IBM 2006 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT DISCUSSION

INTERNATIONAL BUSINESS MACHIN ES CORPORATION AND SUBSI DIARY COMPANIES

42 2006 Annual Report

access to markets, with local management teams who understand the

clients and their challenges and who can respond to these opportuni-

ties with value-add solutions.

In emerging markets, the company will continue to invest for

revenue growth and leadership. The company has had good success in

the emerging markets of China, India, Russia and Brazil. These coun-

tries have been among the fastest growing IT markets in the world,

and the company expects them to continue to grow at a rate greater

than the worldwide IT growth rate for several years.

As a globally integrated enterprise, the company will continue to

leverage the skills and capabilities of its global infrastructure and work-

force. The company’s global scale provides a base to leverage its invest-

ments and continue to focus on increased productivity and efficiency

in the coming year. In 2006, the company expanded its global delivery

centers—improving its services delivery to clients—and significantly

increased its resources in service delivery centers. Going forward, the

company will also continue the global integration of its internal sup-

port functions with a continued objective of increased productivity.

With respect to technology, in 2006, the company was awarded

more U.S. patents than any other company for the fourteenth year in

a row. The company remains committed to technology leadership and

will continue to focus internal development investments on high-

value, high-growth opportunities and to broaden its ability to deliver

client and industry solutions.

The company will also continue to selectively pursue acquisitions

to grow its capabilities. The company has a targeted acquisition strat-

egy and has developed the ability to efficiently acquire, integrate and

accelerate new product and service offerings. In addition, the com-

pany will continue to evaluate underperforming and less strategic

areas of its portfolio.

The company’s continued investments in Software have led to this

segment’s emergence as a strong source of revenue growth and the

largest contributor to the company’s profit in 2006. The company’s

Software is differentiated in the industry by both the strength of its

individual products and the breadth of the software offerings. The key

to the company’s continued Software growth stems from the ability to

maintain and grow this industry-leading software business. The com-

pany expects to accomplish this through a combination of internal

development and strategic acquisitions. These products will be rapidly

developed and integrated to bring continued value to clients.

In addition, continued Software growth is also dependent on the

company’s ability to bring these technologies to market effectively,

leveraging its worldwide sales and marketing capabilities. The com-

pany will continue to invest in sales and marketing resources, targeting

the faster growing regions, sectors and technologies in the industry.

Finally, growth is fueled by the rapid deployment of these technolo-

gies in client accounts. The company’s unique ability to combine

Software, Services and Hardware into robust customer solutions

increases the rate of Software deployment, leading to higher loyalty

rates and improved Software annuity streams.

Within the Global Services business, revenue growth improved

over the course of the year and the company saw results from the

targeted actions and investments it has made the past two years. The

Integrated Technology Services business is improving after rebalanc-

ing its offerings and resources. Global Business Services significantly

improved profitability. The company will continue to make invest-

ments in sales, delivery and business development across its services

offerings. The company will also continue to optimize its resources

and processes to increase productivity and improve flexibility and

scalability. The key to future success in Services will come from the

company’s ability to integrate its business globally, leverage both local

and global skills and effectively use technology to create solutions that

deliver value and cost savings for clients.

The company’s Systems and Technology Group is the leader in

servers. Through continued development investment, the company

introduced POWER5+, extended virtualization capabilities and pro-

vided leading technology for all major game platforms in 2006. Going

forward, the company will focus its investments on differentiating

technologies with high-growth potential including POWER6, blades,

high-performance computing and energy efficiency. In the Micro-

electronics business, the company anticipates that game processor

demand will continue to moderate through the first half of 2007 given

the seasonality of the consumer segment.

As discussed in note X, “Subsequent Events,” on page 115, the

company will form a joint venture with Ricoh based on the company’s

Printing Systems Division and initially have a 49 percent ownership

interest in the joint venture. This transaction is expected to close in

the second quarter of 2007, and the company will continue to operate

this business in the normal course until the closing.

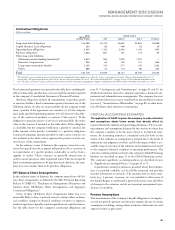

The company expects 2007 pre-tax retirement-related plan expense

to increase approximately $100 million when compared to 2006. This

expected year-to-year change is primarily driven by an increase in the

cost of defined contribution plans. The cost of defined benefit plans

is estimated to be essentially flat year to year as increases due to

changes in the actuarial assumptions (used to determine 2007 expense)

will be offset by expected savings due to better-than-expected 2006

return on asset performance. The actual return on the U.S. Personal

Pension Plan (PPP) assets for 2006 was 15 percent.

Pre-tax stock-based compensation expense declined $189 million in

2006, compared to 2005. The company expects stock-based compensa-

tion expense to decline in 2007, when compared to 2006. The anticipated

decline is expected to be less than $100 million on a pre-tax basis.

Management Discussion ........................................................

Road Map .............................................................................

Forward-Looking and Cautionary Statements .....................

Management Discussion Snapshot ......................................

Description of Business .......................................................

Year in Review......................................................................

Prior Year in Review .............................................................

Discontinued Operations .....................................................

Other Information ................................................................

Global Financing ..................................................................

Report of Management .........................................................

Report of Independent Registered Public Accounting Firm ....

Consolidated Statements .......................................................

Black

MAC

2718 CG10