IBM 2006 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

82 2006 Annual Report

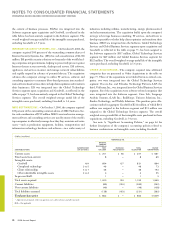

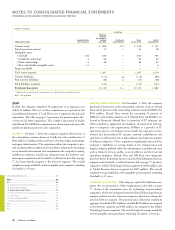

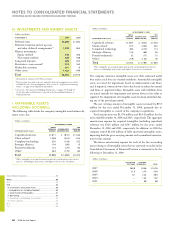

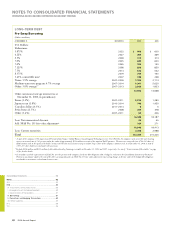

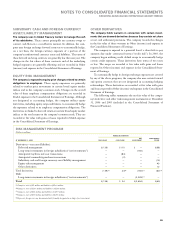

LONG-TERM DEBT

Pre-Swap Borrowing

(Dollars in millions)

AT DECEMBER 31: MATURITIES 2006 2005

U.S. Dollars:

Debentures:

5.875% $ $

6.22%

6.5%

7.0%

7.0%

7.125%

7.5%

8.375%

3.43% convertible note*

Notes: 5.9% average – , ,

Medium-term note program: 4.7% average – , ,

Other: 3.8% average** – , ,

, ,

Other currencies (average interest rate at

December 31, 2006, in parentheses):

Euros (3.4%) – , ,

Japanese yen (1.8%) – ,

Canadian dollars (6.3%) –

Swiss francs (1.5%)

Other ( 5.4%) –

, ,

Less: Net unamortized discount

Add: SFAS No. 133 fair value adjustment+

, ,

Less: Current maturities , ,

Total $, $,

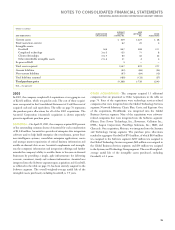

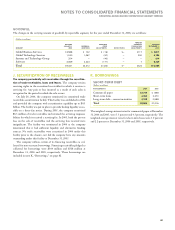

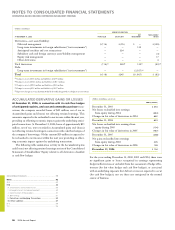

* As part of the company’s 2002 acquisition of PricewaterhouseCoopers’ Global Business Consulting and Technology Services Unit ( PwCC), the company issued convertible notes bearing

interest at a stated rate of 3.43 percent with a face value of approximately $328 million to certain of the acquired PwCC partners. The notes are convertible into 4,764,543 shares of

IBM common stock at the option of the holders at any time based on a fixed conversion price of $68.81 per share of the company’s common stock. As of December 31, 2006, a total of

2,053,267 shares had been issued under this provision.

** Includes $304 million and $318 million of debt collateralized by financing receivables at December 31, 2006 and 2005, respectively. See note J, “Securitization of Receivables,” on page

81 for further details.

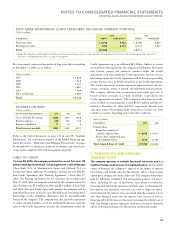

+ In accordance with the requirements of SFAS No. 133, the portion of the company’s fixed rate debt obligations that is hedged is reflected in the Consolidated Statement of Financial

Position as an amount equal to the sum of the debt’s carrying value plus an SFAS No. 133 fair value adjustment representing changes in the fair value of the hedged debt obligations

attributable to movements in benchmark interest rates.

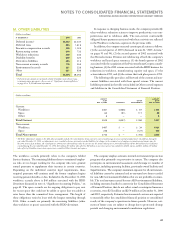

Consolidated Statements .........................................................

Notes .....................................................................................

A-G ......................................................................................... 62

H-M .........................................................................................

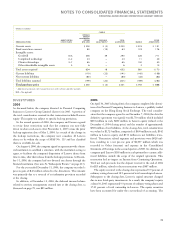

H. Investments and Sundry Assets ......................................

I. Intangible Assets Including Goodwill ...............................

J. Securitization of Receivables ...........................................

K. Borrowings .......................................................................

L. Derivatives and Hedging Transactions ............................

M. Other Liabilities ...............................................................

N-S ..........................................................................................

T-X ..........................................................................................

Black

MAC

390 CG10