IBM 2006 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

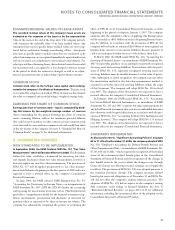

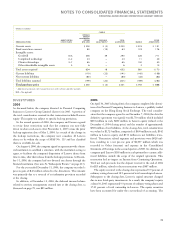

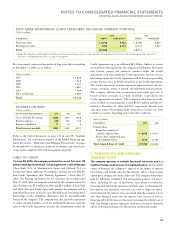

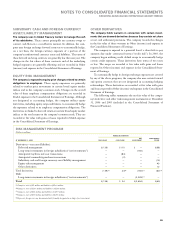

(Dollars in millions)

ASCENTIAL

ORIGINAL

AMOUNT

DISCLOSED IN

AMORTIZATION SECOND PURCHASE TOTAL OTHER

2005 ACQUISITIONS LIFE (IN YEARS) QTR. 2005 ADJUSTMENTS* ALLOCATION ACQUISITIONS

Current assets $ $() $ $

Fixed assets/non-current —

Intangible assets:

Goodwill N/A

Completed technology —

Client relationships —

Other identifiable intangible assets – — — —

In-process R&D — — —

Total assets acquired , — , ,

Current liabilities () () () ()

Non-current liabilities () () ()

Total liabilities assumed () — () ()

Total purchase price $, $ — $, $

* Adjustments primarily relate to acquisition costs, deferred taxes and other accruals.

N/A—Not applicable

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

76 2006 Annual Report

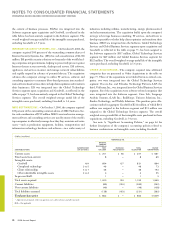

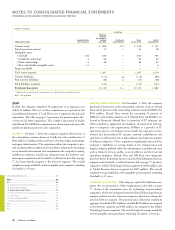

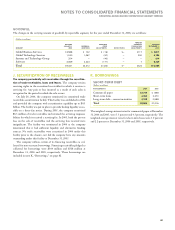

2004

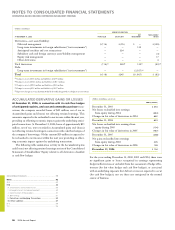

In 2004, the company completed 14 acquisitions at an aggregate cost

of $2,111 million. The cost of these acquisitions are reported in the

Consolidated Statement of Cash Flows net of acquired cash and cash

equivalents. The table on page 77 represents the purchase price allo-

cations for all 2004 acquisitions. The Candle Corporation (Candle)

and Maersk Data/DMdata acquisitions are shown separately given the

significant purchase price for each acquisition.

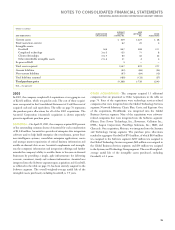

CANDLE – On June 7, 2004, the company acquired 100 percent of

the outstanding common shares of Candle for cash consideration of

$431 million. Candle provides services to develop, deploy and manage

enterprise infrastructure. The acquisition allows the company to pro-

vide its clients with an enhanced set of software solutions for managing

an on demand environment and complements the company’s existing

middleware solutions. Candle was integrated into the Software seg-

ment upon acquisition and Goodwill, as reflected in the table on page

77, has been entirely assigned to the Software segment. The overall

weighted-average useful life of the intangible assets acquired, excluding

Goodwill, is 5.9 years.

MAERSK DATA/DMDATA – On December 1, 2004, the company

purchased 100 percent of the outstanding common stock of Maersk

Data and 45 percent of the outstanding common stock of DMdata for

$792 million. Maersk Data owned the remaining 55 percent of

DMdata’s outstanding common stock. Maersk Data and DMdata are

located in Denmark. Maersk Data is a provider of IT solutions and

offers consultancy, application development, and operations and sup-

port to companies and organizations. DMdata is a provider of IT

operations and its core business areas include the operation of cen-

tralized and decentralized IT systems, network establishment and

operation, as well as print and security solutions for clients in a number

of different industries. These acquisitions significantly increased the

company’s capabilities in serving clients in the transportation and

logistics industry globally, while also enhancing its capabilities in areas

such as financial services, public sector, healthcare and the food and

agriculture industries. Maersk Data and DM Data were integrated

into the Global Technology Services and the Global Business Services

segments and Goodwill, as reflected in the table on page 77, has been

assigned to Global Technology Services segment for $269 million and

to Global Business Services segment for $157 million. The overall

weighted-average useful life of the intangible assets acquired, excluding

Goodwill, is 4.7 years.

OTHER ACQUISITIONS –The company acquired 12 additional com-

panies that are presented as Other Acquisitions in the table on page

77. Seven of the acquisitions were for technology services-related

companies, which were integrated into the Global Technology Services

segment and five were for software companies, which were integrated

into the Software segment. The purchase price allocations resulted in

aggregate Goodwill of $711 million, of which $329 million was assigned

to the Software segment and $382 million was assigned to the Global

Technology Services segment. The overall weighted-average useful life

of the intangible assets purchased, excluding Goodwill, is 4.8 years.

Consolidated Statements .........................................................

Notes .....................................................................................

A-G ......................................................................................... 62

A. Significant Accounting Policies ....................................... 62

B. Accounting Changes........................................................ 71

C. Acquisitions/Divestitures ................................................. 73

D. Financial Instruments (excluding derivatives) ................ 78

E. Inventories ....................................................................... 79

F. Financing Receivables ...................................................... 79

G. Plant, Rental Machines and Other Property ................... 79

H-M ......................................................................................... 80

N-S .......................................................................................... 88

T-X .......................................................................................... 96

Black

MAC

390 CG10