IBM 2006 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MANAGEMENT DISCUSSION

INTERNATIONAL BUSINESS MACHIN ES CORPORATION AND SUBSI DIARY COMPANIES

23

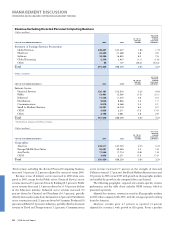

The company divested its Personal Computing business to Lenovo

on April 30, 2005. The details of this significant transaction are dis-

cussed in note C, “Acquisitions/Divestitures”, on pages 77 and 78. As

a result of this divestiture, the company’s reported financial results do

not include any activity in 2006 and include four months of activity for

the Personal Computing Division in 2005. This lack of comparable

periods has a material impact on the company’s reported revenue

growth. The company believes that a more appropriate analysis is one

that excludes the revenue results of the Personal Computing Division

in 2005 because it presents results on a comparable basis and provides

a more meaningful focus on the company’s ongoing operational per-

formance. Such discussion is presented on pages 24 and 25.

Total revenue, as reported, increased 0.3 percent versus 2005. In

addition to the revenue presentation in the Consolidated Statement of

Earnings, the company also measures revenue performance on both

an industry sector and geographic basis.

As-reported revenue performance by industry sector was mixed in

2006 when compared to 2005. Revenue in the Financial Services sec-

tor increased 4.1 percent versus the year-ago period, driven by

Banking, which increased 7.2 percent. The Public sector revenue

decline of 4.7 percent was attributable to decreased revenue in the

Government ( 3.2 percent) and Education (25.1 percent) industries.

The Industrial sector revenue decline (1.4 percent) was driven by

Automotive (5.5 percent), partially offset by increased revenue in

Chemical and Petroleum (12.4 percent). Revenue in the Distribution

sector increased (0.8 percent) with growth in Consumer Products

( 5.3 percent) and the Retail industry (2.4 percent), partially offset by

decreased revenue in Travel and Transportation (4.5 percent). The

Communications sector revenue increase (0.9 percent) was driven by

increased revenue in Utilities (9.3 percent). Revenue from Small and

Medium Business decreased 3.5 percent in 2006 when compared to

2005, with revenue declines in all geographic markets. This sector was

impacted most significantly by the loss of the Personal Computing

business revenue.

The following geographic, regional and country-specific revenue

performance excludes OEM revenue, which is presented separately.

From a geographic perspective, as-reported revenue performance

was mixed in 2006 compared to 2005, with growth in the Americas

and EMEA, being offset by a decrease in Asia Pacific.

Americas’ revenue increased 1.8 percent (1 percent adjusted for

currency) in 2006 versus the year-ago period. Revenue increased in all

regions with the U.S. up 1.0 percent, Canada 2.4 percent (decreased

4 percent adjusted for currency) and Latin America 8.6 percent ( 3

percent adjusted for currency).

EMEA revenue increased a modest 0.2 percent on an as-reported

basis (declined 1 percent adjusted for currency) in 2006 when com-

pared to 2005. In the major countries, the U.K. increased 0.5 percent

(decreased 1 percent adjusted for currency), France increased 1.6

percent (flat adjusted for currency), Italy increased 1.6 percent (flat

adjusted for currency) and Spain increased 2.1 percent (flat adjusted

for currency). These increases were largely offset by lower revenue in

Germany of 2.8 percent (4 percent adjusted for currency) in 2006

versus the year-ago period.

Asia Pacific revenue declined 5.7 percent (3 percent adjusted for

currency) year over year. Japan, which represents over 50 percent of

the Asia Pacific revenue base, declined 10.1 percent ( 5 percent

adjusted for currency). Partially offsetting the Japan decline were

revenue increases in Korea 12.6 percent and India 22.9 percent.

The emerging countries of Brazil, India, Russia and China

together grew 9.9 percent ( 5 percent adjusted for currency), as the

company continues to invest to build capabilities in these countries.

Brazil grew 15.4 percent (4 percent adjusted for currency), India

increased 22.9 percent (26 percent adjusted for currency) and Russia

increased 13.9 percent (14 percent adjusted for currency). China

declined 0.3 percent (2 percent adjusted for currency) in 2006 as this

country’s performance was significantly impacted by the Personal

Computing divestiture.

OEM revenue increased 17.9 percent (18 percent adjusted for cur-

rency) in 2006 driven by strong demand for game processors in the

Microelectronics business.

Black

MAC

CG10