IBM 2006 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Black

MAC

390 CG10

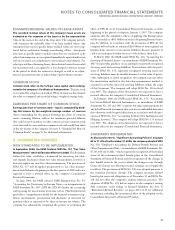

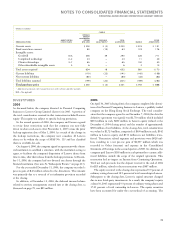

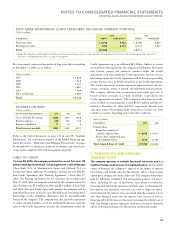

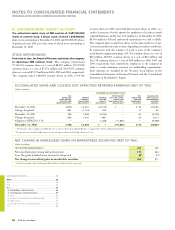

MARKETABLE SECURITIES*

The following table summarizes the company’s marketable secu-

rities, all of which are considered available-for-sale, and alliance

investments.

(Dollars in millions)

FAIR VALUE

AT DECEMBER 31: 2006 2005

Marketable securities—current:

Auction rate securities

and other obligations $, $,

Marketable securities—non-current:**

Time deposits and other obligations $ $

Non-U.S. government securities and

other fixed-term obligations

Total $ $

Non-equity method alliance investments** $ $

* Gross unrealized gains (before taxes) on marketable securities were $19 million

and $31 million at December 31, 2006 and 2005, respectively. Gross unrealized

gains (before taxes) on alliance investments were $178 million and $79 million

at December 31, 2006 and 2005, respectively. Gross unrealized losses (before

taxes) on marketable securities and alliance investments were immaterial to the

Consolidated Financial Statements at December 31, 2006 and 2005. See note N,

“Stockholders’ Equity Activity,” on page 88 for net change in unrealized gains

and losses on marketable securities.

** Included within Investments and sundry assets in the Consolidated Statement of

Financial Position. See note H, “Investments and Sundry Assets,” on page 80.

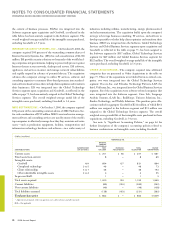

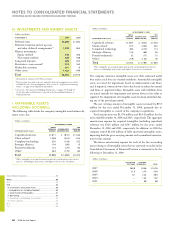

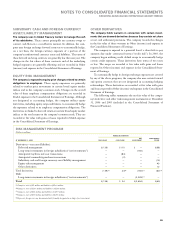

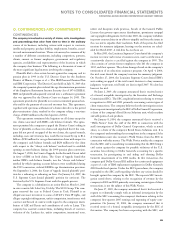

E. INVENTORIES

(Dollars in millions)

AT DECEMBER 31: 2006 2005

Finished goods $ $

Work in process and raw materials , ,

Total $, $,

F. FINANCING RECEIVABLES

(Dollars in millions)

AT DECEMBER 31: 2006 2005

Short-term:

Net investment in sales-type leases $ , $ ,

Commercial financing receivables , ,

Client loan receivables , ,

Installment payment receivables

Total $, $,

Long-term:

Net investment in sales-type leases $ , $ ,

Commercial financing receivables

Client loan receivables , ,

Installment payment receivables

Total $, $ ,

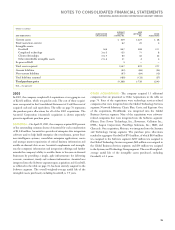

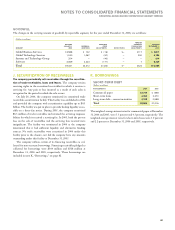

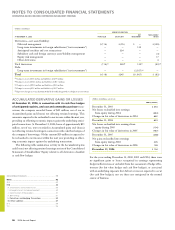

Net investment in sales-type leases is for leases that relate princi-

pally to the company’s equipment and are for terms ranging from two

to seven years. Net investment in sales-type leases includes unguaran-

teed residual values of $854 million and $792 million at December 31,

2006 and 2005, respectively, and is reflected net of unearned income

of $1,005 million and $939 million and of allowance for uncollectible

accounts of $135 million and $176 million at those dates, respectively.

Scheduled maturities of minimum lease payments outstanding at

December 31, 2006, expressed as a percentage of the total, are

approximately: 2007, 44 percent; 2008, 28 percent; 2009, 17 percent;

2010, 7 percent; and 2011 and beyond, 4 percent.

Commercial financing receivables arise primarily from inventory

and accounts receivable financing for dealers and remarketers of IBM

and non-IBM products. Payment terms for inventory and accounts

receivable financing generally range from 30 to 90 days.

Client loan receivables relate to loans that are provided by Global

Financing primarily to the company’s clients to finance the purchase

of the company’s software and services. Separate contractual relation-

ships on these financing arrangements are for terms ranging from two

to seven years. Each financing contract is priced independently at

competitive market rates. The company has a history of enforcing the

terms of these separate financing agreements.

