IBM 2006 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Black

MAC

390 CG10

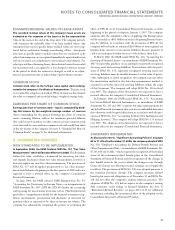

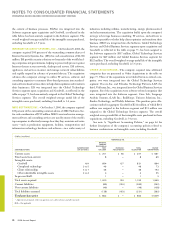

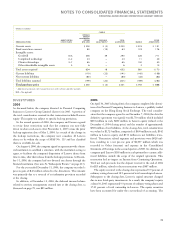

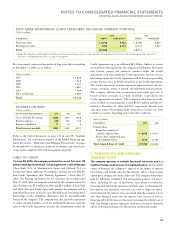

(Dollars in millions)

CANDLE

ORIGINAL

AMOUNT

DISCLOSED IN

AMORTIZATION SECOND PURCHASE TOTAL OTHER

2004 ACQUISITIONS LIFE (IN YEARS) QTR. 2004 ADJUSTMENTS* ALLOCATION MAERSK ACQUISITIONS

Current assets $ $ () $ $ $

Fixed assets/non-current ()

Intangible assets:

Goodwill N/A

Completed technology – —

Client relationships – —

Other identifiable intangible assets —

Total assets acquired ,

Current liabilities () () () () ()

Non-current liabilities () — () () ()

Total liabilities assumed () () () () ()

Total purchase price $ $ () $ $ $

* Adjustments primarily relate to acquisition costs, deferred taxes and other accruals.

N/A—Not applicable

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

77

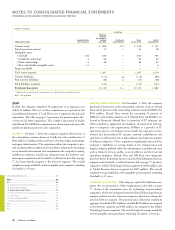

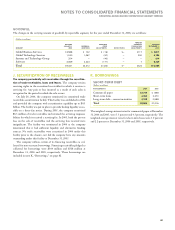

DIVESTITURES

2006

As discussed below, the company divested its Personal Computing

business to Lenovo Group Limited (Lenovo) in 2005. A portion of

the total consideration received in that transaction included Lenovo

equity. This equity was subject to specific lock-up provisions.

In the second quarter of 2006, the company and Lenovo agreed

to revise these restrictions such that the company can now fully

divest its shares in Lenovo after November 1, 2007 versus the prior

lock-up expiration date of May 1, 2008. As a result of the change in

the lock-up restrictions, the company now considers all Lenovo

shares to be within the scope of SFAS No. 115 and has classified

them as available-for-sale.

On August 4, 2006, the company signed an agreement with a finan-

cial institution to establish a structure, with the institution acting as

agent, to facilitate the company’s disposition of Lenovo shares from

time to time, after their release from the lock-up provisions. At Decem-

ber 31, 2006, the company had not divested any shares through the

financial institution. (See note X, “Subsequent Events,” on page 115).

For the year ended December 31, 2006, the company recorded a

pre-tax gain of $45 million related to the divestiture. This amount

was primarily due to a reversal of an indemnity provision recorded

at the closing.

In addition, at December 31, 2006, the deferred income balance

related to services arrangements entered into at the closing date, as

discussed on page 78, was $85 million.

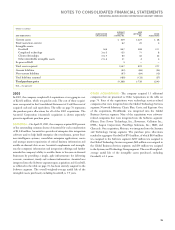

2005

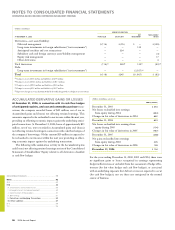

On April 30, 2005 (closing date), the company completed the divesti-

ture of its Personal Computing business to Lenovo, a publicly traded

company on the Hong Kong Stock Exchange. The total consider-

ation that the company agreed to on December 7, 2004 (the date the

definitive agreement was signed) was $1,750 million which included

$650 million in cash, $600 million in Lenovo equity (valued at the

December 6, 2004 closing price) and the transfer of approximately

$500 million of net liabilities. At the closing date, total consideration

was valued at $1,725 million, comprised of: $650 million in cash, $542

million in Lenovo equity and $533 million in net liabilities trans-

ferred. Transaction related expenses and provisions were $628 mil-

lion, resulting in a net pre-tax gain of $1,097 million which was

recorded in Other (income) and expense in the Consolidated

Statement of Earnings in the second quarter of 2005. In addition, the

company paid Lenovo $138 million in cash primarily to assume addi-

tional liabilities outside the scope of the original agreement. This

transaction had no impact on Income from Continuing Operations.

Total net cash proceeds, less the deposit received at the end of 2004

for $25 million, related to these transactions were $487 million.

The equity received at the closing date represented 9.9 percent of

ordinary voting shares and 18.9 percent of total ownership in Lenovo.

Subsequent to the closing date, Lenovo’s capital structure changed

due to new third-party investments. As a result, the company’s equity

at June 30, 2005 represented 9.9 percent of ordinary voting shares and

17.05 percent of total ownership in Lenovo. The equity securities

have been accounted for under the cost method of accounting. The