IBM 2006 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Black

MAC

390 CG10

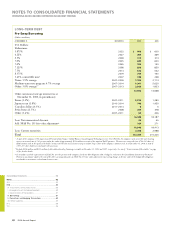

In June 2005, the FASB issued FASB Staff Position (FSP) No. FAS

143-1, “Accounting for Electronic Equipment Waste Obligations,”

(FSP FAS 143-1) that provides guidance on how commercial users

and producers of electronic equipment should recognize and measure

asset retirement obligations associated with the European Directive

2002/96/EC on Waste Electrical and Electronic Equipment (the

“Directive”). In 2005, the company adopted FSP FAS 143-1 in those

European Union (EU) member countries that transposed the

Directive into country-specific laws. Its adoption did not have a mate-

rial effect on the company’s Consolidated Financial Statements. The

effect of applying FSP FAS 143-1 in the remaining countries in future

periods is not expected to have a material effect on the company’s

Consolidated Financial Statements.

In the third quarter of 2005, the company adopted SFAS No. 153,

“Exchanges of Nonmonetary Assets—an amendment of APB Opinion

No. 29.” SFAS No. 153 requires that exchanges of productive assets

be accounted for at fair value unless fair value cannot be reasonably

determined or the transaction lacks commercial substance. The adop-

tion of SFAS No. 153 did not have a material effect on the company’s

Consolidated Financial Statements.

The American Jobs Creation Act of 2004 (the “Act”) introduced a

temporary incentive for the company to repatriate earnings accumu-

lated outside the U.S. In the fourth quarter of 2004, the company

adopted the provisions of FSP No. FAS 109-2, “Accounting and

Disclosure Guidance for the Foreign Earnings Repatriation Provision

within the American Jobs Creation Act of 2004.” According to FSP

No. FAS 109-2, the company was allowed time beyond the financial

reporting period of enactment to evaluate the effects of the Act on its

plan for repatriation of foreign earnings for purposes of applying

SFAS No. 109, “Accounting for Income Taxes.” Accordingly, as of

December 31, 2004, the company did not adjust its income tax

expense or deferred tax liability to reflect the possible effect of the

new repatriation provision. In 2005, the company repatriated $9.5

billion of foreign earnings and recorded income tax expense of $525

million associated with this repatriation.

In January 2003, the FASB issued FASB Interpretation No. 46

(FIN 46), “Consolidation of Variable Interest Entities,” and amended

it by issuing FIN 46(R) in December 2003. FIN 46(R) addresses

consolidation by business enterprises of variable interest entities

(VIEs) that either: (1) do not have sufficient equity investment at risk

to permit the entity to finance its activities without additional subor-

dinated financial support or (2) have equity investors that lack an

essential characteristic of a controlling financial interest. In accor-

dance with the transition provisions of FIN 46(R), the company

adopted FIN 46(R) for all VIEs and special-purpose entities as

defined within FIN 46(R) as of March 31, 2004. These accounting

pronouncements did not have a material effect on the company’s

Consolidated Financial Statements.

C. ACQUISITIONS/DIVESTITURES

ACQUISITIONS

2006

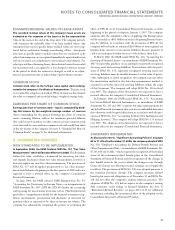

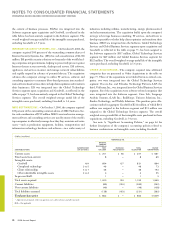

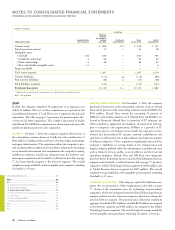

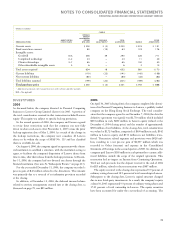

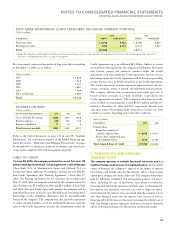

In 2006, the company completed 13 acquisitions at an aggregate cost

of $4,817 million, which was paid in cash. The cost of these acquisi-

tions is reported in the Consolidated Statement of Cash Flows net of

acquired cash and cash equivalents. The tables on page 74 and 75

represent the purchase price allocations for all of the 2006 acquisitions.

The Micromuse Inc., FileNet Corporation, Internet Security Systems,

Inc. and MRO Software, Inc. acquisitions are shown separately given

their significant purchase prices.

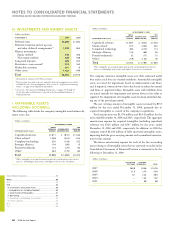

MICROMUSE, INC.– On February 15, 2006, the company acquired

100 percent of the outstanding common shares of Micromuse, Inc. for

cash consideration of $862 million. Micromuse is a leading provider

of network management software used by banks, telecommunications

carriers, governments, retailers and other organizations to monitor

and manage their sophisticated technology infrastructures. The soft-

ware helps customers manage increasingly complex IT systems that

support the proliferation of voice, data and video traffic due to the

growing adoption of voice over IP (VoIP)-based audio and video

services delivered over the internet. The combination of Micromuse’s

software and the company’s IT services management technology can

provide a comprehensive approach to help customers reduce the com-

plexity of their IT environments, lower operational costs and address

compliance mandates. Micromuse was integrated into the Software

segment upon acquisition and Goodwill, as reflected in the table on

page 74, has been entirely assigned to the Software segment. The

overall weighted-average useful life of the intangible assets purchased,

excluding Goodwill, is 4.0 years.

In the fourth quarter, as a result of completing the integration of

Micromuse’s legal and intercompany structure into the company’s

legal structure, the company recorded an increase in current assets and

current liabilities with a corresponding offset in Goodwill totaling

$137 million. These increases relate to an increase in both deferred

tax assets and current tax liabilities. These adjustments are reflected in

the table on page 74.

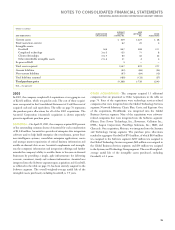

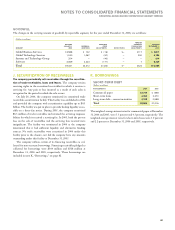

FILENET CORPORATION – On October 12, 2006, the company

acquired 100 percent of the outstanding common shares of FileNet

Corporation for cash consideration of $1,609 million. FileNet is a

leading provider of business process and content management solu-

tions that help companies simplify critical and everyday decision

making processes and give organizations a competitive advantage. The

FileNet acquisition enhances the company’s ability to meet increasing

client demand for a combination of content- and process-centric busi-

ness process management capabilities, which is driven by changing

governance and compliance mandates, as well as the need to integrate

content-centric business processes with enterprise applications. The

company has integrated its business process management and service

oriented architecture (SOA) technologies with the FileNet platform to

allow customers to access content wherever it may reside and use it in

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

73