service at retirement, plus 0.6% of his final average earnings in excess of Social Security covered compensation multiplied by the number of years of service... -

Page 53

... insurance and other Internal Revenue Code Section 125 plan deductions, as well as up to 100% of their annual and long-term cash bonus compensation. Kroger does not match any deferral or provide other contributions. Deferral account amounts are credited with interest at the rate representing Kroger... -

Page 54

... the retirement age and is eligible for the full benefit. The HT Flexible Deferral Plan also allows for an in-service withdrawal for an unforeseeable emergency based on facts and circumstances that meet Internal Revenue Service and plan guidelines. Harris Teeter uses a nonqualified trust to purchase... -

Page 55

... payments will not exceed 2.99 times the officer's average W-2 earnings over the preceding five years. Long-Term Compensation Awards The following table describes the treatment of long-term compensation awards following a termination of employment or change in control of Kroger. In each case, the... -

Page 56

... on the last day of the fiscal year, January 30, 2016, given compensation, age and service levels as of that date and, where applicable, based on the closing market price per Kroger common share on the last trading day of the fiscal year ($38.81 on January 29, 2016). Amounts actually received... -

Page 57

...exercise price of the stock option and the closing price per Kroger common share on January 29, 2016. In accordance with SEC rules, no amount is reported in the voluntary termination/retirement column because vesting is not accelerated, but the awards may continue to vest on the original schedule if... -

Page 58

... proxy statement in accordance with the SEC's rules. As discussed earlier in the Compensation Discussion and Analysis, our compensation philosophy is to attract and retain the best management talent and to motivate these employees to achieve our business and financial goals. Our incentive plans are... -

Page 59

... date fair value of the annual incentive share award, computed in accordance with FASB ASC Topic 718. Options are no longer granted to non-employee directors. The aggregate number of previously granted stock options that remained unexercised and outstanding at fiscal year-end was as follows: Name... -

Page 60

... service on the Board. Non-employee director compensation will be reviewed from time to time as the Corporate Governance Committee deems appropriate. Pension Plan Non-employee directors first elected prior to July 17, 1997 receive an unfunded retirement benefit equal to the average cash compensation... -

Page 61

...those named above) (1) (2) No director or officer owned as much as 1% of Kroger common shares. The directors and executive officers as a group beneficially owned less than 1% of Kroger common shares. This amount includes incentive share awards that were deferred under the deferred compensation plan... -

Page 62

...beneficial owners were timely satisfied, with the following exception. In August 2015, Michael L. Ellis, who retired as President and Chief Operating Officer of the Company in July 2015, was 2 days late in the filing of a Form 4 to report a stock purchase in the amount of 500 shares. Related Person... -

Page 63

... Audit Committee Report. The Audit Committee performs this work pursuant to a written charter approved by the Board of Directors. The Audit Committee charter most recently was revised during fiscal 2012 and is available on the Company's website at ir.kroger.com under Corporate Governance - Committee... -

Page 64

... by PricewaterhouseCoopers LLP for the annual audit and quarterly reviews of our consolidated financial statements for fiscal 2015 and 2014, and for audit-related, tax and all other services performed in 2015 and 2014. Fiscal Year Ended January 30, 2016 January 31, 2015 $5,659,193 $5,250,203 - 441... -

Page 65

... in executive sessions; • Reviewed and discussed with management the audited financial statements included in our Annual Report; • Discussed with PricewaterhouseCoopers LLP the matters required to be discussed under the applicable requirements of the Public Company Accounting Oversight Board... -

Page 66

...The report should be made available to shareholders on Kroger's website no later than October 31, 2016. Supporting Statement As long-term shareholders, we favor policies and practices that protect and enhance the value of our investments. There is increasing recognition that company risks related to... -

Page 67

... informs our business decisions. The Center of Excellence is also tasked with recommending ways to continually improve social accountability in our supply chain. • In 2015, our annual sustainability report included a more in-depth report on our social responsibility activities, which is available... -

