IBM 2006 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

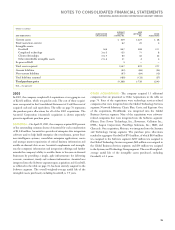

SHIPPING AND HANDLING

Costs related to shipping and handling are included in Cost in the

Consolidated Statement of Earnings.

EXPENSE AND OTHER INCOME

Selling, General and Administrative

Selling, general and administrative (SG&A) expense is charged to

income as incurred. Expenses of promoting and selling products and

services are classified as selling expense and include such items as

advertising, sales commissions and travel. General and administrative

expense includes such items as compensation, office supplies, non-

income taxes, insurance and office rental. In addition, general and

administrative expense includes other operating items such as a pro-

vision for doubtful accounts, workforce accruals for contractually

obligated payments to employees terminated in the ongoing course of

business, amortization of certain intangible assets and environmental

remediation costs. Certain special actions discussed in note R, “2005

Actions,” on pages 93 and 94 are also included in SG&A.

Advertising and Promotional Expense

The company expenses advertising and promotional costs when

incurred. Cooperative advertising reimbursements from vendors are

recorded net of advertising and promotional expense in the period the

related advertising and promotional expense is incurred. Advertising

and promotional expense, which includes media, agency and promo-

tional expense, was $1,195 million, $1,284 million and $1,335 million

in 2006, 2005 and 2004, respectively, and is recorded in SG&A expense

in the Consolidated Statement of Earnings.

Research, Development and Engineering

Research, development and engineering (RD&E) costs are expensed

as incurred.

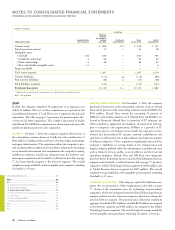

Intellectual Property and Custom

Development Income

As part of the company’s business model and as a result of the compa-

ny’s ongoing investment in research and development, the company

licenses and sells the rights to certain of its intellectual property (IP)

including internally developed patents, trade secrets and technologi-

cal know-how. Certain transfers of IP to third parties are licensing/

royalty-based and other transfers are transaction-based sales and other

transfers. Licensing/royalty-based fees involve transfers in which the

company earns the income over time, or the amount of income is not

fixed or determinable until the licensee sells future related products

(i.e., variable royalty, based upon licensee’s revenue). Sales and other

transfers typically include transfers of IP whereby the company has

fulfilled its obligations and the fee received is fixed or determinable at

the transfer date. The company also enters into cross-licensing arrange-

ments of patents, and income from these arrangements is recorded only

to the extent cash is received. Furthermore, the company earns income

from certain custom development projects for strategic technology

partners and specific clients. The company records the income from

these projects when the fee is realized or realizable and earned, is not

refundable and is not dependent upon the success of the project.

Other (Income) and Expense

Other (income) and expense includes interest income (other than

from the company’s Global Financing external business transactions),

gains and losses on certain derivative instruments, gains and losses

from securities and other investments, gains and losses from certain

real estate activity, foreign currency transaction gains and losses, gains

and losses from the sale of businesses and amounts related to accre-

tion of asset retirement obligations. Certain special actions discussed

in note R, “2005 Actions,” on pages 93 and 94 are also included in

Other (income) and expense.

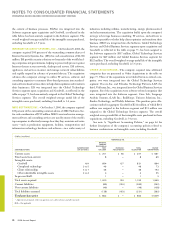

BUSINESS COMBINATIONS AND INTANGIBLE

ASSETS INCLUDING GOODWILL

The company accounts for business combinations using the

purchase method of accounting and accordingly, the assets and

liabilities of the acquired entities are recorded at their estimated fair

values at the date of acquisition. Goodwill represents the excess of the

purchase price over the fair value of net assets, including the amount

assigned to identifiable intangible assets. The company does not amor-

tize the goodwill balance. Substantially all of the company’s goodwill is

not deductible for tax purposes. The primary drivers that generate

goodwill are the value of synergies between the acquired entities and

the company and the acquired assembled workforce, neither of which

qualifies as an identifiable intangible asset. Identifiable intangible

assets with finite lives are amortized over their useful lives. See note C,

“Acquisition/Divestitures,” on pages 73 to 78 and note I, “Intangible

Assets Including Goodwill,” on pages 80 and 81, for additional infor-

mation. The results of operations of the acquired businesses were

included in the company’s Consolidated Financial Statements from the

respective dates of acquisition.

IMPAIRMENT

Assets, other than goodwill, are tested for impairment based on

undiscounted cash flows and, if impaired, written down to fair value

based on either discounted cash flows or appraised values. Goodwill

is tested annually for impairment, or sooner when circumstances

indicate an impairment may exist, using a fair-value approach at the

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

66 2006 Annual Report

Consolidated Statements .........................................................

Notes .....................................................................................

A-G ......................................................................................... 62

A. Significant Accounting Policies ....................................... 62

B. Accounting Changes........................................................ 71

C. Acquisitions/Divestitures ................................................. 73

D. Financial Instruments (excluding derivatives) ................ 78

E. Inventories ....................................................................... 79

F. Financing Receivables ...................................................... 79

G. Plant, Rental Machines and Other Property ................... 79

H-M ......................................................................................... 80

N-S .......................................................................................... 88

T-X .......................................................................................... 96

Black

MAC

390 CG10