IBM 2006 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Black

MAC

390 CG10

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

111

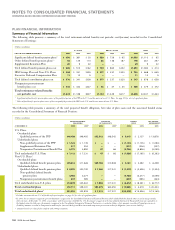

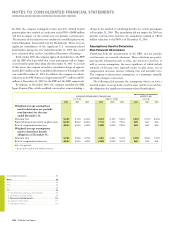

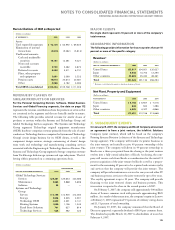

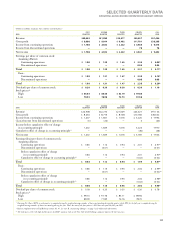

(Dollars in millions)

2006 2005

BENEFIT BENEFIT

AT DECEMBER 31: OBLIGATION PLAN ASSETS OBLIGATION PLAN ASSETS

Plans with PBO in excess of plan assets $, $ , $, $,

Plans with ABO in excess of plan assets , , , ,

Plans with assets in excess of PBO , , , ,

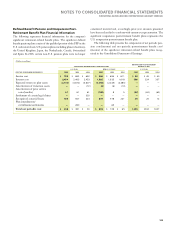

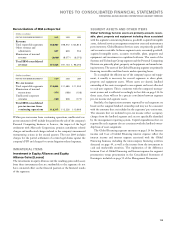

W. SEGMENT INFORMATION

The company uses business insight and its broad range of IT

capabilities to create client- and industry-specific information

solutions. The company operates primarily in a single industry using

several segments that create value by offering solutions that include,

either singularly or in some combination, services, software, hardware

and financing.

Organizationally, the company’s major operations comprise a

Global Technology Services segment; a Global Business Services

segment; a Software segment; a predominantly hardware product seg-

ment—Systems and Technology Group; and a Global Financing

segment. The segments represent components of the company for

which separate financial information is available that is utilized on a

regular basis by the chief executive officer in determining how to

allocate the company’s resources and evaluate performance. The seg-

ments are determined based on several factors, including client base,

homogeneity of products, technology, delivery channels and similar

economic characteristics.

Information about each segment’s business and the products and

services that generate each segment’s revenue is located in the

“Description of Business” section of the Management Discussion on

page 19, and “Segment Details,” on pages 29 to 32.

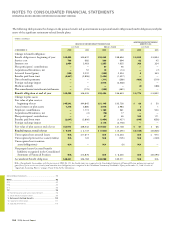

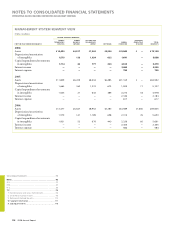

In 2004, the company combined the Systems Group segment and

the Technology Group segment and formed the Systems and Technol-

ogy Group segment.

In the second quarter of 2005, the company sold its Personal

Computing business which was previously a part of the Personal

Systems Group. The two remaining units of the Personal Systems

Group, Retail Store Solutions and Printing Systems, were combined

with the Systems and Technology Group. Personal Computing

Division financial results are displayed as part of the segment disclo-

sures, in a manner consistent with the segment disclosures.

In the first quarter of 2006, the company made changes to its

management system. This included the transfer of products and ser-

vices from the former Enterprise Investments segment to other

reportable segments and the separation of the prior Global Services

segment into the two new reportable segments: Global Technology

Services and Global Business Services. In addition to the creation of

two new reportable segments, there are two primary differences to

previously reported information. First, the Business Transformation

Outsourcing (BTO) business was aligned within the Global

Technology Services segment. This brought the company’s outsourc-

ing businesses together, and drives synergies within the company’s

offerings and delivery capabilities. U.S. Federal BTO remained with

the U.S. Federal business within Global Business Services, to con-

tinue to leverage the synergy in the company’s Federal offerings and

delivery capabilities. Secondly, the Application Management Services

(AMS) business was consolidated under the Global Business Services

segment. As a result, the AMS business for custom and legacy applica-

tions previously reported in Strategic Outsourcing revenue is now

included in Global Business Services.

Previously reported segment information has been restated for

all periods presented to reflect those changes in the company’s

reportable segments.

Segment revenue and pre-tax income include transactions between

the segments that are intended to reflect an arm’s-length transfer

price. Hardware and software that is used by the Global Technology

Services segment in outsourcing engagements is primarily sourced

internally from the Systems and Technology Group and Software seg-

ments. For the internal use of IT services, the Global Technology

Services segment and the Global Business Services segment recover

cost, as well as a reasonable fee, reflecting the arm’s-length value of

providing the services. The Global Services segments enter into

arm’s-length leases and loans at prices equivalent to market rates with

the Global Financing segment to facilitate the acquisition of equip-

ment used in services engagements. All internal transaction prices are

reviewed annually, and reset if appropriate.

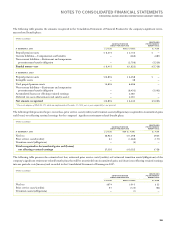

The company uses shared resources concepts to realize economies

of scale and efficient use of resources. As a result, a considerable

amount of expense is shared by all of the company’s segments. This

expense represents sales coverage, marketing and support functions

such as Accounting, Treasury, Procurement, Legal, Human Resources

and Billing and Collections. Where practical, shared expenses are

allocated based on measurable drivers of expense, e.g., headcount.

When a clear and measurable driver cannot be identified, shared

expenses are allocated on a financial basis that is consistent with the

company’s management system; e.g., advertising is allocated based on

the gross profits of the segments. The unallocated corporate amounts

arising from certain divestitures, indirect infrastructure reductions,

miscellaneous tax items and the unallocated corporate expense pool

are recorded in net income but are not allocated to the segments.