Page 68

..., availability, quality, material type, function, recyclability and cost, among others. We are increasingly labeling recyclable Corporate Brand products per the Federal Trade Commission's Green Guides, prompting our customers to "PLEASE RECYCLE." One example is through our redesign of Kroger brand... -

Page 69

... renewable energy at only 8 of its 3,806 stores, plants, and distribution centers, approximately 0.2% of its locations. (Kroger "Energy/Carbon" website, Factbook). In contrast, Whole Foods Market offsets its entire power use with renewable energy credits, and Walmart is at 24% renewable power... -

Page 70

... makes business sense, helping companies diversify their power supply, hedge against fuel risks, and support innovation in an increasingly cost-competitive way ." ("Google's commitment to sustainability", Google Green Blog, 2014). Resolved: Shareholders request that Kroger produce a report, by year... -

Page 71

... Dividend "Resolved: Shareholders of The Kroger Co. ask the board of directors to adopt and issue a general payout policy that gives preference to share repurchases (relative to cash dividends) as a method to return capital to shareholders. If a general payout policy currently exists, we ask that it... -

Page 72

...and reviews on a regular basis. Our long-term financial strategy continues to be to use cash flow from operations, in a balanced manner, to repurchase shares, fund dividends, and increase capital investments, all while maintaining our current investment grade debt rating. Our balanced approach gives... -

Page 73

... description of our business, including the general scope and nature thereof during fiscal year 2015, together with the audited financial information contained in our 2015 Annual Report on Form 10-K filed with the SEC. A copy of that report is available to shareholders on request without charge by... -

Page 74

2015 ANNUAL REPORT -

Page 75

... financial statement amounts as of and for the year ended January 30, 2016. Based on this evaluation, management has concluded that the Company's internal control over financial reporting was effective as of January 30, 2016. W. Rodney McMullen Chairman of the Board and Chief Executive Officer... -

Page 76

...Sheets for 2015, 2014 and 2013 and in our Consolidated Statements of Operations for 2015 and 2014. Due to the timing of the merger closing late in fiscal year 2013, its results of operations were not material to our consolidated results of operations for 2013. COMMON SHARE PRICE R ANGE 2015 High Low... -

Page 77

... 500 Stock Index and a peer group composed of food and drug companies. COMPARISON OF CUMULATIVE FIVE-YEAR TOTAL RETURN* Among The Kroger Co., the S&P 500, and Peer Group** 500 400 300 200 100 0 2010 2011 2012 2013 2014 2015 The Kroger Co. S&P 500 Index Peer Group Company Name/Index The Kroger Co... -

Page 78

...any time. On March 10, 2016, our Board of Directors approved a new $500 million share repurchase program to supplement the 2015 Repurchase Program, which is expected to be exhausted by the end of the second quarter of 2016. (3) (4) BUSINESS The Kroger Co. (the "Company" or "Kroger") was founded in... -

Page 79

...local banner names, 1,387 of which had fuel centers. Approximately 42% of these supermarkets were operated in Company-owned facilities, including some Company-owned buildings on leased land. Our current strategy emphasizes self-development and ownership of store real estate. Our stores operate under... -

Page 80

..., profits and losses and total assets are shown in our Consolidated Financial Statements set forth beginning on page A-29 below. MERCHANDISING AND MANUFACTURING Corporate brand products play an important role in our merchandising strategy. Our supermarkets, on average, stock over 14,000 private... -

Page 81

... the Harris Teeter outstanding common stock for approximately $2.4 billion. Harris Teeter is included in our ending Consolidated Balance Sheets for 2014 and 2015 and in our Consolidated Statements of Operations for 2014 and 2015. Due to the timing of the merger closing late in fiscal year 2013, its... -

Page 82

... long-term strategy as it best reflects how our products and services resonate with customers. Market share growth allows us to spread the fixed costs in our business over a wider revenue base. Our fundamental operating philosophy is to maintain and increase market share by offering customers good... -

