IBM 2006 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

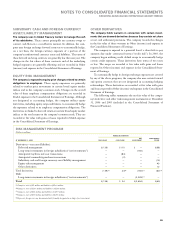

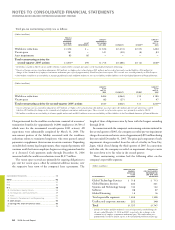

N. STOCKHOLDERS’ EQUITY ACTIVITY

The authorized capital stock of IBM consists of 4,687,500,000

shares of common stock, $.20 par value, of which 1,506,482,612

shares were outstanding at December 31, 2006 and 150,000,000 shares

of preferred stock, $.01 par value, none of which were outstanding at

December 31, 2006.

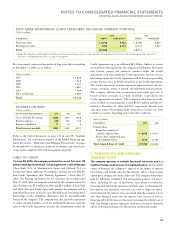

STOCK REPURCHASES

From time to time, the Board of Directors authorizes the company

to repurchase IBM common stock. The company repurchased

97,564,462 common shares at a cost of $8,022 million, 90,237,800

common shares at a cost of $7,671 million and 78,562,974 common

shares at a cost of $7,275 million in 2006, 2005 and 2004, respectively.

The company issued 3,489,803 treasury shares in 2006, 2,594,786

treasury shares in 2005 and 2,840,648 treasury shares in 2004, as a

result of exercises of stock options by employees of certain recently

acquired businesses and by non-U.S. employees. At December 31, 2006,

$4,993 million of Board authorized repurchases was still available.

The company plans to purchase shares on the open market or in pri-

vate transactions from time to time, depending on market conditions.

In connection with the issuance of stock as part of the company’s

stock-based compensation plans, 633,769 common shares at a cost of

$52 million, 606,697 common shares at a cost of $52 million and

422,338 common shares at a cost of $38 million in 2006, 2005 and

2004, respectively, were remitted by employees to the company in

order to satisfy minimum statutory tax withholding requirements.

Such amounts are included in the Treasury stock balance in the

Consolidated Statement of Financial Position and the Consolidated

Statement of Stockholders’ Equity.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

88 2006 Annual Report

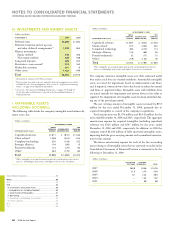

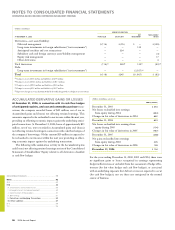

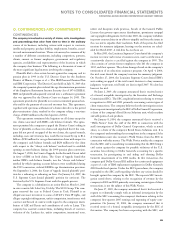

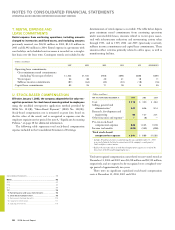

ACCUMULATED GAINS AND (LOSSES) NOT AFFECTING RETAINED EARNINGS (NET OF TAX)

(Dollars in millions)

RETIREMENT-RELATED BENEFIT PLANS*

NET PRIOR SERVICE NET ACCUMULATED

UNREALIZED FOREIGN MINIMUM COSTS, NET GAINS/ UNREALIZED GAINS/(LOSSES)

GAINS/(LOSSES) CURRENCY PENSION (LOSSES) AND GAINS ON NOT AFFECTING

ON CASH FLOW TRANSLATION LIABILITY TRANSITION ASSETS/ MARKETABLE RETAINED

HEDGE DERIVATIVES ADJUSTMENTS** ADJUSTMENTS* (OBLIGATIONS)* SECURITIES EARNINGS

December 31, 2004 $() $ , $(,) $ — $ $(,)

Change for period (,) —

December 31, 2005 , (,) — (,)

Change for period () , , — ,

Adoption of SFAS No. 158 — — , (,) — (,)

December 31, 2006 $() $ , $ — $(,) $ $(,)

* 2006 activity relates to adoption of SFAS No. 158, see note V, “Retirement-Related Benefits,” on pages 100 to 111 for additional information.

** Foreign currency translation adjustments are presented gross with associated hedges shown net of tax.

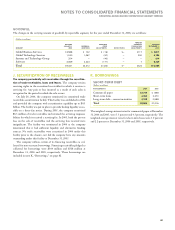

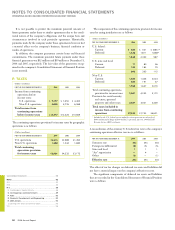

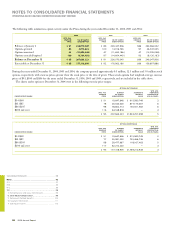

NET CHANGE IN UNREALIZED GAINS ON MARKETABLE SECURITIES (NET OF TAX)

(Dollars in millions)

FOR THE PERIOD ENDED DECEMBER 31: 2006 2005

Net unrealized gains arising during the period $ $

Less: Net gains included in net income for the period * *

Net change in unrealized gains on marketable securities $ $

* Includes writedowns of $2.9 million and $0.6 million in 2006 and 2005, respectively.

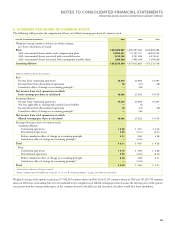

Consolidated Statements .........................................................

Notes .....................................................................................

A-G ......................................................................................... 62

H-M .........................................................................................

N-S ..........................................................................................

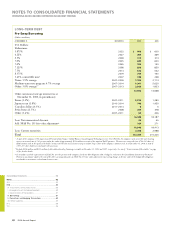

N. Stockholders’ Equity Activity ..........................................

O. Contingencies and Commitments ...................................

P. Taxes ................................................................................

Q. Research, Development and Engineering ......................

R. 2005 Actions ....................................................................

S. Earnings Per Share of Common Stock .............................

T-X ..........................................................................................

Black

MAC

390 CG10