IBM 2006 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

110 2006 Annual Report

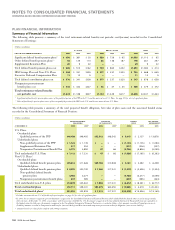

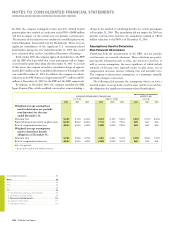

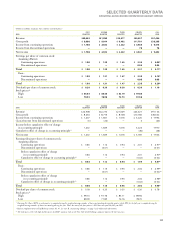

NONPENSION POSTRETIREMENT BENEFIT PLAN EXPECTED PAYMENTS

The following table reflects the total expected benefit payments to nonpension postretirement benefit plan participants, as well as the expected

receipt of the company’s share of the Medicare subsidy described below. These payments have been estimated based on the same assumptions

used to measure the company’s benefit obligation at year end.

(Dollars in millions)

LESS: U.S. PLAN TOTAL

EXPECTED EXPECTED

U.S. PLAN MEDICARE BENEFIT

PAYMENTS SUBSIDY PAYMENTS

2007 $ $ $

2008

2009

2010

2011

2012-2016 , — ,

The 2007 expected benefit payments to nonpension postretirement

benefit plan participants not covered by the plan assets represent a

component of Compensation and benefits, within Current liabilities,

in the Consolidated Statement of Financial Position.

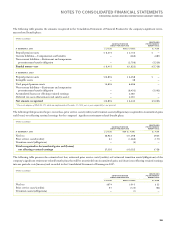

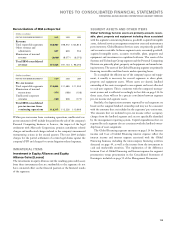

MEDICARE PRESCRIPTION DRUG ACT

In connection with the Medicare Prescription Drug Improvement

and Modernization Act of 2003, the company is expected to receive

a federal subsidy of approximately $340 million to subsidize the

prescription drug coverage provided by the U.S. nonpension postre-

tirement benefit plan over a period of approximately six years beginning

in 2006. Approximately $204 million of the subsidy will be used by the

company to reduce its obligation and expense related to the U.S.

nonpension postretirement benefit plan. The company will contrib-

ute the remaining subsidy of $136 million to the plan in order to

reduce contributions required by the participants. The company

received $27 million of the subsidy during the year ended December

31, 2006, which was utilized to reduce the company contributions for

prescription drug-related coverage.

In accordance with the provision of FASB Staff Position FSP FAS

106-2, “Accounting and Disclosure Requirements Related to the

Medicare Prescription Drug, Improvement and Modernization Act of

2003,” the company has included the impact of its portion of the subsidy

in the determination of APBO for the U.S. nonpension postretirement

benefit plan for the years ended December 31, 2006 and 2005. The

impact of the subsidy resulted in a reduction in the benefit obligation

of approximately $154 million and $188 million, at December 31,

2006 and 2005, respectively, and a reduction of net periodic cost/

(income) of $24 million for the year ended December 31, 2006 and

there was no reduction for the year ended December 31, 2005.

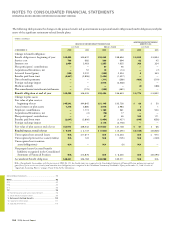

OTHER PLAN INFORMATION

At December 31, 2005 the company elected not to fund certain of the

company’s non-U.S. plans that had unfunded positions to the accumu-

lated benefit obligation (ABO) level, which required the company to

record a minimum pension liability. As of December 31, 2005, the

company recorded a reduction in the minimum pension liability of

$1,726 million and an increase to stockholders’ equity of $436 million.

The differences between these amounts and the amounts included in

the Consolidated Statement of Financial Position and Consolidated

Statement of Stockholders’ Equity relate to the non-material plans.

This accounting transaction did not impact 2005 net periodic cost/

(income). The minimum pension liability at December 31, 2006 of

$2,348 million was eliminated upon adoption of SFAS No. 158.

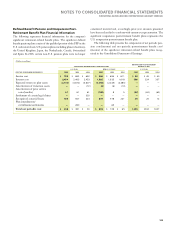

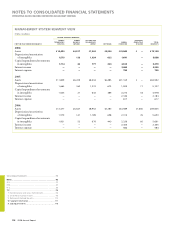

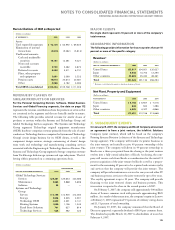

The table on page 111 presents information for significant pen-

sion plans with an ABO in excess of plan assets. For a more detailed

presentation of the funded status of the company’s significant pension

plans, see the table on page 102.

Consolidated Statements .........................................................

Notes .....................................................................................

A-G .........................................................................................

H-M .........................................................................................

N-S ..........................................................................................

T-X ..........................................................................................

T. Rental Expense and Lease Commitments .......................

U. Stock-Based Compensation ............................................

V. Retirement-Related Benefits ......................................... 100

W. Segment Information.................................................... 111

X. Subsequent Events ........................................................ 115

Black

MAC

390 CG10