IBM 2006 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Black

MAC

390 CG10

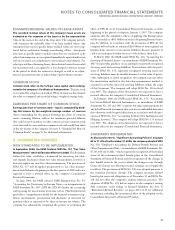

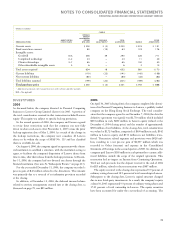

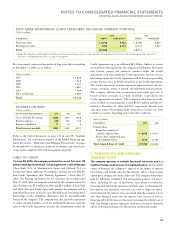

(Dollars in millions)

INTERNET MRO

AMORTIZATION SECURITY SOFTWARE, OTHER

2006 ACQUISITIONS LIFE (IN YEARS) SYSTEMS, INC. INC. ACQUISITIONS

Current assets $ $ $

Fixed assets/non-current

Intangible assets:

Goodwill N/A

Completed technology to

Client relationships to

Other identifiable intangible assets to

In-process R&D — —

Total assets acquired ,

Current liabilities () () ()

Non-current liabilities () () ()

Total liabilities assumed () () ()

Total purchase price $, $ $

N/A—Not applicable

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

75

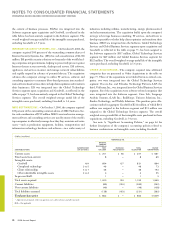

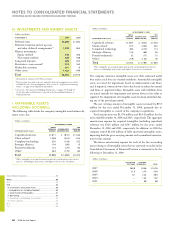

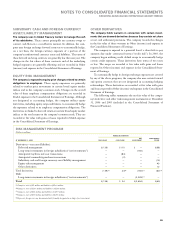

2005

In 2005, the company completed 16 acquisitions at an aggregate cost

of $2,022 million, which was paid in cash. The cost of these acquisi-

tions are reported in the Consolidated Statement of Cash Flows net of

acquired cash and cash equivalents. The table on page 76 represents

the purchase price allocations for all of the 2005 acquisitions. The

Ascential Corporation (Ascential) acquisition is shown separately

given its significant purchase price.

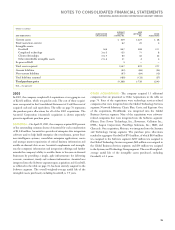

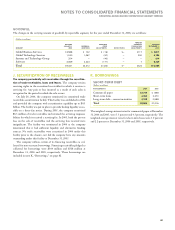

ASCENTIAL – On April 29, 2005, the company acquired 100 percent

of the outstanding common shares of Ascential for cash consideration

of $1,140 million. Ascential is a provider of enterprise data integration

software used to help build enterprise data warehouses, power busi-

ness intelligence systems, consolidate enterprise applications, create

and manage master repositories of critical business information and

enable on demand data access. Ascential complements and strength-

ens the company’s information and integration offerings and further

extends the company’s ability to enable clients to become on demand

businesses by providing a single, agile infrastructure for delivering

accurate, consistent, timely and coherent information. Ascential was

integrated into the Software segment upon acquisition and Goodwill,

as reflected in the table on page 76, has been entirely assigned to the

Software segment. The overall weighted-average useful life of the

intangible assets purchased, excluding Goodwill, is 3.9 years.

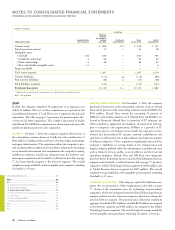

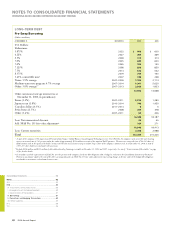

OTHER ACQUISITIONS – The company acquired 15 additional

companies that are presented as Other Acquisitions in the table on

page 76. Four of the acquisitions were technology services-related

companies that were integrated into the Global Technology Services

segment: Network Solutions; Classic Blue; Corio; and Equitant. One

of the acquisitions, HealthLink, was integrated into the Global

Business Services segment. Nine of the acquisitions were software-

related companies that were integrated into the Software segment:

iPhrase; Data Power Technology, Inc.; Bowstreet; Collation Inc.;

DWL; Isogon Corporation; PureEdge Solutions, Inc.; SRD; and

Gluecode. One acquisition, Meiosys, was integrated into the Systems

and Technology Group segment. The purchase price allocations

resulted in aggregate Goodwill of $791 million, of which $456 million

was assigned to the Software segment; $239 million was assigned to

the Global Technology Services segment; $62 million was assigned to

the Global Business Services segment; and $34 million was assigned

to the Systems and Technology Group segment. The overall weighted-

average useful life of the intangible assets purchased, excluding

Goodwill, is 3.1 years.