IBM 2006 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Employees at IBM and its wholly owned subsidiaries in 2006

increased 26,393 compared with 2005. Resources increased in all

geographies; on a country-basis, India experienced the largest growth,

up 16,024 to approximately 52,000 employees at year end. The U.S.

at approximately 127,000 employees, also increased modestly versus

2005. The company continues to invest in Global Services and

Software through a combination of hiring and acquisitions. IBM also

continues to rebalance its workforce globally to improve the compa-

ny’s competitiveness in the marketplace, as well as to withdraw from

certain businesses.

The company’s complementary workforce is an approximation of

equivalent full-time employees hired under temporary, part-time and

limited-term employment arrangements to meet specific business

needs in a flexible and cost-effective manner.

GLOBAL FINANCING

DESCRIPTION OF BUSINESS

Global Financing is a business segment within IBM that is measured

as if it were a standalone entity. Accordingly, the information pre-

sented in this section is consistent with this separate company view.

The mission of Global Financing is to generate a return on equity

and to facilitate clients’ acquisition of primarily IBM hardware, soft-

ware and services.

Global Financing invests in financing assets, manages the associ-

ated risks and leverages with debt, all with the objective of generating

consistently strong returns on equity. The primary focus on IBM

products and IBM clients mitigates the risks normally associated with

a financing company. Global Financing has the benefit of both a deep

knowledge of its client base and a clear insight into the products that

are being leased. This combination allows Global Financing to effec-

tively manage two of the major risks (credit and residual value) that

are normally associated with financing.

Global Financing comprises three lines of business:

• Client financing provides lease and loan financing to end users and

internal clients for terms generally between two and seven years.

Internal financing is predominantly in support of Global Services’

long-term client services contracts. Global Financing also factors a

selected portion of the company’s accounts receivable, primarily for

cash management purposes. All internal financing arrangements

are at arm’s-length rates and are based upon market conditions.

• Commercial financing provides primarily short-term inventory and

accounts receivable financing to dealers and remarketers of IT products.

• Remarketing sells and leases used equipment to new or existing clients

both externally and internally. This equipment is primarily sourced

from the conclusion of lease transactions. Externally-remarketed

equipment revenue represents sales or leases to clients and resellers.

Internally-remarketed equipment revenue primarily represents used

equipment that is sold or leased internally to the Systems and Technology

Group and Global Services segments. The Systems and Technology

Group may also sell the equipment that it purchases from Global

Financing to external clients.

In addition to the strength of the economy and its impact on cor-

porate IT budgets, key drivers of Global Financing’s results are interest

rates and originations. Interest rates directly impact Global Financing’s

business by increasing or decreasing both financing revenue and the

associated borrowing costs. Originations, which determine the asset

base of Global Financing’s annuity-like business, are impacted by

IBM’s non-Global Financing sales volumes and Global Financing’s

participation rates. Participation rates are the propensity of IBM’s cli-

ents to finance their purchases through Global Financing in lieu of

paying IBM up-front cash or financing through a third party.

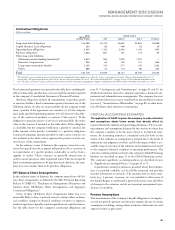

RESULTS OF OPERATIONS

(Dollars in millions)

FOR THE YEAR ENDED DECEMBER 31: 2006 2005 2004

External revenue $, $, $,

Internal revenue , , ,

Total revenue , , ,

Cost , , ,

Gross profit $, $, $,

Gross profit margin .% .% .%

Pre-tax income $, $, $,

After-tax income* $ $, $

Return on equity* .% .% .%

* See page 53 for the details of the After-tax income and the Return on equity calculations.

Total Global Financing revenue decreased 0.4 percent in 2006 as

compared to 2005, driven by a decrease in External revenue. External

revenue decreased 1.5 percent (2.0 percent adjusted for currency)

primarily driven by used equipment sales of $625 million in 2006

versus $681 million in 2005, a decrease of 8.3 percent. Internal revenue

increased 1.4 percent driven by financing revenue of $602 million in

2006 versus $544 million in 2005, an increase of 10.6 percent, par-

tially offset by used equipment sales of $925 million in 2006 versus

$962 million in 2005, a decrease of 3.8 percent. The increase in

financing revenue was due to higher average asset balances and higher

asset yields. The decrease in internal used equipment sales was due to

higher prior-year early terminations of internal leases and the subse-

quent sale of this equipment to Global Services, partially offset by

higher sales to the Systems and Technology Group.

Total Global Financing revenue increased 0.3 percent in 2005 as

compared to 2004, driven by Internal revenue growth. External reve-

nue decreased 7.9 percent (8.6 percent adjusted for currency) primarily

driven by financing revenue of $1,720 million in 2005 versus $1,899

million in 2004, a decrease of 9.4 percent, due to lower average asset

balances and declining asset yields. Internal revenue increased 17.0

percent driven by used equipment sales of $962 million in 2005 versus

$716 million in 2004, an increase of 34.4 percent, partially offset by

financing income of $544 million in 2005 versus $571 million in 2004,

a decrease of 4.7 percent. The increase in internal used equipment

sales was due to higher sales to the Systems and Technology Group,

as well as higher early terminations of internal leases and the subse-

quent sale of this equipment to Global Services.

MANAGEMENT DISCUSSION

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

49

Black

MAC

2718 CG10