IBM 2006 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Black

MAC

390 CG10

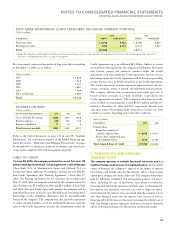

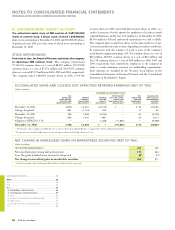

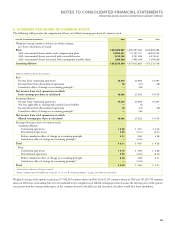

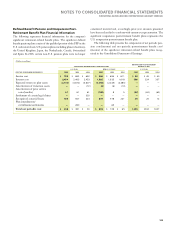

DEFERRED TAX ASSETS

(Dollars in millions)

AT DECEMBER 31: 2006 2005*

Stock-based and other compensation $ , $ ,

Retirement-related benefits , ,

Capitalized research and development , ,

Bad debt, inventory and warranty reserves

Deferred income

Foreign tax loss carryforwards

Domestic tax loss carryforwards

Capital loss carryforwards

Alternate minimum tax credits —

Other , ,

Gross deferred tax assets , ,

Less: valuation allowance

Net deferred tax assets $, $,

* Reclassified to conform with 2006 presentation.

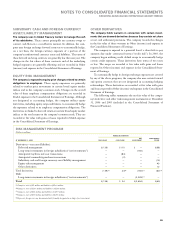

DEFERRED TAX LIABILITIES

(Dollars in millions)

AT DECEMBER 31: 2006 2005

Retirement-related benefits $, $ ,

Leases ,

Software development costs

Other , ,

Gross deferred tax liabilities $, $,

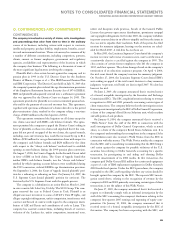

The valuation allowance at December 31, 2006, principally applies

to certain foreign, state and local and capital loss carryforwards that,

in the opinion of management, are more likely than not to expire

unutilized. However, to the extent that tax benefits related to these

carryforwards are realized in the future, the reduction in the valua-

tion allowance will reduce income tax expense.

In December 2006, the company and the IRS reached resolution

of the company’s U.S. income tax audit for 2001 through 2003. The

settlement of this audit resulted in a decrease in the 2006 effective

tax rate of 3 points due to the release of previously recorded tax

reserves. The company also expects to receive an immaterial tax

refund for these years.

In the fourth quarter of 2006, as a continuation of its global strat-

egy, the company aligned, through an intercompany transfer, certain

non-U.S. intellectual property rights with existing non-U.S. rights

currently owned by one of the company’s non-U.S. manufacturing

subsidiaries. This transfer resulted in a one-time increase in the 2006

effective tax rate of 4 points.

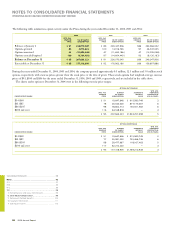

For income tax return purposes, the company has foreign, domes-

tic and capital loss carryforwards, the tax effect of which is $820

million. Substantially all of these carryforwards are available for at

least two years or are available for 10 years or more.

With limited exception, the company is no longer subject to U.S.

federal, state and local or non-U.S. income tax audits by taxing

authorities for years through 2000. The years subsequent to 2000

contain matters that could be subject to differing interpretations of

applicable tax laws and regulations as it relates to the amount and/or

timing of income, deductions and tax credits. Although the outcome

of tax audits is always uncertain, the company believes that adequate

amounts of tax and interest have been provided for any adjustments

that are expected to result for these years.

The company has not provided deferred taxes on $14.2 billion of

undistributed earnings of non-U.S. subsidiaries at December 31, 2006,

as it is the company’s policy to indefinitely reinvest these earnings in

non-U.S. operations. However, the company periodically repatriates a

portion of these earnings to the extent that it does not incur an addi-

tional U.S. tax liability. Quantification of the deferred tax liability, if

any, associated with indefinitely reinvested earnings is not practicable.

For additional information on the trends related to the company’s

ongoing effective tax rate, as well as the company’s cash tax rate, refer

to the “Looking Forward” section of the Management Discussion

on page 43.

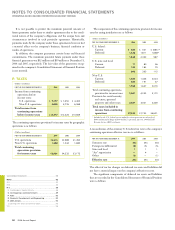

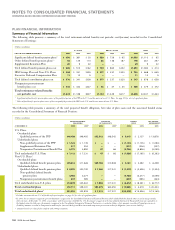

Q. RESEARCH, DEVELOPMENT

AND ENGINEERING

RD&E expense was $6,107 million in 2006, $5,842 million in 2005

and $5,874 million in 2004.

The company incurred expense of $5,682 million in 2006, $5,379

million in 2005 and $5,339 million in 2004 for scientific research and

the application of scientific advances to the development of new and

improved products and their uses, as well as services and their applica-

tion. Of these amounts, software-related expense was $2,842 million,

$2,689 million and $2,626 million in 2006, 2005 and 2004, respectively.

Included in the expense was a charge of $7 million and $1 million in

2006 and 2005, respectively, for acquired in-process R&D.

Expense for product-related engineering was $425 million, $463

million and $535 million in 2006, 2005 and 2004, respectively.

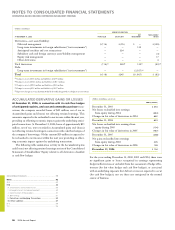

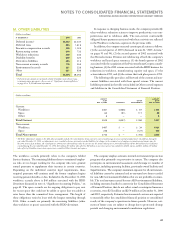

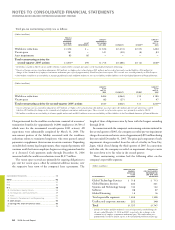

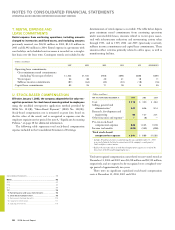

R. 2005 ACTIONS

In May 2005, management announced its plans to implement a

series of restructuring actions designed to improve the company’s

efficiencies, strengthen its client-facing operations and capture oppor-

tunities in high-growth markets. The company’s actions primarily

included voluntary and involuntary workforce reductions, with the

majority impacting the Global Services segments, primarily in Europe,

as well as costs incurred in connection with the vacating of leased

facilities. These actions were in addition to the company’s ongoing

workforce reduction and rebalancing activities that occur each quarter.

The total charges expected to be incurred in connection with all sec-

ond-quarter 2005 initiatives is approximately $1,757 million ($1,747

million of which has been recorded cumulatively through December

31, 2006) . Approximately $1,625 million of the total charges require

cash payments, of which approximately $1,368 million have been made

as of December 31, 2006 and $92 million are expected to be made over

the next 12 months.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

93