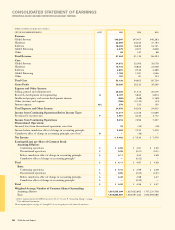

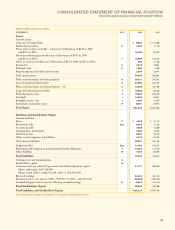

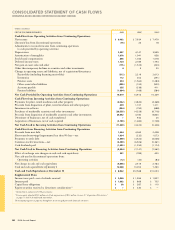

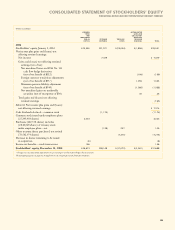

IBM 2006 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

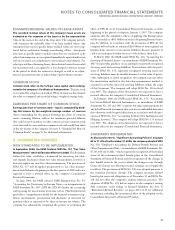

A. SIGNIFICANT ACCOUNTING POLICIES

BASIS OF PRESENTATION

The International Business Machines Corporation (IBM or the

company) made changes to its management system effective as

of the first quarter of 2006. In accordance with Statement of Financial

Accounting Standards (SFAS) No. 131, “Disclosures about Segments

of an Enterprise and Related Information,” these changes impacted

the company’s reportable segments and resulted in the reclassification

of certain revenue and cost within its Consolidated Statement of

Earnings from previously reported information. See note W, “Segment

Information,” on page 111 for additional information on the changes

in reportable segments. These changes did not impact IBM’s total

revenue, cost, expense, net income, earnings per share, Consolidated

Statement of Financial Position or Consolidated Statement of Cash

Flows from previously reported information. The company filed a

Form 8-K with the Securities and Exchange Commission (SEC) on

June 13, 2006 to reclassify its historical financial statements and

related footnotes to reflect these management system changes. The

Consolidated Financial Statements and accompanying notes, as appli-

cable, reflect these changes for all periods presented.

On December 31, 2002, the company sold its hard disk drive

(HDD) business to Hitachi, Ltd. (Hitachi). The HDD business was

part of the company’s Systems and Technology Group reportable

segment. The HDD business was accounted for as a discontinued

operation under accounting principles generally accepted in the

United States of America (GAAP) and therefore, the HDD results of

operations and cash flows have been removed from the company’s

results of continuing operations and cash flows for all periods pre-

sented in this document.

For 2006, Income from discontinued operations, net of tax, is

related to tax benefits from tax audit settlements. For the years 2005

and 2004, the Loss from discontinued operations, net of tax, is pri-

marily additional costs associated with parts warranty as agreed upon

by the company and Hitachi.

PRINCIPLES OF CONSOLIDATION

The Consolidated Financial Statements include the accounts of

IBM and its controlled subsidiaries, which are generally majority

owned. The accounts of variable interest entities (VIEs) as defined

by the Financial Accounting Standards Board (FASB) Interpretation

No. 46(R) ( FIN 46(R)), are included in the Consolidated Financial

Statements, if required. Investments in business entities in which the

company does not have control, but has the ability to exercise sig-

nificant influence over operating and financial policies, are accounted

for using the equity method and the company’s proportionate share

of income or loss is recorded in Other (income) and expense. The

accounting policy for other investments in equity securities is

described on page 70 within “Marketable Securities.” Equity invest-

ments in non-publicly traded entities are primarily accounted for

using the cost method. Intercompany transactions and accounts

have been eliminated.

USE OF ESTIMATES

The preparation of Consolidated Financial Statements in confor-

mity with GAAP requires management to make estimates and

assumptions that affect the amounts of assets, liabilities, revenue, costs,

expenses and gains and losses not affecting retained earnings that are

reported in the Consolidated Financial Statements and accompanying

disclosures, including the disclosure of contingent assets and liabilities.

These estimates are based on management’s best knowledge of current

events, historical experience, actions that the company may undertake

in the future and on various other assumptions that are believed to be

reasonable under the circumstances. As a result, actual results may be

different from these estimates. See pages 45 to 47 and page 53 for a

discussion of the company’s critical accounting estimates.

REVENUE

The company recognizes revenue when it is realized or realizable

and earned. The company considers revenue realized or realizable

and earned when it has persuasive evidence of an arrangement,

delivery has occurred, the sales price is fixed or determinable and

collectibility is reasonably assured. Delivery does not occur until

products have been shipped or services have been provided to the

client, risk of loss has transferred to the client, and either client

acceptance has been obtained, client acceptance provisions have

lapsed, or the company has objective evidence that the criteria speci-

fied in the client acceptance provisions have been satisfied. The sales

price is not considered to be fixed or determinable until all contin-

gencies related to the sale have been resolved.

The company recognizes revenue on sales to solution providers,

resellers and distributors (herein referred to as “resellers”) when the

reseller has economic substance apart from the company, credit risk,

title and risk of loss to the inventory, the fee to the company is not

contingent upon resale or payment by the end user, the company has

no further obligations related to bringing about resale or delivery and

all other revenue recognition criteria have been met.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

62 2006 Annual Report

Consolidated Statements .........................................................

Notes .....................................................................................

A-G .........................................................................................

A. Significant Accounting Policies .......................................

B. Accounting Changes........................................................

C. Acquisitions/Divestitures .................................................

D. Financial Instruments (excluding derivatives) ................

E. Inventories .......................................................................

F. Financing Receivables ......................................................

G. Plant, Rental Machines and Other Property ...................

H-M .........................................................................................

N-S ..........................................................................................

T-X ..........................................................................................

Black

MAC

390 CG10