IBM 2006 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Commercial financing receivables arise primarily from inventory

and accounts receivable financing for dealers and remarketers of IBM

and non-IBM products. Payment terms for inventory financing and

accounts receivable financing generally range from 30 to 90 days.

These short-term receivables are primarily unsecured and are also sub-

ject to additional credit actions in order to mitigate the associated risk.

Originations

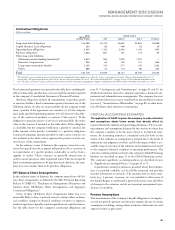

The following are total external and internal financing originations.

(Dollars in millions)

FOR THE YEAR ENDED DECEMBER 31: 2006 2005 2004

Client financing:

External $, $, $,

Internal , , ,

Commercial financing , , ,

Total $, $, $,

New financing originations exceeded cash collections for both client

and commercial financing in 2006, which resulted in a net increase in

financing assets from December 31, 2005. The increase in origina-

tions in 2006 versus 2005 was due to improving volumes in both client

and commercial financing. The increase from 2005 versus 2004 was

driven by an improvement in commercial financing partially offset by

a decline in client financing.

Cash generated by Global Financing in 2006 was deployed to pay

intercompany payables and dividends to IBM.

Financing Assets by Sector

The following are the percentages of external financing assets by

industry sector.

AT DECEMBER 31: 2006 2005

Financial Services % %

Business Partners*

Industrial

Public

Distribution

Communications

Other

Total % %

* Business Partners’ financing assets represent a portion of commercial financing

inventory and accounts receivable financing for terms generally less than 90 days.

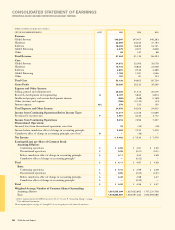

Global Financing Receivables and Allowances

The following table presents external financing receivables, excluding

residual values, and the allowance for doubtful accounts.

(Dollars in millions)

AT DECEMBER 31: 2006 2005

Gross financing receivables $, $,

Specific allowance for doubtful accounts

Unallocated allowance for

doubtful accounts

Total allowance for doubtful accounts

Net financing receivables $, $,

Allowance for doubtful account coverage .% .%

Roll-Forward of Financing Receivables

Allowance for Doubtful Accounts

(Dollars in millions)

ADDITIONS/

(REDUCTIONS)

ALLOWANCE BAD DEBT DEC. 31,

JAN. 1, 2006 USED* EXPENSE OTHER** 2006

$ $() $() $ $

* Represents reserved receivables, net of recoveries, that were disposed of during

the period.

** Primarily represents translation adjustments.

The percentage of financing receivables reserved decreased from 2.2

percent at December 31, 2005 to 1.5 percent at December 31, 2006

primarily due to the decrease in the specific allowance for doubtful

accounts. Specific reserves decreased 30.2 percent from $421 million

at December 31, 2005 to $294 million at December 31, 2006 due to

the disposition of reserved receivables during the period combined

with lower requirements for additional specific reserves. This lower

requirement is due to improving economic conditions, as well as

portfolio management to reduce credit risk. Unallocated reserves

decreased 9.5 percent from $84 million at December 31, 2005 to $76

million at December 31, 2006 also due to improved economic condi-

tions and the improved credit quality of the portfolio.

Global Financing’s bad debt expense was a reduction of $20 mil-

lion for 2006 and a reduction of $35 million for 2005. The continued

reduction was primarily attributable to the improvement in economic

conditions and improved credit quality of the portfolio during 2006.

Residual Value

Residual value is a risk unique to the financing business and manage-

ment of this risk is dependent upon the ability to accurately project

future equipment values at lease inception. Global Financing has

insight into product plans and cycles for the IBM products under

lease. Based upon this product information, Global Financing con-

tinually monitors projections of future equipment values and compares

them with the residual values reflected in the portfolio. See note A,

“Significant Accounting Policies,” on page 71 for the company’s

accounting policy for residual values.

MANAGEMENT DISCUSSION

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

51

Black

MAC

2718 CG10