Page 83

... sold. Continued investments in lower prices for our customers includes our pharmacy department, which experienced high levels of inflation that were not fully passed on to the customer in 2015. Net earnings improved in 2014, compared to net earnings in 2013, due to an increase in operating profit... -

Page 84

... household, changes in product mix and product cost inflation. Total fuel sales decreased in 2015, compared to 2014, primarily due to a 26.7% decrease in the average retail fuel price, partially offset by an increase in fuel gallons sold of 7.1%. Total sales increased in 2014, compared to 2013, by... -

Page 85

...sales. The merger with Harris Teeter, which closed late in fiscal year 2013, had a positive effect on our gross margin rate in 2014 since Harris Teeter has a higher gross margin rate as compared to total Company without Harris Teeter. The increase in fuel gross margin rate for 2014, compared to 2013... -

Page 86

...charge resulted primarily from an annualized product cost inflation related to meat, seafood and pharmacy. Operating, General and Administrative Expenses OG&A expenses consist primarily of employee-related costs such as wages, health care benefits and retirement plan costs, utilities and credit card... -

Page 87

... OG&A rate in 2014, compared to 2013, resulted primarily from increased supermarket sales growth, productivity improvements and effective cost controls at the store level, offset partially by the effect of our merger with Harris Teeter and increases in credit card fees and incentive plan costs, as... -

Page 88

... 2014 Multi-Employer Pension Plan Obligation, increased 5 basis points in 2015, compared to 2014. The increase in our adjusted FIFO operating profit rate in 2015, compared to 2014, was primarily due to increased supermarket sales, productivity improvements, effective cost controls at the store level... -

Page 89

... Refer to Note 2 to the Consolidated Financial Statements for more information on the mergers with Roundy's, Vitacost.com and Harris Teeter. Capital investments for the purchase of leased facilities totaled $35 million in 2015, $135 million in 2014 and $108 million in 2013. The table below shows our... -

Page 90

... the financial position, results and merger costs for the Roundy's transaction: January 30, 2016 Return on Invested Capital Numerator Operating profit LIFO charge Depreciation and amortization Rent Adjustments for pension plan agreements Other Adjusted operating profit Denominator Average total... -

Page 91

... direct costs of disposal. We recorded asset impairments in the normal course of business totaling $46 million in 2015, $37 million in 2014 and $39 million in 2013. We record costs to reduce the carrying value of long-lived assets in the Consolidated Statements of Operations as "Operating, general... -

Page 92

...of the market in which the closed store is located, our previous efforts to dispose of similar assets and current economic conditions. The ultimate cost of the disposition of the leases and the related assets is affected by current real estate markets, inflation rates and general economic conditions... -

Page 93

... are described in Note 15 to the Consolidated Financial Statements and include, among others, the discount rate, the expected long-term rate of return on plan assets, mortality and the rate of increases in compensation and health care costs. Actual results that differ from our assumptions are... -

Page 94

...) - Discount Rate Expected Return on Assets Percentage Point Change +/- 1.0% +/- 1.0% Expense Decrease/ (Increase) $36/($42) $38/($38) In 2015, we contributed $5 million to our Company-sponsored defined benefit plans and do not expect to make any contributions to these plans in 2016. In 2014, we... -

Page 95

... returns. Tax years 2012 and 2013 remain under examination. The assessment of our tax position relies on the judgment of management to estimate the exposures associated with our various filing positions. Share-Based Compensation Expense We account for stock options under the fair value recognition... -

Page 96

... count to the financial statement date. Vendor Allowances We recognize all vendor allowances as a reduction in merchandise costs when the related product is sold. In most cases, vendor allowances are applied to the related product cost by item, and therefore reduce the carrying value of inventory by... -

Page 97

... adoption of this ASU on our Consolidated Financial Statements. We believe our current off-balance sheet leasing commitments are reflected in our investment grade debt rating. LIQUIDITY AND CAPITAL RESOURCES Cash Flow Information Net cash provided by operating activities We generated $4.8 billion of... -

