IBM 2006 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

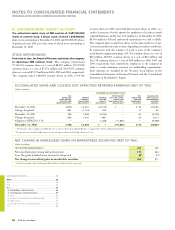

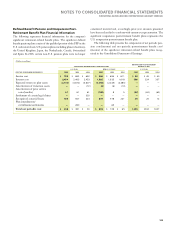

Charges incurred for the workforce reductions consisted of severance/

termination benefits for approximately 16,000 employees (14,500 of

which were for the incremental second-quarter 2005 actions). All

separations were substantially completed by March 31, 2006. The

non-current portion of the liability associated with the workforce

reductions relates to terminated employees who were granted annual

payments to supplement their income in certain countries. Depending

on individual country legal requirements, these required payments will

continue until the former employee begins receiving pension benefits

or is deceased. Cash payments made through December 31, 2006

associated with the workforce reductions were $1,277 million.

The vacant space accruals are primarily for ongoing obligations to

pay rent for vacant space, offset by estimated sublease income, over

the respective lease term of the company’s lease agreements. The

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

94 2006 Annual Report

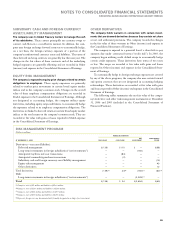

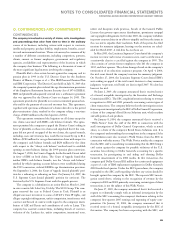

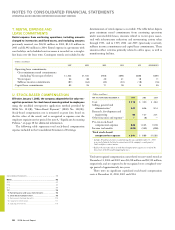

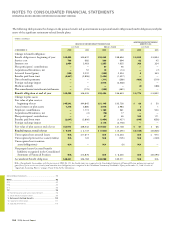

Total pre-tax restructuring activity was as follows:

(Dollars in millions)

PRE-TAX

CHARGES LIABILITY LIABILITY

RECORDED RECORDED IN AS OF

IN SECOND ASSET THE SECOND DEC. 31,

QTR. 2005 IMPAIRMENTS QTR. 2005 PAYMENTS OTHER** 2005

Workforce reductions $, $ — $, $(,) $() $

Vacant space — () ()

Asset impairments — — — —

Total restructuring activity for

second-quarter 2005 actions $,* $ $, $(,) $() $+

* $1.6 billion recorded in SG&A expense and $0.2 billion recorded in Other (income) and expense in the Consolidated Statement of Earnings.

** Consists of foreign currency translation adjustments ($38 million), net balance sheet reclassifications ($41 million) and reversals of previously recorded liabilities ($34 million) for

changes in the estimated cost of employee terminations and vacant space, offset by approximately $1 million of accretion expense. The reversals were recorded primarily in SG&A expense.

+ $391 million recorded as a current liability in Accounts payable and accruals and $146 million as a non-current liability in Other liabilities in the Consolidated Statement of Financial Position.

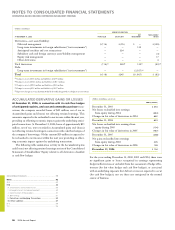

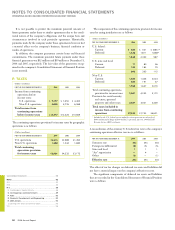

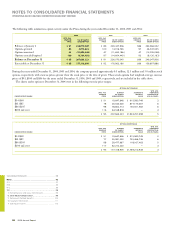

(Dollars in millions)

LIABILITY LIABILITY

AS OF AS OF

DEC. 31, DEC. 31,

2005 PAYMENTS OTHER* 2006

Workforce reductions $ $() $ $

Vacant space ()

Total restructuring activity for second-quarter 2005 actions $ $() $ $**

* Consists of foreign currency translation adjustments ($37 million), net balance sheet reclassifications ($2 million), accretion expense ($7 million) and reversals of previous recorded

liabilities ($35 million) for changes in the estimated cost of employee terminations and vacant space. These reversals, net of accretion expense, were primarily recorded in SG&A.

** $92 million recorded as a current liability in Accounts payable and accruals and $155 million as a non-current liability in Other liabilities in the Consolidated Statement of Financial Position.

length of these obligations varies by lease with the longest extending

through 2016.

In connection with the company’s restructuring activities initiated in

the second quarter of 2005, the company recorded pre-tax impairment

charges for certain real estate assets of approximately $95 million during

the year ended December 31, 2005. The principal component of such

impairment charges resulted from the sale of a facility in Yasu-City,

Japan, which closed during the third quarter of 2005. In connection

with this sale, the company recorded an impairment charge to write

the asset down to its fair value in the second quarter.

