IBM 2006 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

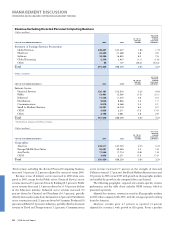

Systems and Technology Group revenue increased 4.7 percent

(4 percent adjusted for currency) in 2006 versus 2005. System z rev-

enue increased reflecting continued strong customer acceptance of

both specialty engines for Linux and Java workloads and traditional

mainframe workloads. MIPS shipments increased 11 percent versus

2005. System x revenue increased driven by increased server revenue

( 5.3 percent) and System x blades growth of 22.3 percent. IBM

BladeCenter offers clients unique power and cooling capabilities and

the flexibility to efficiently handle various workloads. In addition to

the company’s System x blades, the company offers POWER blades

and blades utilizing the Cell Broadband Engine. Total blade growth,

including System p blades, was 24.6 percent in 2006 versus 2005.

Although System p revenue declined for the year, high-end server

revenue increased 9.4 percent. In the third quarter the company com-

pleted its transition to POWER5+ and expanded the implementation

of POWER Quadcore technology to all POWER-based entry level

System p products. These transitions allowed the company to sustain

the price/performance and virtualization leadership position that

has made the company the number one UNIX vendor worldwide.

System i revenue declined as the company completed its transition to

POWER5+ in the third quarter, however clients continued to lever-

age their existing capacity.

System Storage revenue growth was driven by Total disk growth

of 7.8 percent, while tape grew 3.1 percent in 2006 versus 2005.

Within Total disk, mid-range disk revenue increased 16.5 percent and

storage area network products increased 10.6 percent, while enter-

prise products revenue declined 6.7 percent in 2006 versus 2005. The

revenue increase in tape products was primarily driven by the new

tape security offering which includes unique encryption capabilities.

Microelectronics revenue increased due to strong demand in the

game processor business and networking components.

Retail Stores Solutions revenue increased primarily due to clients

replacing older technology in favor of integrated retail solutions.

Printing Systems revenue decreased due primarily to lower mainte-

nance revenue as a result of a declining install base and lower sales of

hardware products.

Personal Computing Division revenue decreased as a result of the

company divesting its Personal Computing business to Lenovo on

April 30, 2005. The 2006 results do not include any revenue while the

2005 results include four months of revenue. See note C, “Acquisitions/

Divestitures,” on pages 77 and 78 for additional information.

(Dollars in millions)

YR. TO YR.

FOR THE YEAR ENDED DECEMBER 31: 2006 2005 CHANGE

Hardware:

Gross profit $, $, (.)%

Gross profit margin .% .% . pts.

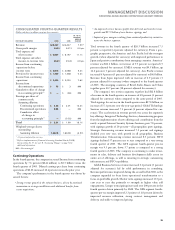

The decrease in gross profit dollars for 2006 versus 2005 was primarily

due to the absence of the Personal Computing business. The increase

in gross profit margin was also primarily due to the divestiture of the

Personal Computing business (which had a lower gross profit margin

than the other hardware products) in the second quarter of 2005.

This divestiture contributed 3.5 points of the improvement in the

Hardware margin.

Systems and Technology Group gross profit margins declined 2.7

points to 37.7 percent in 2006 versus 2005. The decline in gross profit

margin was driven by revenue mix towards lower margin products in

2006 versus 2005 (2.5 points) and pricing pressure in the company’s

low- and mid-range server brands.

Differences between the Hardware segment gross profit margin

and gross profit dollar amounts above and the amounts reported on

page 25 (and derived from page 56) primarily relate to the impact of

certain cost hedging transactions (see “Anticipated Royalties and Cost

Transactions” on page 84) as well as the ongoing warranty costs asso-

ciated with the divested Personal Computing business. The recorded

amounts for these transactions are considered unallocated corporate

amounts for purposes of measuring the segment’s gross margin perfor-

mance and therefore are not included in the segment results above.

Software

(Dollars in millions)

YR. TO YR.

FOR THE YEAR ENDED DECEMBER 31: 2006 2005* CHANGE

Software segment revenue: $, $, .%

Middleware $, $, .%

Key Branded Middleware , , .

WebSphere family .

Information Management .

Lotus .

Tivoli .

Rational .

Other middleware , , (.)

Operating systems , , (.)

Product Lifecycle

Management , , .

Other .

* Reclassified to conform with 2006 presentation.

Software revenue increased 7.9 percent (7 percent adjusted for cur-

rency) in 2006 versus 2005 reflecting strong demand for the company’s

industry-leading middleware capabilities. The revenue growth was

driven from both organic sources and the company’s targeted acquisi-

tions. The company’s leadership in technology and innovation has

allowed it to continue to capitalize on industry trends such as SOA

and Information on Demand.

Key Branded Middleware is made up of five key brands which

provide an integrated suite for the company’s customers. All five

brands grew in 2006, reflecting continued momentum and benefit

from the company’s sales and development investments along with

additional benefit from acquisitions.

MANAGEMENT DISCUSSION

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

31

Black

MAC

2718 CG10