Page 98

... Kroger common shares in 2015, compared to $1.3 billion in 2014 and $609 million in 2013. We paid dividends totaling $385 million in 2015, $338 million in 2014 and $319 million in 2013. Debt Management Total debt, including both the current and long-term portions of capital lease and lease-financing... -

Page 99

... and commercial paper, offset by cash and temporary cash investments on hand at the end of 2015. We generally operate with a working capital deficit due to our efficient use of cash in funding operations and because we have consistent access to the capital markets. Based on current operating trends... -

Page 100

...used in our stores and food production plants. Our obligations also include management fees for facilities operated by third parties and outside service contracts. Any upfront vendor allowances or incentives associated with outstanding purchase commitments are recorded as either current or long-term... -

Page 101

... core business in 2016 to grow in line with our longterm net earnings per diluted share growth rate of 8% - 11%. • We expect identical supermarket sales growth, excluding fuel sales, of 2.5%-3.5% in 2016, reflecting the lower inflationary environment. • We expect full-year FIFO operating margin... -

Page 102

... to support our Customer 1st business strategy. • We expect total supermarket square footage for 2016 to grow approximately 3.0% - 3.5% before mergers, acquisitions and operational closings. • We expect 2016 year-end ROIC to increase slightly compared to the 2015 result. • We expect the 2016... -

Page 103

... to add supermarket fuel centers to our store base. Since fuel generates lower profit margins than our supermarket sales, we expect to see our FIFO gross margins decline as fuel sales increase. We cannot fully foresee the effects of changes in economic conditions on Kroger's business. We have... -

Page 104

... over financial reporting. Roundy's, Inc. is a wholly-owned subsidiary whose total assets and total revenues represent 2% and less than 1%, respectively, of the related consolidated financial statement amounts as of and for the year ended January 30, 2016. Cincinnati, Ohio March 29, 2016 A-30 -

Page 105

... Common shares, $1 par per share, 2,000 shares authorized; 1,918 shares issued in 2015 and 2014 Additional paid-in capital Accumulated other comprehensive loss Accumulated earnings Common stock in treasury, at cost, 951 shares in 2015 and 944 shares in 2014 Total Shareholders' Equity - The Kroger Co... -

Page 106

THE KROGER CO. CONSOLIDATED STATEMENTS OF OPERATIONS Years Ended January 30, 2016, January 31, 2015 and February 1, 2014 (In millions, except per share amounts) Sales Merchandise costs, including advertising, warehousing, and transportation, excluding items shown separately below Operating, general ... -

Page 107

THE KROGER CO. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Years Ended January 30, 2016, January 31, 2015 and February 1, 2014 2015 2014 2013 (In millions) (52 weeks) (52 weeks) (52 weeks) Net earnings including noncontrolling interests $ 2,049 $ 1,747 $ 1,531 Other comprehensive income (loss) ... -

Page 108

... payments for lease buyouts Payments for lease buyouts Changes in construction-in-progress payables Total capital investments, excluding lease buyouts Disclosure of cash flow information: Cash paid during the year for interest Cash paid during the year for income taxes 2015 2014 2013 (52 weeks... -

Page 109

THE KROGER CO. CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY Years Ended January 30, 2016, January 31, 2015 and February 1, 2014 Additional Treasury Stock Paid-In Capital Shares Amount Shares Amount Common Stock 1,918 1,918 1,918 1,918 $ 1,918 1,918 1,918 1,918 $ 2,492 - (60) - - ... -

Page 110

...credit cards and checks, to which the Company does not have immediate access but settle within a few days of the sales transaction. Inventories Inventories are stated at the lower of cost (principally on a last-in, first-out "LIFO" basis) or market. In total, approximately 95% of inventories in 2015... -

Page 111

...purchases of store equipment are assigned lives varying from three to nine years. Leasehold improvements are amortized over the shorter of the lease term to which they relate, which generally varies from four to 25 years, or the useful life of the asset. Food production plant and distribution center... -

