IBM 2006 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

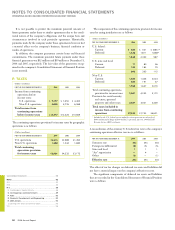

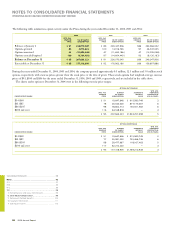

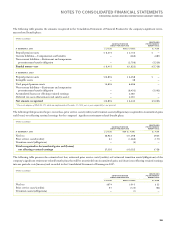

Employees purchased 5.8 million, 6.7 million and 11.6 million

shares under the ESPP during the years ended December 31, 2006,

2005 and 2004, respectively. Cash dividends declared and paid by the

company on its common stock also include cash dividends on the

company stock purchased through the ESPP. Dividends are paid on

full and fractional shares and can be reinvested in the ESPP. The

company stock purchased through the ESPP is considered outstand-

ing and is included in the weighted-average outstanding shares for

purposes of computing basic and diluted earnings per share.

Approximately 20.3 million, 26.2 million and 32.8 million shares

were available for purchase under the ESPP at December 31, 2006,

2005 and 2004, respectively.

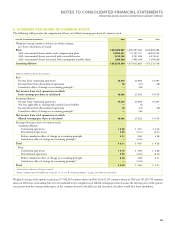

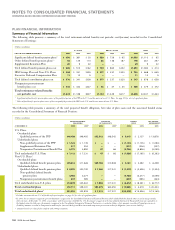

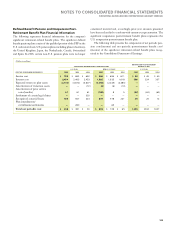

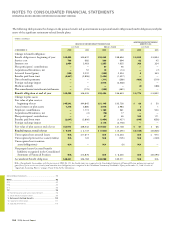

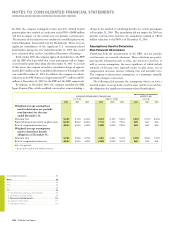

V. RETIREMENT-RELATED BENEFITS

DESCRIPTION OF PLANS

IBM sponsors defined benefit pension plans and defined contri-

bution plans that cover substantially all regular employees, a

supplemental retention plan that covers certain U.S. executives and

nonpension postretirement benefit plans primarily consisting of

retiree medical and dental benefits for eligible retirees and depen-

dents. These benefits form an important part of the company’s total

compensation and benefits program that is designed to attract and

retain highly skilled and talented employees.

U.S. Plans

DEFINED BENEFIT PENSION PLAN

IBM Personal Pension Plan

IBM provides U.S. regular, full-time and part-time employees hired

prior to January 1, 2005 with noncontributory defined benefit pension

benefits via the IBM Personal Pension Plan (PPP). The PPP consists

of a tax-qualified (qualified) plan and a non-tax qualified (non-quali-

fied) plan. The qualified plan is funded by company contributions to

an irrevocable trust fund, which is held for the sole benefit of partici-

pants and beneficiaries. The non-qualified plan, which is unfunded,

provides benefits in excess of IRS limitations for qualified plans.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

100 2006 Annual Report

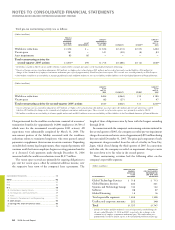

Benefits provided to the PPP participants are calculated using

benefit formulas that vary based on the participant. Pension benefits

are calculated using one of two methods based upon specified crite-

ria used to determine each participant’s eligibility. The first method

uses a five-year, final pay formula that determines benefits based on

salary, years of service, mortality and other participant-specific fac-

tors. The second method is a cash balance formula that calculates

benefits using a percentage of employees’ annual salary, as well as an

interest crediting rate.

In December 2005, the company approved an amendment to the

PPP, which provides that no further benefits under the PPP will

accrue for active participants after December 31, 2007.

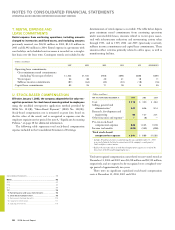

U.S. Supplemental Retention Plan

The company also sponsors a non-qualified U.S. Supplemental Reten-

tion Plan (SRP). The SRP, which is unfunded, provides benefits to

eligible U.S. executives based on average earnings, years of service and

age at termination of employment. Effective July 1, 1999, the company

replaced the then-effective SRP with the current SRP. Some partici-

pants in the previous SRP will still be eligible for benefits under that

prior plan if those benefits are greater than the benefits provided

under the current plan.

In December 2005, the company approved an amendment to the

SRP, which provides that no further benefits will accrue for active

participants after December 31, 2007.

DEFINED CONTRIBUTION PLANS

IBM Savings Plan

U.S. regular, full-time and part-time employees are eligible to par-

ticipate in the IBM Savings Plan, which is a qualified defined contribu-

tion plan under section 401(k) of the Internal Revenue Code. For

participants hired prior to January 1, 2005, the company matches 50

percent of their contributions up to the first 6 percent of eligible com-

pensation. For participants hired or rehired on or after January 1,

2005, who have completed one year of service, the company matches

100 percent of their contributions up to the first 6 percent of eligible

compensation. These participants participate in the 401(k) Pension

Plan offered through the IBM Savings Plan. The company’s matching

contributions vest immediately, and participants are always fully vested

in their own contributions. All contributions, including the company

match, are made in cash in accordance with the participants’ invest-

ment elections. There are no minimum amounts that must be invested

in company stock, and there are no restrictions on transferring

amounts out of the company stock to another investment choice.

In January 2006, the company announced its intention to amend

the plan effective January 1, 2008. The announced change will con-

sist of two components: an automatic contribution for all eligible

U.S. employees and an increase in the amount of company matching

contribution for all eligible U.S. employees hired on or before

December 31, 2004.

Consolidated Statements .........................................................

Notes .....................................................................................

A-G .........................................................................................

H-M .........................................................................................

N-S ..........................................................................................

T-X ..........................................................................................

T. Rental Expense and Lease Commitments .......................

U. Stock-Based Compensation ............................................

V. Retirement-Related Benefits .........................................

W. Segment Information....................................................

X. Subsequent Events ........................................................

Black

MAC

390 CG10