IBM 2006 Annual Report Download - page 43

Download and view the complete annual report

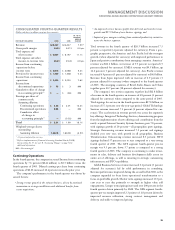

Please find page 43 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. Total SG&A expense of $21,314 million increased 6.1 percent (6

percent adjusted for currency). The increase was primarily driven by

the restructuring charges recorded in the second quarter of 2005. In

addition, retirement-related expenses increased ($236 million) in

2005. These increases were partially offset by lower operational

expenses as a result of the restructuring actions and the Personal

Computing business divestiture, lower stock-based compensation

expense of $308 million and lower ongoing workforce reductions. In

addition, Bad debt expense declined $164 million primarily due to

decreased specific reserve requirements, an overall reduction in the

financing asset portfolio, an improvement in economic conditions and

improved credit quality.

Other (income) and expense was income of $2,122 million and

$23 million in 2005 and 2004, respectively. The increase was primar-

ily driven by the gain on the sale of the Personal Computing business.

The pre-tax gain associated with this transaction was $1,108 million.

In addition, the company settled certain antitrust issues with the

Microsoft Corporation and the gain from this settlement was $775

million; additional Interest income ($127 million) generated by the

company in 2005; and lower foreign currency transaction losses of

$211 million, which relate to losses on certain hedge contracts offset

by settlement of foreign currency receivables and payables. The com-

pany also had additional gains ($108 million) from the sale of certain

real estate transactions in 2005 versus 2004. These gains were par-

tially offset by real-estate related restructuring charges recorded in

the second quarter of 2005.

Research, development and engineering (RD&E) expense of

$5,842 million decreased $32 million or 0.6 percent driven by the

sale of the Personal Computing business in the second quarter of

2005 ($93 million) and lower spending in Microelectronics ($93 mil-

lion) and Software ($25 million). These decreases were partially

offset by increased spending in Systems and Technology for server

products ($171 million). Included in RD&E expense was increased

retirement-related expense of $95 million and a decrease of $94 mil-

lion for stock-based compensation expense in 2005 versus 2004.

Intellectual property (IP) and custom development income of

$948 million decreased $222 million or 19.0 percent in 2005 versus

2004. The decrease was driven by Sales and other transfers of intel-

lectual property ($230 million) due primarily to Applied Micro

Circuits Corporation’s (AMCC) acquisition of the company’s IP

associated with its embedded PowerPC 4xx standard products for

$208 million in 2004.

The provision for income taxes resulted in an effective tax rate of

34.6 percent for 2005, compared with the 2004 effective tax rate of

29.7 percent. The 4.9 point increase in the effective tax rate in 2005

was primarily due to the third-quarter 2005 tax charge associated with

the repatriation of $9.5 billion under the American Jobs Creation

Act of 2004.

Assets of $105,748 million declined $5,256 million or 4.7 percent,

of which, $5,715 million of the year-to-year decrease relates to the

impact of currency translation. Other asset changes primarily con-

sisted of an increase in Cash and cash equivalents, an increase in

Goodwill associated with 2005 acquisitions and increased Prepaid

pension assets. These increases were partially offset by lower financ-

ing receivables and lower deferred tax assets.

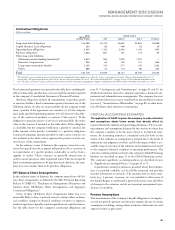

DISCONTINUED OPERATIONS

On December 31, 2002, the company sold its HDD business to

Hitachi for approximately $2 billion. The final cash payment of $399

million was received on December 30, 2005. In addition, the company

paid Hitachi $80 million to settle warranty obligations during 2005.

These transactions were consistent with the company’s previous esti-

mates. The HDD business was accounted for as a discontinued

operation whereby the results of operations and cash flows were

removed from the company’s results from continuing operations for

all periods presented.

In 2006, the company reported net income of $76 million, net of

tax, primarily related to tax benefits from tax audit settlements. The

company incurred a loss from discontinued operations of $24 million

in 2005 and $18 million in 2004, net of tax. These losses were primar-

ily due to additional costs associated with parts warranty as agreed

upon by the company and Hitachi, under the terms of the agreement

for the sale of the HDD business to Hitachi.

OTHER INFORMATION

LOOKING FORWARD

The following key drivers impacting the company’s business are

discussed on page 21:

• Economic environment and corporate spending budgets;

• Internal business transformation and global integration initiatives;

• Innovation initiatives;

• Open standards; and

• Investing in growth opportunities.

Looking forward, while uncertainties make forecasts difficult, based

on economic indicators, the company anticipates moderate growth

for the world economy, capital investment and the traditional IT

industry. The pace of globalization is expected to increase competi-

tion, further driving clients to innovate and transform their business

models, processes and practices, all of which create opportunities for

the company.

As highlighted in the Management Discussion Snapshot on page

14, the company has successfully transformed its business model over

the past several years. This transformation led to the company’s per-

formance in 2006 and has positioned it to capture additional market

opportunities worldwide going forward.

The company has a significant global presence, operating in 170

countries, with approximately 60 percent of its revenue generated

outside the United States. In addition, approximately 65 percent of the

company’s employees are located outside the United States, including

about 30 percent in Asia Pacific. This global reach gives the company

MANAGEMENT DISCUSSION

INTERNATIONAL BUSINESS MACHIN ES CORPORATION AND SUBSI DIARY COMPANIES

41

Black

MAC

2718 CG10