Page 112

... of business totaling $46, $37 and $39 in 2015, 2014 and 2013, respectively. Costs to reduce the carrying value of long-lived assets for each of the years presented have been included in the Consolidated Statements of Operations as "Operating, general and administrative" expense. Store Closing Costs... -

Page 113

... Plans and Multi-Employer Pension Plans The Company recognizes the funded status of its retirement plans on the Consolidated Balance Sheets. Actuarial gains or losses, prior service costs or credits and transition obligations that have not yet been recognized as part of net periodic benefit cost... -

Page 114

... returns. Tax years 2012 and 2013 remain under examination. The assessment of the Company's tax position relies on the judgment of management to estimate the exposures associated with the Company's various filing positions. Self-Insurance Costs The Company is primarily self-insured for costs related... -

Page 115

...remit the value of the unredeemed gift card. The amount of breakage has not been material for 2015, 2014 and 2013. Merchandise Costs The "Merchandise costs" line item of the Consolidated Statements of Operations includes product costs, net of discounts and allowances; advertising costs (see separate... -

Page 116

... business is managed and how the Company's Chief Executive Officer, who acts as the Company's chief operating decision maker, assess performance internally. All of the Company's operations are domestic. The following table presents sales revenue by type of product for 2015, 2014 and 2013. 2015 2014... -

Page 117

... allocation of the purchase price, and are subject to revision when the resulting valuations of property and intangible assets are finalized, which will occur prior to December 18, 2016. Due to the timing of the merger closing late in the year, the revenue and earnings of Roundy's in 2015 were not... -

Page 118

....com") by purchasing 100% of the Vitacost.com outstanding common stock for $8.00 per share or $287. This merger affords the Company access to Vitacost.com's extensive e-commerce platform, which can be combined with the Company's customer insights and loyal customer base, to create new levels of... -

Page 119

... had the Harris Teeter merger been completed at the beginning of 2012, the Vitacost.com merger completed at the beginning of 2013 or the Roundy's merger completed at the beginning of 2014. Fiscal year ended Fiscal year ended Fiscal year ended January 30, 2016 January 31, 2015 February 1, 2014 $113... -

Page 120

... intangibles are amortized to operating, general and administrative ("OG&A") expense and depreciation and amortization expense. Amortization expense associated with intangible assets totaled approximately $51, $41 and $18, during fiscal years 2015, 2014 and 2013, respectively. Future amortization... -

Page 121

... from filing amended returns to claim additional credits. The 2013 benefit from the Domestic Manufacturing Deduction is greater than 2015 and 2014 due to the amendment of prior years' tax returns to claim the additional benefit available in years still under review by the Internal Revenue Service... -

Page 122

... Current deferred tax liabilities: Insurance related costs Inventory related costs Total current deferred tax liabilities Current deferred taxes Long-term deferred tax assets: Compensation related costs Lease accounting Closed store reserves Insurance related costs Net operating loss and credit... -

Page 123

...$246 2013 $299 23 (10) 17 (4) - - $325 The Company does not anticipate that changes in the amount of unrecognized tax benefits over the next twelve months will have a significant impact on its results of operations or financial position. As of January 30, 2016, January 31, 2015 and February 1, 2014... -

Page 124

...66% Commercial paper due through February 2016 Other Total debt Less current portion Total long-term debt 2015 $ 9,826 58 990 522 11,396 (2,318) $ 9,078 2014 $ 9,224 73 1,275 454 11,026 (1,844) $ 9,182 In 2015, the Company issued $500 of senior notes due in fiscal year 2026 bearing an interest rate... -

Page 125

... of the continuing directors of the Company or (iii) both a change of control and a below investment grade rating. The aggregate annual maturities and scheduled payments of long-term debt, as of year-end 2015, and for the years subsequent to 2015 are: 2016 2017 2018 2019 2020 Thereafter Total debt... -

Page 126

... Financial Policy Committee of the Board of Directors. These guidelines may change as the Company's needs dictate. Fair Value Interest Rate Swaps The table below summarizes the outstanding interest rate swaps designated as fair value hedges as of January 30, 2016 and January 31, 2015. 2015 Pay Pay... -

