IBM 2006 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

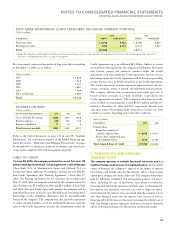

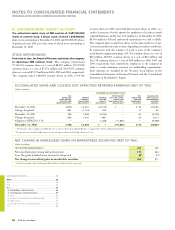

will continue to do so. The SEC has informed the company that the

investigation should not be construed as an indication that any viola-

tions of law have occurred.

In July 2005, two lawsuits were filed in the United States District

Court for the Southern District of New York related to the company’s

disclosures concerning first-quarter 2005 earnings and the expensing of

equity compensation. One lawsuit named as defendants IBM and

IBM’s Senior Vice President and Chief Financial Officer. The other

lawsuit named as defendants IBM, IBM’s Senior Vice President and

Chief Financial Officer and IBM’s Chairman and Chief Executive

Officer. Both complaints alleged that defendants made certain misrep-

resentations in violation of Section 10(b) and 20(a) of the Securities

Exchange Act of 1934 and Rule 10b-5 promulgated thereunder. On

September 6, 2005, counsel in one of these lawsuits filed a motion

seeking to have the lawsuits consolidated, and for the appointment of

lead plaintiff and lead counsel. Pursuant to an Order from the Court

dated March 28, 2006, the two lawsuits were consolidated into a sin-

gle action captioned “In re. International Business Machines Corp.

Securities Litigation.” Pursuant to a schedule set by the Court, Plaintiffs

served on the company an Amended Consolidated Complaint on May

19, 2006. IBM filed a Motion to Dismiss the Amended Consolidated

Complaint on June 23, 2006. Plaintiffs filed their response to IBM’s

Motion on July 21, 2006; and IBM filed its final brief in support of its

Motion on August 2, 2006. On September 20, 2006, the Court denied

IBM’s Motion to Dismiss. On January 16, 2007, Plaintiffs filed a

motion for class certification. IBM filed its response on January 23,

2007 and the Plaintiffs’ reply is due to be filed in late February 2007.

In January 2004, the Seoul District Prosecutors Office in South

Korea announced it had brought criminal bid-rigging charges against

several companies, including IBM Korea and LG IBM (a joint ven-

ture between IBM Korea and LG Electronics, which has since been

dissolved, effective January, 2005) and had also charged employees of

some of those entities with, among other things, bribery of certain

officials of government-controlled entities in Korea and bid rigging.

IBM Korea and LG IBM cooperated fully with authorities in these

matters. A number of individuals, including former IBM Korea and

LG IBM employees, were subsequently found guilty and sentenced.

IBM Korea and LG IBM were also required to pay fines. Debarment

orders were imposed at different times, covering a period of no more

than a year from the date of issuance, which barred IBM Korea from

doing business directly with certain government-controlled entities in

Korea. All debarment orders have since expired and when they were

in force did not prohibit IBM Korea from selling products and ser-

vices to business partners who sold to government-controlled entities

in Korea. In addition, the U.S. Department of Justice and the SEC

have both contacted the company in connection with this matter.

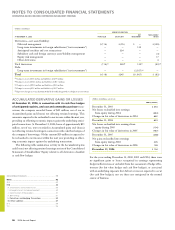

On January 24, 2006, a putative class action lawsuit was filed

against IBM in federal court in San Francisco on behalf of technical

support workers whose primary responsibilities are or were to install

and maintain computer software and hardware. The complaint

was subsequently amended on March 13, 2006. The First Amended

Complaint, among other things, adds four additional named plaintiffs

and modifies the definition of the workers purportedly included in the

class. The suit, Rosenburg, et. al., v. IBM, alleges the company failed

to pay overtime wages pursuant to the Fair Labor Standards Act and

state law, and asserts violations of various state wage requirements,

including recordkeeping and meal-break provisions. The suit also

asserts certain violations of ERISA. Relief sought includes back wages,

corresponding 401(k) and pension plan credits, interest and attorneys’

fees. On January 11, 2007, the District Court granted preliminary

approval to a class-wide settlement whereby IBM will place into a

fund $65 million, plus certain interest accruing between December 1,

2006 until such time as the fund is transferred to the claims adminis-

trator, to pay claims asserted by class members, Plaintiffs’ attorneys’

fees and administrative costs. Individual payments will be based on

factors, including the class member’s state of employment, time

worked in the relevant job position and base salary. The District

Court is scheduled to have a hearing to finally approve the settlement

in July 2007. The charge associated with this settlement was consis-

tent with a provision previously established by the company.

On October 23, 2006, the company filed two lawsuits against

Amazon.com, Inc. (Amazon), in the United States District Court for

the Eastern District of Texas, one in the Lufkin Division and one in

the Tyler Division. The Lufkin suit alleges that Amazon has unlaw-

fully infringed three IBM patents. The Tyler suit alleges that Amazon

has unlawfully infringed two IBM patents. The Lufkin Division patents

cover methods for storing data, presenting applications and presenting

advertising on a computer network. The Tyler Division patents cover

an electronic catalog requisition system and related information

retrieval and ordering methods and a computer-implemented hyper-

text system and method for operating a computer-implemented

object-oriented hypertext system. Each suit seeks, among other

things, compensatory damages and injunctive relief. On December

14, 2006, Amazon answered, counterclaimed in each suit and sought

to transfer the Lufkin suit to consolidate it with Tyler suit. IBM filed

its opposition to the transfer motion on January 2, 2007 and answered

the counterclaims in both suits on January 8. On January 16, 2007, the

Lufkin court denied Amazon’s transfer motion. The courts have

issued scheduling orders in both suits. The Lufkin action has been set

for trial on April 14, 2008 and the Tyler action on October 13, 2008.

On November 29, 2006, the company filed a lawsuit against Platform

Solutions, Inc. (PSI) in the United States District Court for the Southern

District of New York. IBM asserted claims for patent infringement and

breach of contract in connection with PSI’s development and marketing

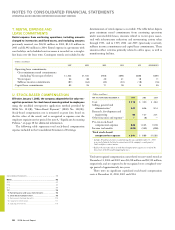

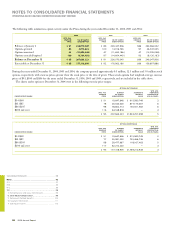

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

90 2006 Annual Report

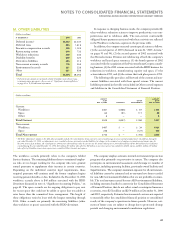

Consolidated Statements .........................................................

Notes .....................................................................................

A-G ......................................................................................... 62

H-M .........................................................................................

N-S ..........................................................................................

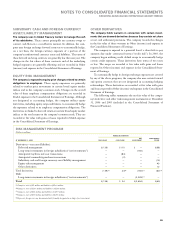

N. Stockholders’ Equity Activity ..........................................

O. Contingencies and Commitments ...................................

P. Taxes ................................................................................

Q. Research, Development and Engineering ......................

R. 2005 Actions ....................................................................

S. Earnings Per Share of Common Stock .............................

T-X ..........................................................................................

Black

MAC

390 CG10