IBM 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

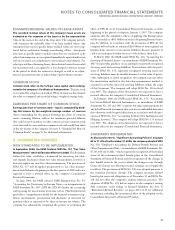

Revenue from fixed-price Design and Build contracts is recog-

nized in accordance with SOP No. 81-1, “Accounting for Performance

of Construction-Type and Certain Production-Type Contracts,”

under the percentage-of-completion (POC) method. Under the

POC method, revenue is recognized based on the costs incurred to

date as a percentage of the total estimated costs to fulfill the contract.

If circumstances arise that change the original estimates of revenues,

costs, or extent of progress toward completion, revisions to the esti-

mates are made. These revisions may result in increases or decreases

in estimated revenues or costs, and such revisions are reflected in

income in the period in which the circumstances that give rise to the

revision become known by management. While the company uses the

POC method as its basic accounting policy under SOP 81-1, the

company uses the completed-contract method if reasonable estimates

for a contract or group of contracts cannot be developed.

The company performs ongoing profitability analyses of its ser-

vices contracts accounted for under the POC method in order to

determine whether the latest estimates of revenue, costs and profits

require updating. If at any time these estimates indicate that the

contract will be unprofitable, the entire estimated loss for the remain-

der of the contract is recorded immediately. For non-POC services

contracts, losses are recorded as incurred.

In some of the company’s services contracts, the company bills the

client prior to recognizing revenue from performing the services.

Deferred income of $5.0 billion and $4.3 billion at December 31,

2006 and 2005, respectively, is included in the Consolidated Statement

of Financial Position. In other services contracts, the company per-

forms the services prior to billing the client. Unbilled accounts

receivable of $1.8 billion and $1.7 billion at December 31, 2006 and

2005, respectively, are included in Notes and accounts receivable-

trade in the Consolidated Statement of Financial Position. Billings

usually occur in the month after the company performs the services

or in accordance with specific contractual provisions. Unbilled

receivables are expected to be billed and collected within four

months, rarely exceeding nine months.

Hardware

Revenue from hardware sales and sales-type leases is recognized

when risk of loss has transferred to the client and there are no unful-

filled company obligations that affect the client’s final acceptance of

the arrangement. Any cost of standard warranties and remaining

obligations that are inconsequential or perfunctory are accrued when

the corresponding revenue is recognized. Revenue from rentals and

operating leases is recognized on a straight-line basis over the term

of the rental or lease.

Software

Revenue from perpetual (one-time charge) license software is recog-

nized at the inception of the license term if all revenue recognition

criteria have been met. Revenue from term (recurring license charge)

license software is recognized on a subscription basis over the period

that the client is entitled to use the license. Revenue from maintenance,

unspecified upgrades on a when-and-if-available basis and technical

support is recognized over the period such items are delivered. In

multiple-element revenue arrangements that include software that is

more than incidental to the products or services as a whole (software

multiple-element arrangements), software and software-related ele-

ments are accounted for in accordance with the following policies.

Software-related elements include software products and services, as

well as any non-software deliverable for which a software deliverable

is essential to its functionality.

A software multiple-element arrangement is separated into more

than one unit of accounting if all of the following criteria are met:

• The functionality of the delivered element(s) is not dependent on the

undelivered element(s);

• There is vendor-specific objective evidence ( VSOE) of fair value of the

undelivered element(s). VSOE of fair value is based on the price charged

when the deliverable is sold separately by the company on a regular

basis and not as part of the multiple-element arrangement; and

• Delivery of the delivered element(s) represents the culmination of the

earnings process for that element(s).

If these criteria are not met, the arrangement is accounted for as one

unit of accounting which would result in revenue being recognized on

a straight-line basis or being deferred until the earlier of when such

criteria are met or when the last undelivered element is delivered. If

these criteria are met for each element and there is VSOE of fair value

for all units of accounting in an arrangement, the arrangement con-

sideration is allocated to the separate units of accounting based on

each unit’s relative VSOE of fair value. There may be cases, however,

in which there is VSOE of fair value of the undelivered item(s) but no

such evidence for the delivered item(s). In these cases, the residual

method is used to allocate the arrangement consideration. Under the

residual method, the amount of consideration allocated to the deliv-

ered item(s) equals the total arrangement consideration less the

aggregate VSOE of fair value of the undelivered elements.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

64 2006 Annual Report

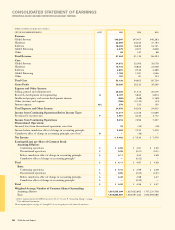

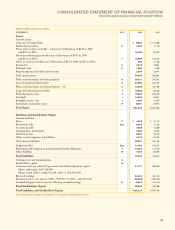

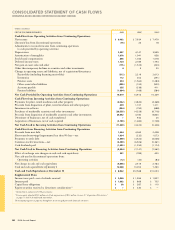

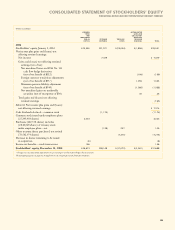

Consolidated Statements .........................................................

Notes .....................................................................................

A-G .........................................................................................

A. Significant Accounting Policies .......................................

B. Accounting Changes........................................................

C. Acquisitions/Divestitures .................................................

D. Financial Instruments (excluding derivatives) ................

E. Inventories .......................................................................

F. Financing Receivables ......................................................

G. Plant, Rental Machines and Other Property ...................

H-M .........................................................................................

N-S ..........................................................................................

T-X ..........................................................................................

Black

MAC

390 CG10