IBM 2006 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

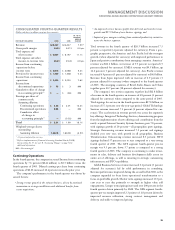

CONSOLIDATED FOURTH-QUARTER RESULTS

(Dollars and shares in millions except per share amounts)

YR. TO YR.

PERCENT/

MARGIN

FOR FOURTH QUARTER: 2006 2005 CHANGE

Revenue $, $, .%*

Gross profit margin .% .% . pts.

Total expense and

other income $ , $ , .%

Total expense and other

income-to-revenue ratio .% .% . pts.

Income from continuing

operations before

income taxes $ , $ , .%

Provision for income taxes $ , $ , .%

Income from continuing

operations $ , $ , .%

Income from

discontinued operations $ $ NM

Cumulative effect of change

in accounting principle** $ — $ () NM

Earnings per share of

common stock:

Assuming dilution:

Continuing operations $ . $ . .%

Discontinued operations . — NM

Cumulative effect

of change in

accounting principle** — (.) NM

Total $ . $ . .%

Weighted-average shares

outstanding:

Assuming dilution ,. ,. (.)%

* 4.1 percent adjusted for currency.

** Reflects implementation of Financial Accounting Standards Board (FASB)

Interpretation No. 47. See note B, “Accounting Changes,” on page 72 for

additional information.

NM—Not meaningful

Continuing Operations

In the fourth quarter, the company increased Income from continuing

operations by 7.6 percent ($244 million) to $3.5 billion versus the

fourth quarter of 2005. Diluted earnings per share from continuing

operations of $2.26 increased 12.4 percent versus the prior year.

The company’s performance in the fourth quarter was driven by

several factors:

• Strong revenue growth in the software business, driven by continued

momentum in strategic middleware and additional benefits from

recent acquisitions;

• An improved services business profile that delivered accelerated revenue

growth and $17.8 billion of new business signings; and

• Improved gross margins resulting from continued productivity initiatives

across the business segments.

Total revenue in the fourth quarter of $26.3 billion increased 7.5

percent as reported (4 percent adjusted for currency). From a geo-

graphic perspective, the Americas and Asia Pacific had the strongest

growth, (when adjusted for currency) with improved performance in

Japan and positive contributions from emerging countries. Americas’

revenue was $11.1 billion, an increase of 5.9 percent as reported (5

percent adjusted for currency). EMEA revenue was $9.3 billion, up

11.2 percent ( 3 percent adjusted for currency). Asia Pacific revenue

increased 6.9 percent (5 percent adjusted for currency) to $4.8 billion.

Revenue from Japan improved with an increase of 2.9 percent (3

percent adjusted for currency) when compared to the fourth quarter

of 2005. The emerging countries of Brazil, India, Russia and China

together grew 20.7 percent (18 percent adjusted for currency).

The company’s two services segments together had $12.8 billion

of revenue in the fourth quarter, an increase of 6.8 percent (3 percent

adjusted for currency) when compared to the same period of 2005.

Total signings for services in the fourth quarter were $17.8 billion, an

increase of 55.1 percent over the year-ago period. Global Technology

Services revenue increased 7.1 percent (4 percent adjusted for cur-

rency). The acceleration in revenue growth was across the segment’s

key offerings. Integrated Technology Services, demonstrating progress

from the implementation of new offerings and contribution from the

newly acquired Internet Security Systems business grew 7.8 percent,

with signings growth of 20 percent—all geographies grew signings.

Strategic Outsourcing revenue increased 7.2 percent and signings

doubled year over year, with growth in all geographies. Business

Transformation Outsourcing revenue increased 8.5 percent. BTO

signings declined 57 percent year to year compared to a very strong

fourth quarter of 2005. The GTS segment fourth-quarter pre-tax

margin was 9.3 percent, down 3.7 points as compared to a strong

fourth quarter of 2005. The company is continuing to make invest-

ments in sales, delivery and business development skills across its

entire set of offerings, as well as investing in strategic outsourcing

infrastructure and BTO capabilities.

Global Business Services revenue increased 6.1 percent (3 percent

adjusted for currency) led by solid performance in consulting.

Revenue performance improved during the second half of 2006, as the

company expanded its focus from operational transformation to a

focus on profitable growth. Shorter term signings increased 13.5 per-

cent year to year due primarily to strength in higher value add

engagements. Longer term signings increased over 200 percent in the

fourth quarter driven primarily by AMS. The GBS segment fourth-

quarter pre-tax margin improved 2.3 points to 11.8 percent driven by

improved resource utilization, strong contract management and

delivery, and stable-to-improved pricing.

MANAGEMENT DISCUSSION

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

35

Black

MAC

2718 CG10