IBM 2006 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Change of the company’s operating model in Europe—shifting

resources and decision-making closer to the clients;

• Redesign of the company’s U.S. pension plan, as well as taking actions

in other countries; over the longer term, these actions will reduce

volatility and provide a more competitive cost structure;

• Repatriation of $9.5 billion of foreign earnings under the American

Jobs Creation Act of 2004 improving the company’s geographic

liquidity position; and

• Further extension of the company’s commitment to innovation and

open standards.

On April 30, 2005, the company sold its Personal Computing busi-

ness. Accordingly, the company’s reported revenue results include

four months of revenue for the Personal Computing Division in 2005

versus 12 months in 2004. A significant driver of the changes in rev-

enue, on an as-reported basis, is the incomparable periods for which

the Personal Computing business results are included in the as-

reported results.

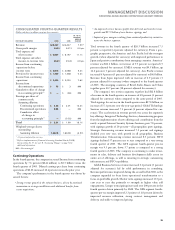

As-reported revenue across all industry sectors declined, except for

the Distribution sector, which was essentially flat, due to the sale of

the Personal Computing business. The Financial Services revenue

decrease (1.7 percent) was driven by Financial Markets (12.2 percent)

partially offset by increases in Insurance (1.9 percent) and Banking

(0.5 percent). The Public sector revenue decline ( 5.1 percent) was

driven by Education ( 31.0 percent), Life Sciences (19.1 percent) and

Government (2.0 percent), partially offset by increased revenue in

Healthcare (13.1 percent). The Distribution sector revenue increase

(0.1 percent) was driven by Travel and Transportation (11.0 percent)

and Consumer Products (2.6 percent), partially offset by lower reve-

nue in Retail industry (7.5 percent). The decrease (3.4 percent) in

Communications sector revenue was driven by Media and

Entertainment (11.5 percent), Utilities ( 5.4 percent) and Telecommu-

nications (1.1 percent). Revenue from Small & Medium Business

declined 13.6 percent.

Americas’ revenue declined 3.1 percent (4 percent adjusted for

currency) and was driven by the sale of the Personal Computing busi-

ness. The U.S. declined 5 percent, while Canada increased 5 percent

(declined 3 percent adjusted for currency) and Latin America increased

8 percent (declined 2 percent adjusted for currency).

Revenue in EMEA declined ( 5.1 percent as reported and 4 per-

cent adjusted for currency) across most major countries driven by the

sale of the Personal Computing business. Of the major countries,

Germany declined 12 percent (11 percent adjusted for currency),

France declined 7 percent (6 percent adjusted for currency), Italy

declined 11 percent (10 percent adjusted for currency), the U.K.

declined 1 percent (flat adjusted for currency) and Spain declined 1

percent (flat adjusted for currency).

Asia Pacific had the weakest results (decreased 12.5 percent as

reported and 13 percent adjusted for currency) of the major geogra-

phies in 2005. Japan, which represents about 60 percent of the Asia

Pacific revenue base, declined 13 percent (11 percent adjusted for

currency) in 2005 versus 2004. In addition, ASEAN (Association of

Southeast Asian Nations) revenue declined 3 percent ( 3 percent

adjusted for currency) and China declined 19 percent (20 percent

adjusted for currency), while India revenue increased 10 percent (8

percent adjusted for currency).

The company continued to invest in growth initiatives in its

emerging countries. Revenue growth in these emerging countries was

driven by client investment to build out their infrastructures, especially

in the Financial Services sector. Overall revenue in these countries

declined 2 percent (9 percent adjusted for currency). The declines

were driven by the sale of the Personal Computing business. China

declined 19 percent (20 percent adjusted for currency), while Brazil’s

revenue grew 21 percent (1 percent adjusted for currency), India’s

revenue grew 10 percent (8 percent adjusted for currency) and Russia’s

revenue increased 2 percent (2 percent adjusted for currency).

OEM revenue increased 13.4 percent primarily due to improved

manufacturing yields for game processors driven by the ramp up of

production for these processors in the second half of 2005. In addi-

tion, E&TS revenue continued to show strong revenue growth.

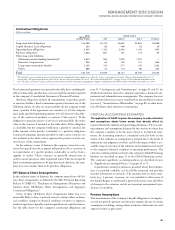

The company believes that a more appropriate discussion is one

that excludes the revenue results of the Personal Computing business

in both 2005 and 2004 because it presents results on a comparable

basis and provides a more meaningful discussion which focuses on the

company’s ongoing operational performance.

Revenue across all Industry sectors increased, except for the

Industrial sector, when excluding revenue from the Personal

Computing business. Revenue growth was lead by Small & Medium

Business (6.5 percent) followed by the Public sector (5.4 percent),

Distribution sector (5.0 percent), Financial Services (1.7 percent) and

Communications (0.8 percent). Revenue from the Industrial sector

declined 2.3 percent.

Revenue in all geographies increased in 2005 versus 2004, with the

exception of Asia Pacific. Americas’ revenue increased 5.1 percent

(4 percent adjusted for currency) with growth across all key brands

and regions. Revenue in EMEA increased 2.3 percent (4 percent

adjusted for currency) with mixed performance across the major

countries. Asia Pacific revenue decreased 0.9 percent (1 percent

adjusted for currency). Overall revenue in the emerging countries of

Brazil, India, Russia and China increased a combined 23 percent (14

percent adjusted for currency) in 2005 versus 2004.

MANAGEMENT DISCUSSION

INTERNATIONAL BUSINESS MACHIN ES CORPORATION AND SUBSI DIARY COMPANIES

38 2006 Annual Report

Management Discussion ........................................................

Road Map .............................................................................

Forward-Looking and Cautionary Statements .....................

Management Discussion Snapshot ......................................

Description of Business .......................................................

Year in Review......................................................................

Prior Year in Review .............................................................

Discontinued Operations .....................................................

Other Information ................................................................

Global Financing ..................................................................

Report of Management .........................................................

Report of Independent Registered Public Accounting Firm ....

Consolidated Statements .......................................................

Black

MAC

2718 CG10