IBM 2006 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT DISCUSSION

INTERNATIONAL BUSINESS MACHIN ES CORPORATION AND SUBSI DIARY COMPANIES

44 2006 Annual Report

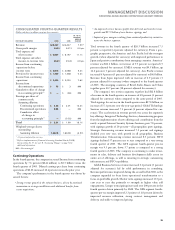

(Dollars in billions)

FOR THE YEAR ENDED DECEMBER 31: 2006 2005 2004 2003 2002

Net cash from operating activities

(Continuing Operations): $. $. $. $. $.

Less: Global Financing accounts receivable (.) . . . .

Net cash from operating activities (Continuing

Operations), excluding Global Financing receivables . . . . .

Investing Activities:

Capital expenditures, net (.) (.) (.) (.) (.)

Global Financing accounts receivable (.) . . . .

Global Financing debt . (.) (.) (.) (.)

Net Global Financing debt to accounts receivable . . . (.) .

Acquisitions (.) (.) (.) (.) (.)

Divestitures — . — . .

Return to shareholders:

Share Repurchase (.) (.) (.) (.) (.)

Dividends (.) (.) (.) (.) (.)

Change in non-Global Financing debt (.) . . (.) (.)

Other . . . . .

Discontinued operations — — (.) (.) (.)

Change in cash, cash equivalents

and short-term marketable securities $ (.) $ . $ . $ . $ (.)

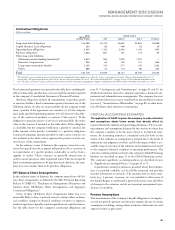

Events that could temporarily change the historical cash flow dynam-

ics discussed above include significant changes in operating results,

material changes in geographic sources of cash, unexpected adverse

impacts from litigation or future pension funding during periods of

severe and prolonged downturn in the capital markets. Whether any

litigation has such an adverse impact will depend on a number of

variables, which are more completely described on page 91. With

respect to pension funding, in the first quarter of 2006, the company

contributed approximately $1 billion to the U.K. pension plan, and on

January 19, 2005, the company contributed $1.7 billion to the quali-

fied portion of the PPP, a U.S. defined benefit plan. As highlighted in

the Contractual Obligations table on page 45, the company expects to

make legally mandated pension plan contributions to certain non-

U.S. plans of approximately $2.6 billion in the next five years. The

company is not quantifying any further impact from pension funding

because it is not possible to predict future movements in the capital

markets or pension plan funding regulations. As discussed in note B,

“Accounting Changes,” on page 71, the company implemented SFAS

No. 158 effective December 31, 2006. The effects of applying SFAS

No. 158 on the Consolidated Statement of Financial Position are

highlighted in the table on page 101. The adoption of SFAS No. 158

will have no impact on the company’s existing debt covenants, credit

ratings or financial flexibility.

The Pension Protection Act of 2006 (the Act) was enacted into law

in 2006, and, among other things, increases the funding requirements

for certain U.S. defined benefit plans beginning after December 31,

2007. The company currently does not expect the Act to have a mate-

rial effect on the company’s minimum mandatory contributions to its

U.S. defined benefit plan.

capital expenditures, invested $12.0 billion in strategic acquisitions,

received $2.3 billion from divestitures and returned $37.7 billion to

shareholders through dividends and share repurchases. The amount of

prospective returns to shareholders in the form of dividends and share

repurchases will vary based upon several factors including each year’s

operating results, capital expenditures, research and development and

acquisitions, as well as the factors discussed following the table below.

The company’s Board of Directors meets quarterly to consider the

dividend payment. The company expects to fund dividend payments

through cash from operations. In the second quarter of 2006, the

Board of Directors increased the company’s quarterly common stock

dividend from $0.20 to $0.30 per share.

The table below represents the way in which management reviews

cash flow as described on page 43.

Management Discussion ........................................................

Road Map .............................................................................

Forward-Looking and Cautionary Statements .....................

Management Discussion Snapshot ......................................

Description of Business .......................................................

Year in Review......................................................................

Prior Year in Review .............................................................

Discontinued Operations .....................................................

Other Information ................................................................

Global Financing ..................................................................

Report of Management .........................................................

Report of Independent Registered Public Accounting Firm ....

Consolidated Statements .......................................................

Black

MAC

2718 CG10