IBM 2006 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

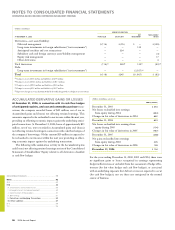

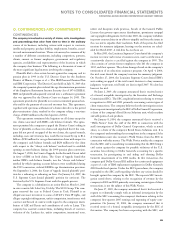

It is not possible to predict the maximum potential amount of

future payments under these or similar agreements due to the condi-

tional nature of the company’s obligations and the unique facts and

circumstances involved in each particular agreement. Historically,

payments made by the company under these agreements have not had

a material effect on the company’s business, financial condition or

results of operations.

In addition, the company guarantees certain loans and financial

commitments. The maximum potential future payment under these

financial guarantees was $32 million and $39 million at December 31,

2006 and 2005, respectively. The fair value of the guarantees recog-

nized in the company’s Consolidated Statement of Financial Position

is not material.

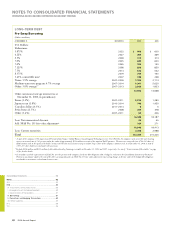

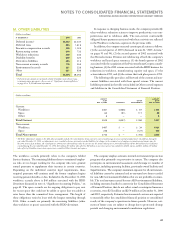

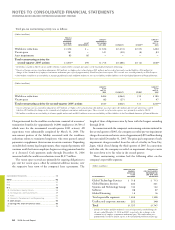

P. TAXES

(Dollars in millions)

FOR THE YEAR ENDED DECEMBER 31: 2006 2005 2004

Income from continuing

operations before

income taxes:

U.S. operations $ , $ , $ ,

Non-U.S. operations , , ,

Total income from

continuing operations

before income taxes $, $, $,

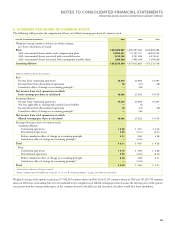

The continuing operations provision for income taxes by geographic

operations is as follows:

(Dollars in millions)

FOR THE YEAR ENDED DECEMBER 31: 2006 2005 2004

U.S. operations $, $, $,

Non-U.S. operations , , ,

Total continuing

operations provision

for income taxes $, $, $,

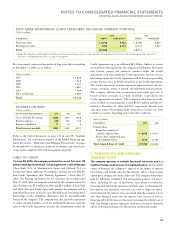

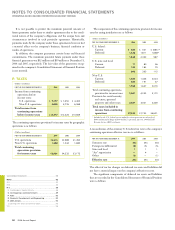

The components of the continuing operations provision for income

taxes by taxing jurisdiction are as follows:

(Dollars in millions)

FOR THE YEAR ENDED DECEMBER 31: 2006 2005 2004

U.S. federal:

Current $ $ $ ()*

Deferred , , ,*

, ,

U.S. state and local:

Current

Deferred

Non-U.S:

Current , , ,

Deferred

, , ,

Total continuing operations

provision for income taxes , , ,

Provision for social security,

real estate, personal

property and other taxes , , ,

Total taxes included in

income from continuing

operations $, $, $,

* Included in the U.S. federal current and deferred tax provisions are a benefit of

$848 million and a charge of $848 million, respectively, due to a 2004 Internal

Revenue Service (IRS) settlement.

A reconciliation of the statutory U.S. federal tax rate to the company’s

continuing operations effective tax rate is as follows:

FOR THE YEAR ENDED DECEMBER 31: 2006 2005 2004

Statutory rate % % %

Foreign tax differential () () ()

State and local

“Act” repatriation — —

Other () — ()

Effective rate % % %

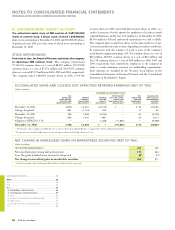

The effect of tax law changes on deferred tax assets and liabilities did

not have a material impact on the company’s effective tax rate.

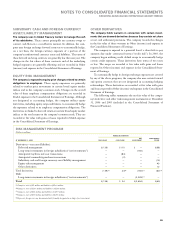

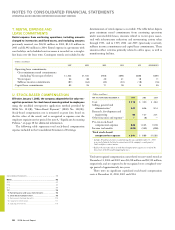

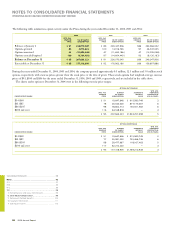

The significant components of deferred tax assets and liabilities

that are recorded in the Consolidated Statement of Financial Position

were as follows:

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

92 2006 Annual Report

Consolidated Statements .........................................................

Notes .....................................................................................

A-G .........................................................................................

H-M .........................................................................................

N-S ..........................................................................................

N. Stockholders’ Equity Activity ..........................................

O. Contingencies and Commitments ...................................

P. Taxes ................................................................................

Q. Research, Development and Engineering ......................

R. 2005 Actions ....................................................................

S. Earnings Per Share of Common Stock .............................

T-X ..........................................................................................

Black

MAC

390 CG10