IBM 2006 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

perspective, the increased revenue was driven by software. Latin

America led the regions with growth of 14.4 percent (9 percent

adjusted for currency). Brazil grew 18.9 percent (8 percent adjusted

for currency). The U.S. increased 3.6 percent and Canada grew 6.5

percent (flat adjusted for currency).

EMEA revenue increased 3.2 percent (2 percent adjusted for cur-

rency) in 2006 when compared with 2005, with revenue growth in all

the major countries, except Germany. Revenue increased in the U.K.

3.0 percent (1 percent adjusted for currency), France 4.0 percent (2

percent adjusted for currency), Spain 4.1 percent (2 percent adjusted

for currency) and Italy 3.6 percent (2 percent adjusted for currency).

Germany declined a modest 0.3 percent as reported (2 percent

adjusted for currency) in 2006 when compared to 2005. Russia grew

21.1 percent (21 percent adjusted for currency).

Asia Pacific revenue declined 0.8 percent (increased 2 percent

adjusted for currency) in 2006 versus the prior year. Although Japan

revenue declined 7.5 percent (2 percent adjusted for currency), its

performance improved sequentially throughout 2006 and returned to

growth in the fourth quarter. Partially offsetting the revenue decline

in Japan was growth in other Asia Pacific regions. China grew 15.8

percent (14 percent adjusted for currency), Korea grew 14.2 percent

(6 percent adjusted for currency) and India increased 38.5 percent (42

percent adjusted for currency).

For the year, the company benefited from solid contributions from

the emerging countries of Brazil, India, Russia and China . Collectively,

revenue from these four countries increased 20.5 percent (16 percent

adjusted for currency) in 2006 versus 2005.

OEM revenue increased 17.9 percent (18 percent adjusted for cur-

rency) in 2006 versus 2005 driven by strong game processor demand

in the Microelectronics business.

Total Global Services revenue increased 1.8 percent in 2006 versus

2005. The increase was driven by GTS (2.4 percent) and GBS (0.4

percent). The increase in GTS was driven by Strategic Outsourcing

(3.2 percent) and BTO (17.2 percent), partially offset by a decline in

ITS revenue of 1.8 percent.

Overall, Hardware revenue declined as reported in 2006 compared

to 2005 due to the divestiture of the Personal Computing business.

Systems and Technology Group revenue increased 4.7 percent as

System z revenue increased 7.8 percent and MIPS (millions of instruc-

tions per second) volumes increased 11 percent versus 2005. System

Storage revenue increased 6.4 percent as Total disk grew 7.8 percent

driven by midrange disk (16.5 percent), while tape products revenue

increased 3.1 percent. Microelectronics revenue increased 21.9 per-

cent driven by strong demand in games processors and networking

components. System x increased 3.7 percent compared to 2005 driven

by increased revenue for servers (5.3 percent) and Blades (22.3 per-

cent). Retail Stores Solutions revenue increased 21.4 percent versus

2005. These increases were partially offset by declines in System i

servers (15.0) percent, System p servers (1.1 percent), Printing

Systems (7.6 percent) and E&TS (16.2 percent).

Personal Computing Division had no revenue in 2006 versus four

months of revenue in 2005. See note C, “Acquisitions/Divestitures,”

on pages 77 and 78 for additional information.

MANAGEMENT DISCUSSION

INTERNATIONAL BUSINESS MACHIN ES CORPORATION AND SUBSI DIARY COMPANIES

25

Software revenue increased 8.2 percent in 2006 versus 2005 driven

by growth in the company’s Key Branded Middleware offerings (17.1

percent), partially offset by lower Operating Systems revenue (6.3

percent). The Key Branded Middleware growth was driven by strong

performance in the WebSphere family of products (23.3 percent) and

Tivoli (26.3 percent). All five brands in Key Branded Middleware had

double-digit revenue growth in 2006 versus 2005 with the exception

of Rational which grew 4.4 percent.

Global Financing revenue decreased 1.1 percent in 2006 versus

2005 due to lower remarketing equipment sales, partially offset by an

increase in financing revenue. See pages 49 through 53 for additional

information regarding Global Financing.

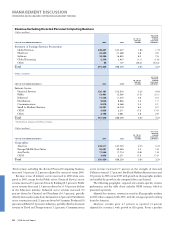

Gross Profit

YR. TO YR.

FOR THE YEAR ENDED DECEMBER 31: 2006 2005 CHANGE

Consolidated Gross

Profit Margins:

Global Services .% .% . pts.

Hardware . . .

Software . . .

Global Financing . . (.)

Other (.) . (.)

Total .% .% . pts.

The increase in the overall Global Services gross profit margin was

primarily due to benefits from the company’s productivity initiatives

and cost efficiencies, including improved utilization. The increase in

Hardware margin was primarily due to the divestiture of the Personal

Computing business (which had a lower gross profit margin than the

other hardware businesses) in the second quarter of 2005. The absence

of the Personal Computing business contributed 3.5 points to the

increase in the 2006 hardware margin. This increase was partially

offset by a 2.7 point decline in the Systems and Technology Group

margin in 2006 versus 2005.

The decrease in Global Financing gross profit margin was primar-

ily driven by lower financing margins due to higher borrowing costs

related to the external interest rate environment.

In addition, an increase in retirement-related plan costs of approx-

imately $235 million partially offset by a decrease in stock-based

compensation costs of approximately $114 million compared to 2005

also impacted overall segment margins. See “Segment Details” dis-

cussion on pages 29 to 32 for further details on gross profit.

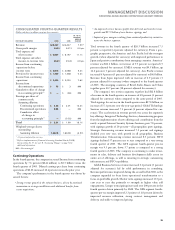

Expense

(Dollars in millions)

YR. TO YR.

FOR THE YEAR ENDED DECEMBER 31: 2006 2005 CHANGE

Total expense and

other income $, $, .%

Expense to Revenue (E/R) .% .% . pts.

Black

MAC

2718 CG10