The company did not have financing receivables held for sale as of

December 31, 2006 and 2005.

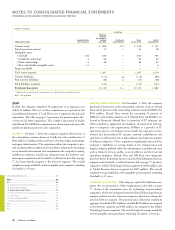

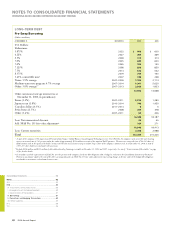

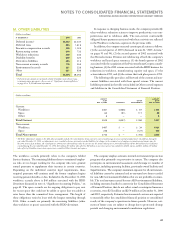

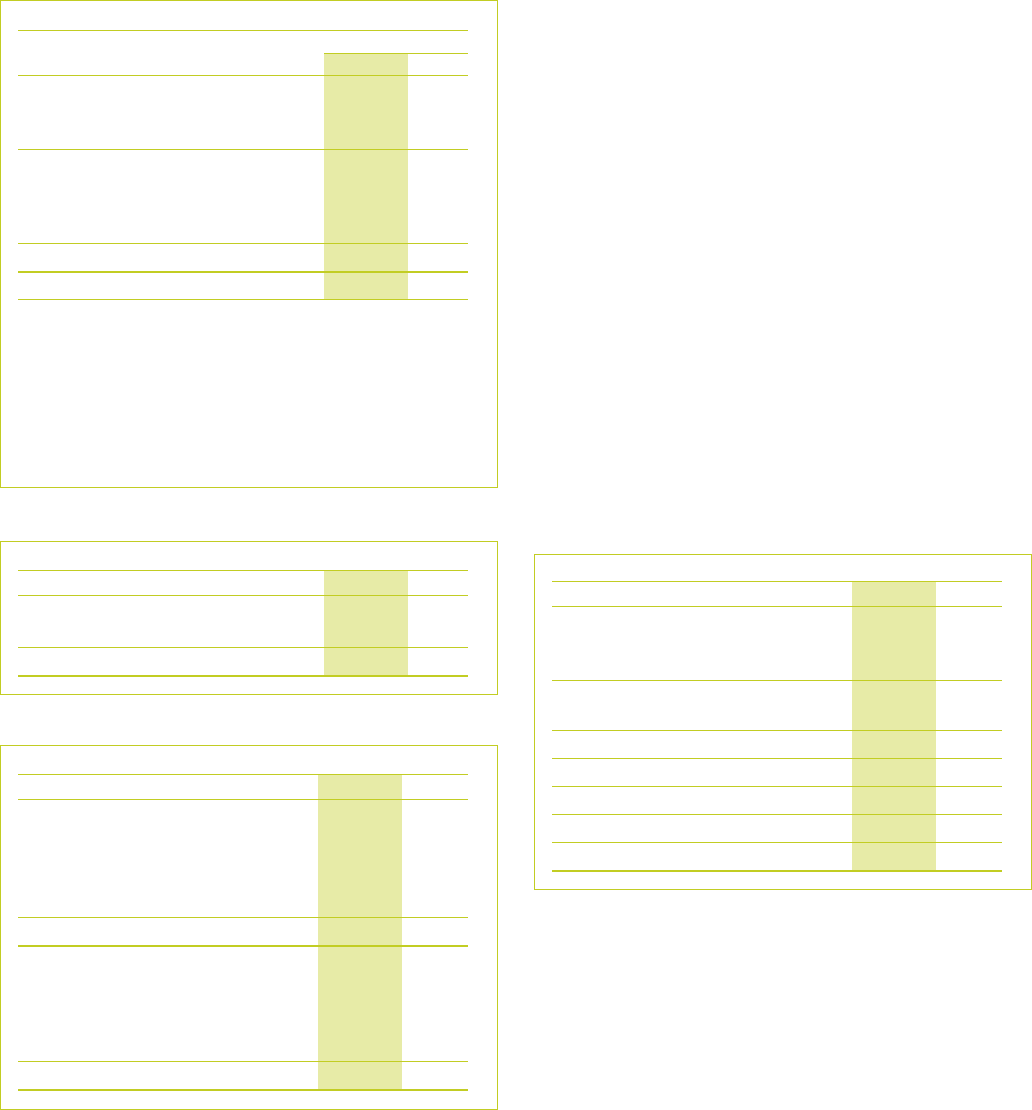

G. PLANT, RENTAL MACHINES AND

OTHER PROPERTY

(Dollars in millions)

AT DECEMBER 31: 2006 2005

Land and land improvements $ $

Buildings and building improvements , ,

Plant, laboratory and office equipment , ,

, ,

Less: Accumulated depreciation , ,

Plant and other property—net , ,

Rental machines , ,

Less: Accumulated depreciation , ,

Rental machines—net , ,

Total—net $, $,

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

79