Page 127

... fair value of the interest rate swaps was recorded in other long-term liabilities for $39 and accumulated other comprehensive loss for $25 net of tax. During 2015, the Company terminated eight forward-starting interest rate swap agreements with maturity dates of October 2015 and January 2016 with... -

Page 128

... Rate Swaps Commodity Price Protection $39 $- $39 $- $- $39 The Company enters into purchase commitments for various resources, including raw materials utilized in its food production plants and energy to be used in its stores, warehouses, food production plants and administrative offices... -

Page 129

...In 2015 and 2014, unrealized gains on the Level 1 available-for-sale securities totaled $5 and $8, respectively. The Company values warrants using the Black-Scholes option-pricing model. The Black-Scholes option-pricing model is classified as a Level 2 input. The Company values interest rate hedges... -

Page 130

... represents the changes in AOCI by component for the years ended January 31, 2015 and January 30, 2016: Cash Flow Hedging Activities (1) $ (25) (25) 1 (24) (49) (3) 1 (2) $ (51) Available for sale Securities (1) $12 5 - 5 17 3 - 3 $20 Pension and Postretirement Defined Benefit Plans (1) $(451) (351... -

Page 131

...63 10. LEASES AND LEASE-FINANCED TRANSACTIONS While the Company's current strategy emphasizes ownership of store real estate, the Company operates primarily in leased facilities. Lease terms generally range from 10 to 20 years with options to renew for varying terms. Terms of certain leases include... -

Page 132

...divided by the weighted average number of common shares outstanding, after giving effect to dilutive stock options. The following table provides a reconciliation of net earnings attributable to The Kroger Co. and shares used in calculating net earnings attributable to The Kroger Co. per basic common... -

Page 133

... June meeting of the Company's Board of Directors. Certain changes to the stock option compensation strategy were put into effect in 2015, which resulted in a reduction to the number of stock options granted in 2015, compared to 2014 and 2013. Stock options typically expire 10 years from the date of... -

Page 134

... expected dividend yield. The increase in the fair value of the stock options granted during 2014, compared to 2013, resulted primarily from an increase in the Company's share price, which decreased the expected dividend yield, and an increase in the weighted average risk-free interest rate. A-60 -

Page 135

... under the Company's equity award plans. This cost is expected to be recognized over a weighted-average period of approximately two years. The total fair value of options that vested was $33, $26 and $20 in 2015, 2014 and 2013, respectively. Shares issued as a result of stock option exercises may... -

Page 136

... market purchases totaling $500, $1,129 and $338 under these repurchase programs in 2015, 2014 and 2013, respectively. In addition to these repurchase programs, in December 1999, the Company began a program to repurchase common shares to reduce dilution resulting from its employee stock option plans... -

Page 137

... benefit costs in the next fiscal year are as follows (pre-tax): Pension Benefits 2016 $62 - $62 Other Benefits 2016 $ (9) (8) $ (17) Total 2016 $53 (8) $45 Net actuarial loss (gain) Prior service credit Total Other changes recognized in other comprehensive income in 2015, 2014 and 2013... -

Page 138

... 31, 2015, pension plan assets do not include common shares of The Kroger Co. Weighted average assumptions Discount rate - Benefit obligation Discount rate - Net periodic benefit cost Expected long-term rate of return on plan assets Rate of compensation increase - Net periodic benefit cost Rate of... -

Page 139

... In 2015 and 2014, the Company decreased the assumed pension plan investment return rate to 7.44% compared to 8.50% in 2013. The Company pension plan's average rate of return was 6.47% for the 10 calendar years ended December 31, 2015, net of all investment management fees and expenses. The value of... -

Page 140

... of the capital markets and each underlying plan's current and projected financial requirements. The time horizon of the investment objectives is long-term in nature and plan assets are managed on a going-concern basis. Investment objectives and guidelines specifically applicable to each manager of... -

