IBM 2006 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Black

MAC

390 CG10

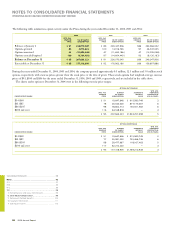

DISCOUNT RATE

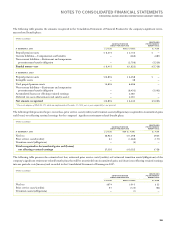

The discount rate assumptions used for the retirement-related benefit

plans accounting reflect the yields available on high-quality, fixed

income debt instruments. For the U.S. discount rate assumptions, a

portfolio of corporate bonds is constructed with maturities that match

the expected timing of the benefit obligation payments. In the non-

U.S., where markets for high-quality long-term bonds are not generally

as well developed, long-term government bonds are used as a base, to

which a credit spread is added to simulate corporate bond yields at

these maturities in the jurisdiction of each plan, as the benchmark for

developing the respective discount rates.

For the PPP, the changes in discount rate assumptions impacted

both net periodic cost/(income) and the PBO. For purposes of mea-

suring the net periodic cost/(income) for the years ended December

31, 2006, 2005 and 2004, the changes in discount rate assumptions

resulted in an increase in net periodic cost/(income) of $94 million,

$90 million and $197 million, respectively. For purposes of measuring

the PBO, the changes in discount rate assumptions resulted in a

decrease in the PBO of $1,240 million at December 31, 2006 and an

increase in the PBO of $1,272 million at December 31, 2005.

For the significant non-U.S. defined benefit pension plans, the

changes in discount rate assumptions at December 31, 2005 resulted

in an increase in 2006 net periodic cost/(income) of $274 million.

Changes in discount rate assumptions at December 31, 2004 had no

material impact on 2005 net periodic cost/(income).

For the U.S. nonpension postretirement benefit plan, the changes

in discount rate assumptions had no material impact on net periodic

cost/(income) for the years ended December 31, 2006, 2005 and 2004

and on the benefit obligation at December 31, 2006 and 2005.

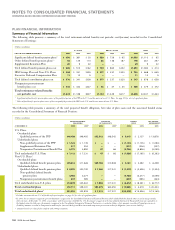

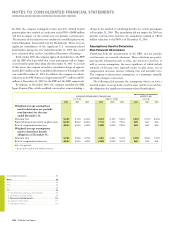

EXPECTED LONG-TERM RETURNS ON PLAN ASSETS

Expected long-term returns on plan assets take into account long-term

expectations for future returns and investment strategy. These rates of

return are developed by the company in conjunction with external

advisors, are calculated using an arithmetic average and are tested for

reasonableness against the historical return average by asset category,

usually over a 10-year period. The use of expected long-term returns

on plan assets may result in recognized pension income that is greater

or less than the actual returns of those plan assets in any given year.

Over time, however, the expected long-term returns are designed to

approximate the actual long-term returns and therefore result in a

pattern of income and expense recognition that more closely matches

the pattern of the services provided by the employees. Differences

between actual and expected returns are recognized over five years in

the expected return on plan assets line in net periodic cost/(income)

and also as a component of unrecognized gains/losses, which is recog-

nized over the service lives of the employees in the plan, provided

such amounts exceed thresholds which are based upon the obligation

or the value of plan assets, as provided by accounting standards.

For the PPP, the expected long-term return on plan assets of 8.0

percent remained constant for the years ended December 31, 2006

and 2005 and, consequently, had no incremental impact on net peri-

odic cost/(income).

For the material non-U.S. defined benefit pension plans, the

changes in the expected long-term return on plan assets for the years

ended December 31, 2006, 2005 and 2004 resulted in an increase in

the net periodic cost/(income) of $18 million, $140 million and $54

million, respectively.

For the U.S. nonpension postretirement benefit plan, the com-

pany maintains a nominal, highly liquid trust fund balance to ensure

payments are made timely. As a result, for the years ended December

31, 2006, 2005 and 2004, the expected long-term return on plan assets

and the actual return on those assets were not material.

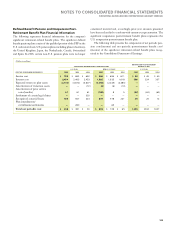

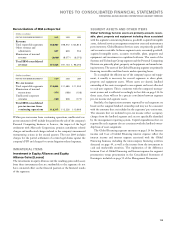

RATE OF COMPENSATION INCREASES

AND MORTALITY RATE

The rate of compensation increases and mortality rates are also signifi-

cant assumptions used in the actuarial model for pension accounting.

The rate of compensation increases is determined by the company,

based upon its long-term plans for such increases. Mortality rate

assumptions are based on life expectancy and death rates for different

types of participants. Mortality rates are periodically updated based on

actual experience. Changes to defined benefit pension plans mortality

rate assumptions increased 2006 net periodic pension cost/(income)

approximately $55 million and changes to the rate of compensation

increases reduced 2006 net periodic pension cost/(income) approxi-

mately $32 million. Changes to the rate of compensation increases or

to mortality rate assumptions had no material impact on the net peri-

odic cost/(income) for the years ended December 31, 2005 and 2004

and on the benefit obligation at December 31, 2006 and 2005.

INTEREST CREDITING RATE

Benefits for certain participants in the PPP are calculated using a cash

balance formula. An assumption underlying this formula is an interest

crediting rate, which impacts both net periodic cost/(income) and the

PBO. This assumption provides a basis for projecting the expected

interest rate that participants will earn on the benefits that they are

expected to receive in the following year and are based on the average

from August to October of the one-year U.S. Treasury Constant

Maturity yield plus one percent.

For the PPP, the change in the interest crediting rate to 5.0 per-

cent for the year ended December 31, 2006 from 3.1 percent for the

year ended December 31, 2005 resulted in an increase to net periodic

cost/(income) of $170 million. The change in the interest crediting

rate to 3.1 percent for the year ended December 31, 2005 from 2.3

percent for the year ended December 31, 2004, resulted in an increase

to net periodic cost/(income) of $55 million. The change in the inter-

est crediting rate to 2.3 percent for the year ended December 31,

2004 from 2.7 percent for the year ended December 31, 2003, resulted

in a decrease to net periodic cost/(income) of $20 million.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

107