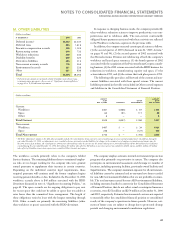

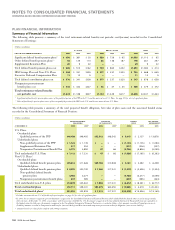

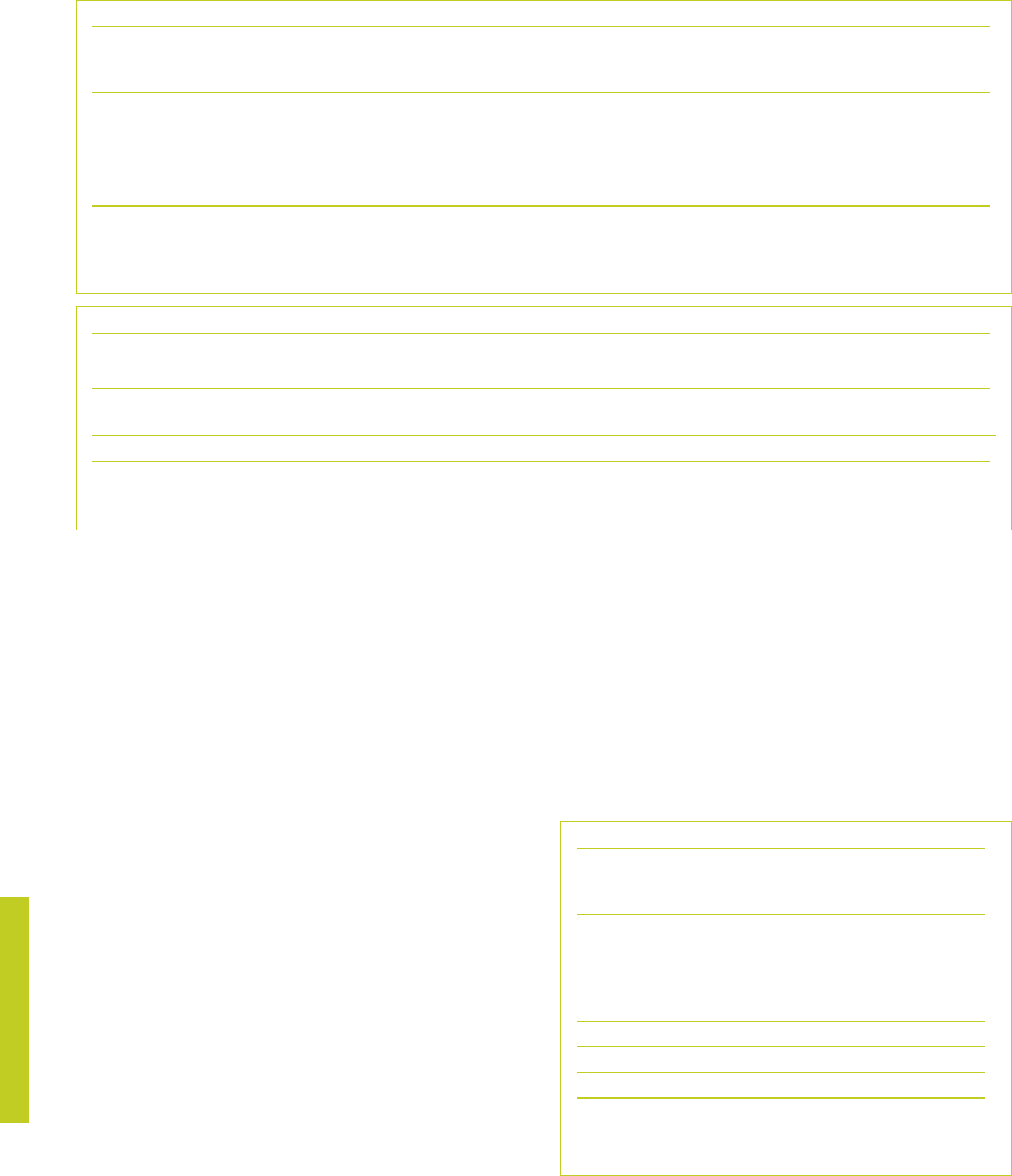

These restructuring activities had the following effect on the

company’s reportable segments:

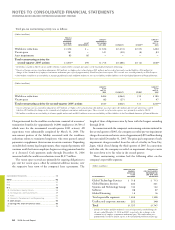

(Dollars in millions)

TOTAL PRE-TAX CUMULATIVE

CHARGES PRE-TAX CHARGES

EXPECTED RECORDED FOR

TO BE 2ND-QTR. 2005

AT DECEMBER 31: INCURRED INITIATIVES*

Global Technology Services $ $

Global Business Services

Systems and Technology Group

Software

Global Financing

Total reportable segments , ,

Unallocated corporate amounts

Total $, $,

* Includes $35 million and $34 million for reversals of previously recorded charges for

the years ended December 31, 2006 and 2005, respectively, due to changes in the

estimated cost of employee terminations and vacant space. These adjustments were

predominantly recorded in SG&A expense in the Consolidated Statement of Earnings.

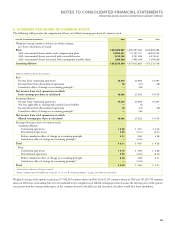

Consolidated Statements .........................................................

Notes .....................................................................................

A-G .........................................................................................

H-M .........................................................................................

N-S ..........................................................................................

N. Stockholders’ Equity Activity ..........................................

O. Contingencies and Commitments ...................................

P. Taxes ................................................................................

Q. Research, Development and Engineering ......................

R. 2005 Actions ....................................................................

S. Earnings Per Share of Common Stock .............................

T-X ..........................................................................................

Black

MAC

390 CG10