IBM 2006 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

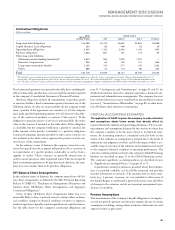

Changes in the discount rate assumptions will impact the service

cost, (gain)/loss amortization and interest cost components of the net

periodic pension cost/(income) calculation (see page 107 for informa-

tion regarding the discount rate assumptions) and the projected benefit

obligation (PBO). As presented on page 106, the company increased

the discount rate assumption for the U.S. PPP by 25 basis points to

5.75 percent on December 31, 2006. This change will decrease pre-tax

cost and expense recognized in 2007 by $90 million. If the discount

rate assumption for the PPP decreased by 25 basis points on

December 31, 2006, pre-tax cost and expense recognized in 2007

would have increased by $87 million. Changes in the discount rate

assumptions will impact the PBO which, in turn, may impact the

company’s funding decisions if the PBO exceeds plan assets. Each 25

basis point increase or decrease in the discount rate will cause a cor-

responding decrease or increase, respectively, in the PPP’s PBO of an

estimated $1.2 billion based upon December 31, 2006 data. Page 104

presents the PPP’s PBO (after the increase in discount rate presented

on page 106) and plan assets as of December 31, 2006.

The expected long-term return on plan assets is used in calculating

the net periodic pension (income)/cost. See page 107 for information

regarding the expected long-term return on plan assets assumption.

The differences between the actual return on plan assets and expected

long-term return on plan assets are recognized over five years in the

expected return on plan assets line in net periodic pension (income)/

cost and also as a component of actuarial gains/losses, which are rec-

ognized over the service lives of the employees in the plan, provided

such amounts exceed thresholds which are based upon the obligation

or the value of plan assets, as provided by accounting standards.

To the extent the outlook for long-term returns changes such that

management changes its expected long-term return on plan assets

assumption, each 50 basis point increase or decrease in the expected

long-term return on PPP plan assets assumption will have an estimated

increase or decrease, respectively, of $232 million on the following

year’s pre-tax net periodic pension (income)/cost (based upon the

PPP’s plan assets at December 31, 2006 and assuming no contribu-

tions are made in 2007).

The company may voluntarily make contributions or be required,

by law, to make contributions to its pension plans. Actual results that

differ from the estimates may result in more or less future company

funding into the pension plans than is planned by management.

Impacts of these types of changes on the company’s pension plans

in other countries worldwide will vary depending upon the status of

each respective plan.

Costs to Complete Service Contracts

The company enters into numerous service contracts through its

GTS and GBS businesses. During the contractual period, revenue,

cost and profits may be impacted by estimates of the ultimate profit-

ability of each contract, especially contracts for which the company

uses the percentage-of-completion (POC) method of accounting. If

at any time these estimates indicate the contract will be unprofitable

for POC contracts, the entire estimated loss for the remainder of the

contract is recorded immediately in cost. The company performs ongo-

ing profitability analyses of its services contracts in order to determine

whether the latest estimates require updating. Key factors reviewed by

the company to estimate the future costs to complete each contract

are future labor costs, future product costs and productivity efficiencies.

Contract loss provisions recorded as a component of Other accrued

expenses and liabilities are approximately $32 million and $70 million

at December 31, 2006 and December 31, 2005, respectively.

Income Taxes

The company is subject to income taxes in both the U.S. and numerous

foreign jurisdictions. Significant judgments are required in determin-

ing the consolidated provision for income taxes.

During the ordinary course of business, there are many transac-

tions and calculations for which the ultimate tax determination is

uncertain. As a result, the company recognizes tax liabilities based on

estimates of whether additional taxes and interest will be due. These

tax liabilities are recognized when, despite the company’s belief that

its tax return positions are supportable, the company believes that

certain positions are likely to be challenged and may not be fully sus-

tained upon review by tax authorities. The company believes that its

accruals for tax liabilities are adequate for all open audit years based on

its assessment of many factors including past experience and interpre-

tations of tax law. This assessment relies on estimates and assumptions

and may involve a series of complex judgments about future events.

To the extent that the final tax outcome of these matters is different

than the amounts recorded, such differences will impact income tax

expense in the period in which such determination is made.

Significant judgment is also required in determining any valuation

allowance recorded against deferred tax assets. In assessing the need

for a valuation allowance, management considers all available evi-

dence including past operating results, estimates of future taxable

income and the feasibility of ongoing tax planning strategies. In the

event that the company changes its determination as to the amount of

deferred tax assets that can be realized, the company will adjust its

valuation allowance with a corresponding impact to income tax

expense in the period in which such determination is made.

MANAGEMENT DISCUSSION

INTERNATIONAL BUSINESS MACHIN ES CORPORATION AND SUBSI DIARY COMPANIES

46 2006 Annual Report

Management Discussion ........................................................

Road Map .............................................................................

Forward-Looking and Cautionary Statements .....................

Management Discussion Snapshot ......................................

Description of Business .......................................................

Year in Review......................................................................

Prior Year in Review .............................................................

Discontinued Operations .....................................................

Other Information ................................................................

Global Financing ..................................................................

Report of Management .........................................................

Report of Independent Registered Public Accounting Firm ....

Consolidated Statements .......................................................

Black

MAC

2718 CG10