IBM 2006 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Black

MAC

390 CG10

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

81

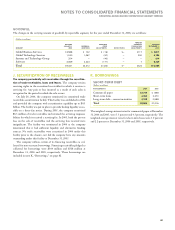

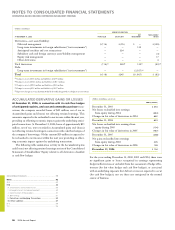

J. SECURITIZATION OF RECEIVABLES

The company periodically sells receivables through the securitiza-

tion of trade receivables, loans and leases. The company retains

servicing rights in the securitized receivables for which it receives a

servicing fee. Any gain or loss incurred as a result of such sales is

recognized in the period in which the sale occurs.

On July 28, 2006, the company terminated its committed trade

receivables securitization facility. This facility was established in 2004

and provided the company with securitization capability up to $0.5

billion. The facility was put in place to provide backup liquidity acces-

sible on a three-day notice. During 2005, the company securitized

$6.3 million of trade receivables and retained the servicing responsi-

bilities for which it received a servicing fee. In 2005, both the pre-tax

loss on the sale of receivables and the servicing fees received were

insignificant. The facility was terminated in 2006 as the company

determined that it had sufficient liquidity and alternative funding

sources. No trade receivables were securitized in 2006 under this

facility prior to the closure, nor did the company have any amounts

outstanding under this facility at December 31, 2005.

The company utilizes certain of its financing receivables as col-

lateral for non-recourse borrowings. Financing receivables pledged as

collateral for borrowings were $304 million and $318 million at

December 31, 2006 and 2005, respectively. These borrowings are

included in note K, “Borrowings,” on page 82.

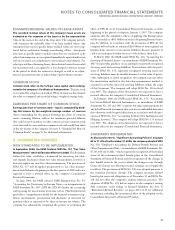

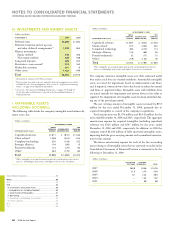

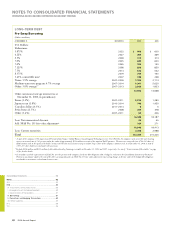

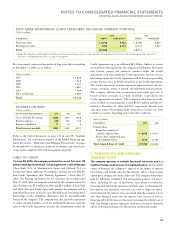

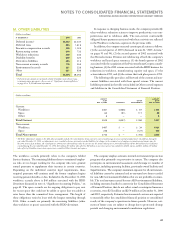

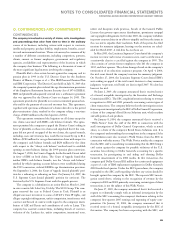

K. BORROWINGS

SHORT-TERM DEBT

(Dollars in millions)

AT DECEMBER 31: 2006 2005

Commercial paper $, $

Short-term loans , ,

Long-term debt—current maturities , ,

Total $, $,

The weighted-average interest rates for commercial paper at December

31, 2006 and 2005, were 5.3 percent and 4.3 percent, respectively. The

weighted-average interest rates for short-term loans were 3.0 percent

and 2.2 percent at December 31, 2006 and 2005, respectively.

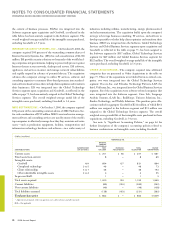

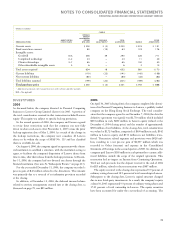

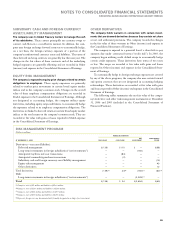

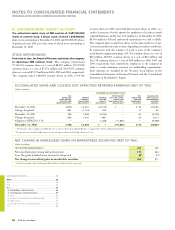

GOODWILL

The changes in the carrying amount of goodwill, by reportable segment, for the year ended December 31, 2006, are as follows:

(Dollars in millions)

FOREIGN

BALANCE PURCHASE CURRENCY BALANCE

JANUARY 1, GOODWILL PRICE TRANSLATION DECEMBER 31,

SEGMENT 2006 ADDITIONS ADJUSTMENTS DIVESTITURES ADJUSTMENTS 2006

Global Business Services $, $ $ () $— $ $ ,

Global Technology Services , , () — ,

Systems and Technology Group — () — —

Software , , () — ,

Total $, $, $() $— $ $,