IBM 2006 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

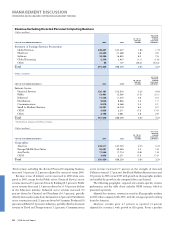

dividend payments, tax payments, acquisitions and capital spending.

See Cash Flow analysis below.

• Increase of $2,420 million in short-term receivables driven by:

— increase of $769 million in trade receivables as a result of fourth

quarter revenue growth;

— increase of $743 million in financing receivables due to asset

growth in commercial financing and customer loans; and

— approximately $1,106 million favorable currency impact.

Current liabilities increased $4,939 million as a result of:

• Increase of $1,686 million in Short-term debt as the company increased

commercial paper balances in support of the increased Global Financing

asset base discussed above;

• Growth in Deferred income driven by Software ($557 million) and

Global Services ($423 million);

• Increase of $1,270 million in Compensation and benefits primarily as

a result of SFAS No. 158 implementation; the company is required to

record as a current liability the amount of retirement-related benefit

payments that will be paid in the coming year ($990 million) that are

not covered by retirement plan assets; this would occur in unfunded or

underfunded plans; and

• Increase of $615 million in Accounts payable of which $256 million

was due to the effects of currency.

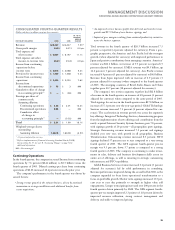

Cash Flow

The company’s cash flow from operating, investing and financing

activities, as reflected in the Consolidated Statement of Cash Flows

on page 58, is summarized in the table below. These amounts include

the cash flows associated with the company’s Global Financing busi-

ness. See pages 49 through 53.

(Dollars in millions)

FOR THE YEAR ENDED DECEMBER 31: 2006 2005

Net cash provided by/(used in)

continuing operations:

Operating activities $ , $,

Investing activities (,) (,)

Financing activities (,) (,)

Effect of exchange rate changes

on cash and cash equivalents ()

Net cash used in discontinued

operations—operating activities* () ()

Net change in cash and

cash equivalents $ (,) $ ,

* Does not include $319 million in 2005 of net proceeds from the sale of the HDD

business. $51 million is included in Operating activities from continuing operations

and $268 million is included in Investing activities from continuing operations.

Net cash from operating activities for 2006 increased $105 million

as compared to 2005 driven by the following key factors:

• Increase in net income of $1,559 million;

• Decrease in cash related to deferred income taxes, $461 million,

due to the utilization of tax credit carryforwards in 2005;

• Decrease in net gains on asset sales, $1,350 million, driven by the

gain related to the Personal Computing business divestiture in 2005;

• Pension assets and liabilities contributed an increase in cash of $878

million, primarily driven by lower pension funding of $549 million

($1,840 million funding of non-U.S. plans in 2006 versus $2,389

million total funding in 2005);

• Increase in cash driven by Accounts payable of $891 million primarily

as a result of the Personal Computing business divestiture in 2005; and

• Growth in accounts receivable drove a use of cash of $2,731 million;

this was driven by Global Financing receivables ($2,071 million)

primarily due to asset growth in the second half of 2006; in addition,

the Personal Computing business divestiture contributed to this year-

to-year decrease in cash.

Net cash used in investing activities increased $7,126 million on a year-

to-year basis driven by:

• Net purchases of marketable securities and other investments of

$2,668 million;

• Increased spending of $2,316 million for acquisitions;

• Increase in net capital spending of $1,210 million as a result of a

$521 million increase in capital expenditures primarily to support the

SO business, and a $677 million decrease in real estate sales versus

the prior year; and

• A decline in divestiture related cash proceeds of $932 million: $662

million related to the Personal Computing business divestiture and $268

million received from Hitachi representing the final proceeds related to

the HDD business sale; both of these payments were received in 2005.

Net cash used in financing activities increased $1,057 million com-

pared to 2005 as a result of:

• Higher dividend payments of $434 million as a result of the increase

in the company’s quarterly common stock dividend from $0.20 to

$0.30 per share; and

• Increase in net cash used to retire debt of $730 million.

Within total debt, on a net basis, the company utilized $121 million

in net cash to retire debt versus $609 million in net proceeds from

new debt in 2005. The net cash used in 2006 to retire debt was com-

prised of: $3,400 million in cash payments to retire debt offset by

$1,444 million of new debt issuances and $1,834 million in net short-

term borrowings. See note K, “Borrowings,” on pages 81 to 83 for a

listing of the company’s debt securities.

MANAGEMENT DISCUSSION

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

33

Black

MAC

2718 CG10