Page 141

...the Company expects 401(k) retirement savings account plans cash contributions and expense from automatic and matching contributions to participants to be approximately $200 in 2016. Assumed health care cost trend rates have a significant effect on the amounts reported for the health care plans. The... -

Page 142

...31, 2015 Quoted Prices in Active Markets for Identical Assets (Level 1) $ 73 294 - - 123 - - - - - $490 Cash and cash equivalents Corporate Stocks Corporate Bonds U.S. Government Securities Mutual Funds/Collective Trusts Partnerships/Joint Ventures Hedge Funds Private Equity Real Estate Other Total... -

Page 143

... For investments not traded on an active market, or for which a quoted price is not publicly available, a variety of unobservable valuation methodologies, including discounted cash flow, market multiple and cost valuation approaches, are employed by the fund manager to value investments. Fair values... -

Page 144

... For investments not traded on an active market, or for which a quoted price is not publicly available, a variety of unobservable valuation methodologies, including discounted cash flow, market multiple and cost valuation approaches, are employed by the fund manager to value investments. Fair values... -

Page 145

... provides the Employer Identification Number ("EIN") and the threedigit pension plan number. The most recent Pension Protection Act Zone Status available in 2015 and 2014 is for the plan's year-end at December 31, 2014 and December 31, 2013, respectively. Among other factors, generally, plans in the... -

Page 146

...contains information about the Company's multi-employer pension plans: Pension Protection Act Zone Status 2015 2014 FIP/RP Multi-Employer Status Contributions Pending/ Implemented 2015 2014 2013 Pension Fund SO CA UFCW Unions & Food Employers Joint Pension Trust Fund (1) (2) Desert States Employers... -

Page 147

.... After the completion of the merger, on July 1, 2014, certain assets and liabilities related to the Washington Meat Industry Pension Trust were transferred from the Sound Retirement Trust to the UFCW Consolidated Pension Plan. See the above information regarding the restructuring of certain pension... -

Page 148

... of adoption of this ASU on the Company's Consolidated Financial Statements. In April 2015, the FASB issued ASU 2015-04, "Retirement Benefits (Topic 715): Practical Expedient for the Measurement Date of an Employer's Defined Benefit Obligation and Plan Assets." This amendment permits an entity to... -

Page 149

... and the Company is currently evaluating the other effects of adoption of this ASU on its Consolidated Financial Statements. 19. QUARTERLY DATA (UNAUDITED) The two tables that follow reflect the unaudited results of operations for 2015 and 2014. Quarter First Second Third Fourth Total Year (16 Weeks... -

Page 150

... Fourth Total Year (12 Weeks) (52 Weeks) $ 25,207 $108,465 2014 Sales Merchandise costs, including advertising, warehousing, and transportation, excluding items shown separately below Operating, general and administrative Rent Depreciation and amortization Operating profit Interest expense Earnings... -

Page 151

... Stock Exchange, or if they wish to sell shares they have purchased through this plan, they should contact: Computershare Plan Managers P.O. Box 43021 Providence, RI 02940 Phone 800-872-3307 Questions regarding Kroger's 401(k) plans should be directed to the employee's Human Resources Department... -

Page 152

...Secretary and General Counsel OPERATING UNIT HEADS Rodney C. Antolock Harris Teeter Paul L. Bowen Jay C/Ruler William H. Breetz, Jr. Houston Division Timothy F. Brown Cincinnati Division Jeffrey D. Burt Fred Meyer Stores Zane Day Nashville Division Russell J. Dispense King Soopers/City Market Peter... -

Page 153

THE ฀ K R O G E R ฀C O 1 0 1 4 ฀V I N E ฀ S T R E E T฀ •฀ C I N C I N N A T I ,฀ O H I O ฀ 4 5 2 0 2 5 1 3 )฀ 7 6 2 - 4 0 0 0 C O V E R PRINTED P R I N T E D ON O N PAPER P A P E R CONTAINING C O N T A I N I N G AT A T LEAST L E A S T30% 30% POST CONSUMER R E C Y C L ECONTENT ...