IBM 2006 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Black

MAC

390 CG10

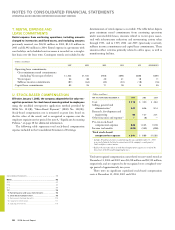

IBM Executive Deferred Compensation Plan

The company also maintains an unfunded, non-qualified, defined

contribution plan, the IBM Executive Deferred Compensation Plan

(EDCP), which allows eligible executives to defer compensation and

to receive company matching contributions under the applicable IBM

Savings Plan formula (depending on the date of hire, as described

earlier), with respect to amounts in excess of IRS limits for qualified

plans. Amounts contributed to the plan as a result of deferred com-

pensation, as well as company matching contributions, are recorded

as liabilities. Deferred compensation amounts may be directed by

participants into an account that replicates the return that would have

been received had the amounts been invested in similar IBM Savings

Plan investment options. The company matching contributions are

directed to participant accounts and change in value each reporting

period based on changes in the company’s stock price.

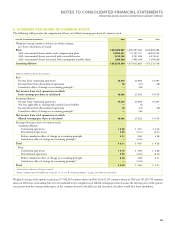

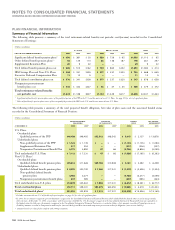

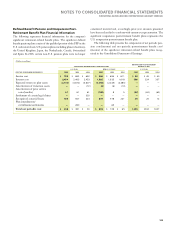

NONPENSION POSTRETIREMENT BENEFIT PLAN

U.S. Nonpension Postretirement Plan

The company sponsors a defined benefit nonpension postretirement

benefit plan that provides medical and dental benefits to eligible U.S.

retirees and eligible dependents, as well as life insurance for eligible

U.S. retirees. Effective July 1, 1999, the company established a Future

Health Account (FHA) for employees who were more than five years

away from retirement eligibility. Employees who were within five

years of retirement eligibility are covered under the company’s prior

retiree health benefits arrangements. Under either the FHA or the

prior retiree health benefit arrangements, there is a maximum cost to

the company for retiree health benefits. For employees who retired

before January 1, 1992, that maximum became effective in 2001. For

all other employees, the maximum is effective upon retirement.

Effective January 1, 2004, the company amended its nonpension

postretirement benefit plan to provide that new hires, as of that date

or later, will no longer be eligible for company subsidized benefits.

Non-U.S. Plans

Most subsidiaries and branches outside the United States sponsor

defined benefit and/or defined contribution plans that cover substan-

tially all regular employees. The company deposits funds under various

fiduciary-type arrangements, purchases annuities under group con-

tracts or provides reserves for these plans. Benefits under the defined

benefit plans are typically based either on years of service and the

employee’s compensation (generally during a fixed number of years

immediately before retirement) or on annual credits. The range of

assumptions that are used for the non-U.S. defined benefit plans

reflects the different economic environments within various countries.

In addition, certain of the company’s non-U.S. subsidiaries sponsor

defined benefit nonpension postretirement benefit plans that provide

medical and dental benefits for eligible non-U.S. retirees and eligible

dependents, as well as life insurance for certain eligible non-U.S.

retirees. However, most of the retirees outside the United States are

covered by local government sponsored and administered programs.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

101

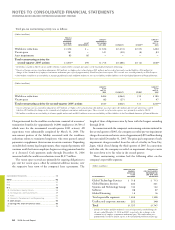

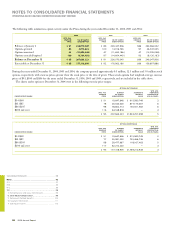

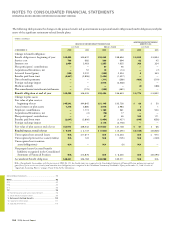

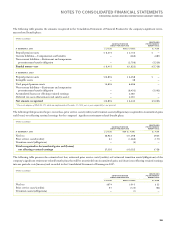

IMPLEMENTATION OF SFAS NO. 158

As highlighted in note B, “Accounting Changes,” on page 71, effec-

tive December 31, 2006, the company adopted the provisions of

SFAS No. 158. In note A, “Significant Accounting Policies,” on pages

67 and 68, the requirements of SFAS No. 158 are discussed in detail.

SFAS No. 158 requires the recognition of the funded status of each

defined benefit pension plan and nonpension postretirement benefit

plan on the company’s balance sheet. Each overfunded plan is recog-

nized as an asset and each underfunded plan (or unfunded) is recognized

as a liability. The initial impact of SFAS No. 158 due to previously

unrecognized actuarial gains and losses and prior service costs or credits,

as well as subsequent changes in the funded status, is recognized as a

component of Accumulated gains and losses not affecting retained

earnings (net of tax) in Stockholders’ equity. The following table

presents the incremental effect of applying SFAS No. 158 on the

Consolidated Statement of Financial Position:

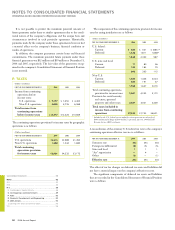

(Dollars in millions)

BEFORE AFTER

APPLICATION APPLICATION

AT DECEMBER 31, 2006 OF SFAS NO. 158 ADJUSTMENTS* OF SFAS NO. 158

Prepaid pension assets $ , $(,) $ ,

Investments and sundry

assets (deferred taxes) $ , $ , $ ,

Total Assets $, $ (,) $,

Current liabilities,

Compensation and

benefits $ , $ $ ,

Non-current liabilities,

Retirement

and nonpension

postretirement

obligations $ , $ $ ,

Other liabilities

(deferred taxes) $ , $ (,) $ ,

Total Liabilities $ , $ $ ,

Accumulated gains and

(losses) not affecting

retained earnings,

net of tax $ $ (,) $ (,)

Total Stockholders’ Equity $ , $ (,) $ ,

* Adjustments are primarily comprised of previously unrecognized gains/(losses),

prior service costs/(credits) and transition assets/(obligations).

At December 31, 2006, the company recorded prior service costs, net

gains/(losses) and transition assets/(obligations) in the Stockholders’

equity section of the Consolidated Statement of Financial Position, net

of tax, of $871 million, $(10,371) million and $2 million, respectively.

In addition, the minimum pension liability of $2,348 million was

eliminated upon the adoption of SFAS No. 158.