IBM 2006 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

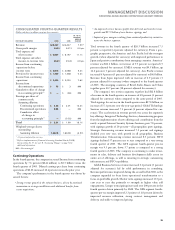

Total expense and other income increased 2.8 percent (2.4 percent

adjusted for currency) in 2006 versus 2005. Overall, the increase was

primarily due to increased Research, development and engineering

expense driven by acquisitions and lower Other (income) and expense

driven by the gain associated with the sale of the Personal Computing

business and the Microsoft settlement in 2005. These increases were

partially offset by lower Selling, general and administrative expense

due primarily to the restructuring charges recorded in the second

quarter of 2005. The expense-to-revenue ratio increased 0.7 points to

27.3 percent in 2006, as revenue increased 0.3 percent and expense

increased 2.8 percent in 2006 versus 2005. For additional information

regarding the increase in Total expense and other income, see the

following analyses by category:

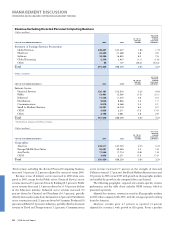

SELLING, GENERAL AND ADMINISTRATIVE

(Dollars in millions)

YR. TO YR.

FOR THE YEAR ENDED DECEMBER 31: 2006 2005* CHANGE

Selling, general and

administrative expense:

Selling, general and

administrative—base $, $, .%

Advertising and

promotional expense , , (.)

Workforce reductions—

ongoing .

Restructuring () , NM

Amortization expense—

acquired intangibles (.)

Retirement-related expense (.)

Stock-based compensation (.)

Bad debt expense () () (.)

Total $, $, (.)%

* Reclassified to conform with 2006 presentation.

NM—Not meaningful

Total Selling, general and administrative (SG&A) expense decreased

4.9 percent (5.3 percent adjusted for currency). The decrease was

primarily driven by the restructuring charges recorded in the second

quarter of 2005. See note R, “2005 Actions,” on pages 93 and 94 for

additional information. In addition, retirement-related expense and

stock-based compensation expense (see “Retirement-Related Benefits”

and “Stock-Based Compensation,” on pages 27 and 28 for additional

information) decreased in 2006 versus 2005. These decreases were

partially offset by increased operational expenses (SG&A-base) as a

result of strategic acquisitions and investments the company is making

in its software and services businesses as well as emerging countries.

The returns on these investments are reflected in the revenue growth

in the company’s key middleware brands and emerging countries dur-

ing 2006 and strong services signings in the fourth quarter.

OTHER (INCOME) AND EXPENSE

(Dollars in millions)

YR. TO YR.

FOR THE YEAR ENDED DECEMBER 31: 2006 2005* CHANGE

Other (income) and expense:

Foreign currency

transaction (gains)/losses $() $ NM

Losses on derivative instruments NM

Interest income () () .%

Net gains from securities

and investments assets () () (.)

Net realized gains from

certain real estate activities () () (.)

Restructuring () NM

Lenovo/Microsoft gains () (,) (.)

Other () () .

Total $() $(,) (.)%

* Reclassified to conform with 2006 presentation.

NM—Not meaningful

Other (income) and expense was net income of $766 million and

$2,122 million in 2006 and 2005, respectively. The decrease in net

income was primarily driven by the gain on the sale of the company’s

Personal Computing business recorded in 2005. The pre-tax gain

associated with this transaction was $1,108 million. See note C,

“Acquisitions/Divestitures,” on pages 77 and 78 for additional infor-

mation. In addition, the company settled certain antitrust issues with

the Microsoft Corporation in 2005 and the gain from this settlement

was $775 million. The company also had lower income from certain

real estate activities, as 2005 had unusually high gains from a few

large real estate transactions. These decreases in income were par-

tially offset by additional Interest income generated by the company

in 2006; foreign currency transaction gains in 2006 versus losses in

2005 and real estate related restructuring charges recorded in the

second quarter of 2005. See note R, “2005 Actions,” on pages 93 and

94 for additional information. The Losses on derivative instruments

relate to losses on certain hedge contracts offset by settlement of

foreign currency receivables and payables. See “Currency Rate Fluc-

tuations,” on page 47 for additional discussion of currency impacts on

the company’s financial results.

MANAGEMENT DISCUSSION

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

26 2006 Annual Report

Management Discussion ........................................................

Road Map .............................................................................

Forward-Looking and Cautionary Statements .....................

Management Discussion Snapshot ......................................

Description of Business .......................................................

Year in Review......................................................................

Prior Year in Review .............................................................

Discontinued Operations .....................................................

Other Information ................................................................

Global Financing ..................................................................

Report of Management .........................................................

Report of Independent Registered Public Accounting Firm ....

Consolidated Statements .......................................................

Black

MAC

2718 CG10