IBM 2006 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

company’s restructuring actions. These non-recurring charges were

recorded in SG&A ($318 million) and Other (income) and expense

($14 million). This decrease year to year in retirement-related plan

costs was essentially offset by an increase in the recognition of previ-

ously deferred actuarial losses in accordance with SFAS No. 87,

“Employers’ Accounting for Pensions.”

Retirement-related expense within SG&A decreased $262 million

year to year: a $318 million decrease as a result of the prior year

charges discussed previously, offset by recurring plan cost increases of

$56 million versus 2005. Other (income) and expense decreased $14

million as discussed above. Increases year to year in Cost and RD&E

expense of approximately $235 million and $32 million, respectively,

were a result of recurring plan cost increases. See note V, “Retirement-

Related Benefits,” on pages 100 to 111 for additional information on

the company’s benefit plans including a description of the plans, plan

financial information and assumptions.

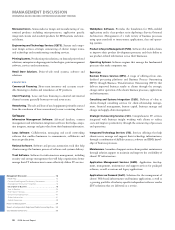

Acquired Intangible Asset Amortization

The company has been investing in targeted acquisitions primarily

within its Software and Global Services segments to increase its capa-

bilities in higher value market segments. The following table presents

the total acquired intangible asset amortization included in the

Consolidated Statement of Earnings. See note I, “Intangible Assets

Including Goodwill,” on pages 80 and 81 for additional information.

(Dollars in millions)

YR. TO YR.

FOR THE YEAR ENDED DECEMBER 31: 2006 2005 CHANGE

Cost:

Software $ $ (.)%

Global Services (.)

Hardware (.)

Selling, general and

administrative expense (.)

Total $ $ (.)%

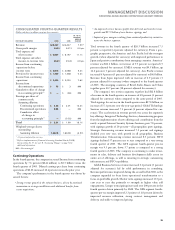

Income Taxes

The provision for income taxes resulted in an effective tax rate of 29.3

percent for 2006, compared with the 2005 effective tax rate of 34.6

percent. The 5.3 point decrease in the 2006 effective tax rate was

primarily attributable to the net effect of several items. In 2006, the

tax rate was favorably impacted by the absence of the foreign earnings

repatriation-related tax charge recorded in the third quarter of 2005

(4.3 points) as well as a benefit from the fourth-quarter 2006 settle-

ment of the U.S. federal income tax audit for the years 2001 through

2003 ( 3.0 points). These benefits were partially offset by a one-time

tax cost associated with the 2006 intercompany transfer of certain

intellectual property (4.3 points). The remaining items were indi-

vidually insignificant.

Earnings Per Share

Basic earnings per share is computed on the basis of the weighted-

average number of shares of common stock outstanding during the

period. Diluted earnings per share is computed on the basis of the

weighted-average number of shares of common stock plus the effect of

dilutive potential common shares outstanding during the period using

the treasury stock method. Dilutive potential common shares include

outstanding stock options, stock awards and convertible notes.

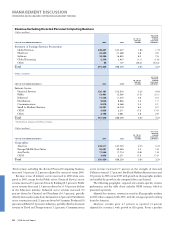

YR. TO YR.

FOR THE YEAR ENDED DECEMBER 31: 2006 2005 CHANGE

Earnings per share of

common stock:

Assuming dilution:

Continuing operations $. $ . .%

Discontinued operations . (.) NM

Cumulative effect of change

in accounting principle* — (.) NM

Total $. $ . .%

Basic:

Continuing operations $. $ . .%

Discontinued operations . (.) NM

Cumulative effect of change

in accounting principle* — (.) NM

Total $. $ . .%

Weighted-average shares

outstanding (in millions):

Assuming dilution ,. ,. (.)%

Basic ,. ,. (.)%

* Reflects implementation of FASB Interpretation No. 47. See note B, “Accounting

Changes,” on page 72 for additional information.

NM—Not meaningful

Actual shares outstanding at December 31, 2006 and December 31,

2005 were 1,506.5 million and 1,574.0 million, respectively. The

average number of common shares outstanding assuming dilution was

lower by 74.1 million shares in 2006 versus 2005. The decrease was

primarily the result of the company’s common share repurchase pro-

gram. See note N, “Stockholders’ Equity Activity,” on page 88 for

additional information regarding the common share activities. Also

see note S, “Earnings Per Share of Common Stock,” on page 95.

MANAGEMENT DISCUSSION

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

28 2006 Annual Report

Management Discussion ........................................................

Road Map .............................................................................

Forward-Looking and Cautionary Statements .....................

Management Discussion Snapshot ......................................

Description of Business .......................................................

Year in Review......................................................................

Prior Year in Review .............................................................

Discontinued Operations .....................................................

Other Information ................................................................

Global Financing ..................................................................

Report of Management .........................................................

Report of Independent Registered Public Accounting Firm ....

Consolidated Statements .......................................................

Black

MAC

2718 CG10