IBM 2006 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

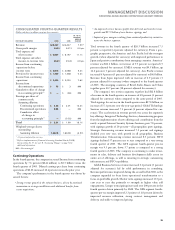

Systems and Technology Group segment revenue was $7.1 billion

and increased 3.2 percent as reported (flat adjusted for currency), when

compared to the fourth quarter of 2005. System z revenue increased 4.5

percent, with MIPS volume growth of 6 percent year to year. System i

revenue declined 10.1 percent as sales of upgrades declined year to year

as customers continue to leverage their existing capability. Revenue

from System p grew 3.5 percent, driven by high-end server sales as

customers leverage the platform’s virtualization capabilities to consoli-

date multiple smaller servers into high-end servers. System x server

revenue increased 6.8 percent with growth in both EMEA and Asia

Pacific, partially offset by decreased revenue in the Americas as cus-

tomers continue to evaluate processor alternatives. Blades revenue was

essentially flat year over year, with growth in both EMEA and Asia

Pacific offset by a decline in the Americas. Storage products increased

9.3 percent, driven by growth in Total disk products of 11.8 percent.

Tape products increased 3.9 percent on the continued strength of the

new tape security offering. Microelectronics OEM revenue declined

5.6 percent when compared to a very strong fourth quarter of 2005.

Retail Store Solutions increased 24.9 percent as customers are replac-

ing older technology in favor of integrated retail solutions.

Software segment revenue of $5.6 billion, increased 14.4 percent

(11 percent adjusted for currency), reflecting strong demand for the

company’s industry-leading middleware capabilities. In the fourth

quarter, revenue from key branded middleware increased 25.1 percent

(21 percent adjusted for currency), with all of the five brands deliver-

ing double-digit growth. The growth came from both organic sources

and strategic acquisitions. The major acquisitions for the year of

FileNet, MRO and Micromuse contributed to the growth in the

Information Management and Tivoli brands. The WebSphere family

of software grew 21.8 percent, with continued strong performance

from Application Servers and Business Integration products.

Information Management software increased 27.9 percent, driven by

the company’s distributed relational database and information on

demand product sets. Lotus grew 29.7 percent, benefiting from

strong momentum in its Notes/Domino family of collaboration prod-

ucts and broad adoption of its enhanced version of Sametime, which

started shipping in the third quarter of 2006. Tivoli increased 25.4

percent with double-digit growth in Systems Management, Security

and Storage software. Rational increased 12.0 percent in a slower

growing market. In addition to the strong revenue growth in the

fourth quarter, the software segment had pre-tax profit of $2.0 billion,

an increase of 4.1 percent year to year. The pre-tax margin of 32.3

percent decreased 3.2 points versus 2005, primarily due to the inte-

gration of new acquisitions.

Global Financing revenue increased 2.9 percent (flat adjusted for

currency), driven primarily by client financing revenue due to an

increased average asset base.

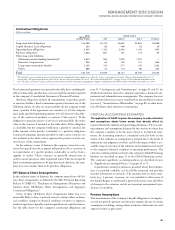

The company’s consolidated gross profit margin was 44.6 percent in

the fourth quarter, compared with 44.1 percent in the year-ago period.

The increase of 0.5 points was driven primarily by improved margins

in services and a mix towards the higher margin software business.

Total expense and other income increased 11.1 percent compared

to the prior-year period. Selling, general and administrative expense

increased 7.0 percent (4 percent adjusted for currency), driven pri-

marily by investments the company made in its software and services

businesses, emerging markets and acquisitions. Partially offsetting

these increases was the year-over-year decline from the pre-tax curtail-

ment charge of $267 million related to pension changes recorded in

the fourth quarter of 2005. RD&E expense increased 8.8 percent in

the fourth quarter, driven partially by acquisitions with the remainder

reflecting the company’s ongoing investments to maintain technology

leadership across its products and services. Other (income) and

expense was $150 million of income, a reduction of $184 million (55.0

percent) versus the fourth quarter of 2005. In the prior year, gains on

real estate transactions were unusually high due to several large trans-

actions compared with current year real estate activity.

The company’s effective tax rate in the fourth-quarter 2006 was

28.0 percent compared with 29.5 percent in the fourth quarter of

2005. The 1.5 point decrease in the fourth-quarter 2006 tax rate was

primarily attributable to the net effect of several items in the quarter.

In 2006, the fourth-quarter tax rate was favorably impacted by the

settlement of the U.S. federal income tax audit for the years 2001

through 2003 as well as the retroactive reinstatement of the U.S.

research tax credit during the quarter. These benefits were partially

offset by the one-time tax cost associated with the intercompany

transfer of certain intellectual property, which also occurred in the

fourth quarter. In addition, the quarter also benefited from a more

favorable mix of income in lower tax jurisdictions.

Share repurchases totaled approximately $1.4 billion in the fourth

quarter. The weighted-average number of diluted common shares

outstanding in the fourth-quarter 2006 was 1,532.5 million compared

with 1,604.8 million in the same period of 2005.

The company generated $5,334 million in cash flow provided by

operating activities. This was driven primarily by net income and

continued focus on working capital. Net cash used in investing

activities of $5,634 million, increased significantly ($4,203 million)

versus the fourth quarter of 2005, driven primarily by increased

spending on acquisitions.

MANAGEMENT DISCUSSION

INTERNATIONAL BUSINESS MACHIN ES CORPORATION AND SUBSI DIARY COMPANIES

36 2006 Annual Report

Management Discussion ........................................................

Road Map .............................................................................

Forward-Looking and Cautionary Statements .....................

Management Discussion Snapshot ......................................

Description of Business .......................................................

Year in Review......................................................................

Prior Year in Review .............................................................

Discontinued Operations .....................................................

Other Information ................................................................

Global Financing ..................................................................

Report of Management .........................................................

Report of Independent Registered Public Accounting Firm ....

Consolidated Statements .......................................................

Black

MAC

2718 CG10