IBM 2006 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Black

MAC

390 CG10

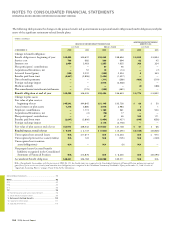

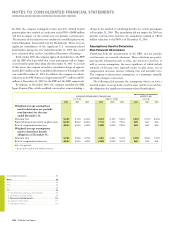

Equity securities include IBM common stock in the amounts of

$159 million (0.3 percent of total PPP plan assets) at December 31,

2006 and $139 million (0.3 percent of total PPP plan assets) at

December 31, 2005.

Outside the U.S., the investment objectives are similar, subject to

local regulations. In some countries, a higher percentage allocation to

fixed income securities is required. In others, the responsibility for

managing the investments typically lies with a board that may include

up to 50 percent of members elected by employees and retirees. This

can result in slight differences compared with the strategies previously

described. Generally, these non-U.S. funds do not invest in illiquid

assets, such as private equities, and their use of derivatives is usually

limited to currency hedging, adjusting portfolio durations and reduc-

ing specific market risks. There was no significant change in the

investment strategies of these plans during either 2006 or 2005.

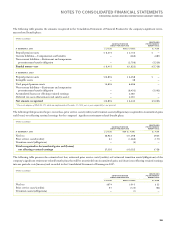

Expected Contributions

DEFINED BENEFIT PENSION PLANS

It is the company’s general practice to fund amounts for pensions suf-

ficient to meet the minimum requirements set forth in applicable

employee benefits laws and local tax laws. From time to time, the

company contributes additional amounts as it deems appropriate.

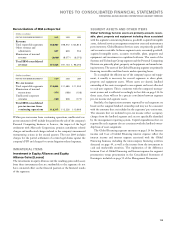

The company contributed approximately $1,769 million and $561

million in cash to the material non-U.S. plans during the years ended

December 31, 2006 and 2005, respectively. During the year ended

December 31, 2005, the company contributed approximately $1,715

million in cash to the qualified portion of the PPP.

In 2007, the company is not legally required to make any contribu-

tions to the PPP. However, depending on market conditions, or other

factors, the company may elect to make discretionary contributions to

the qualified portion of the PPP during the year.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

109

The Pension Protection Act of 2006 (the Act), enacted into law in

2006, is a comprehensive reform package that, among other provisions,

increases pension funding requirements for certain U.S. defined benefit

plans, provides guidelines for measuring pension plan assets and pension

obligations for funding purposes and raises tax deduction limits for con-

tributions to retirement-related benefit plans. The additional funding

requirements by the Act apply to plan years beginning after December

31, 2007. The adoption of the Act is not expected to have a material

effect on the company’s minimum mandatory contributions to its PPP.

In 2007, the company estimates contributions to its non-U.S.

plans to be approximately $560 million, which will be mainly contrib-

uted to defined benefit pension plans in Germany, the Netherlands,

Spain, Switzerland, Sweden and the United Kingdom. These 2007

contributions represent legally mandated minimum contributions to

the company’s non-U.S. plans. The company could elect to contribute

more than the legally mandated amount based on market conditions

or other factors.

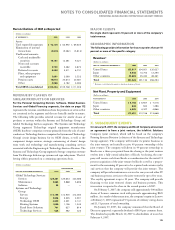

NONPENSION POSTRETIREMENT BENEFIT PLANS

The U.S. nonpension postretirement benefit plan is reviewed in

order to determine the amount of company contributions, if any. In

2007, the company expects its contributions to the U.S. nonpension

postretirement benefit plan will approximate the total expected ben-

efit payments.

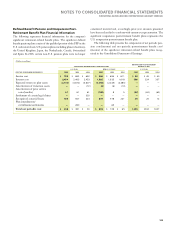

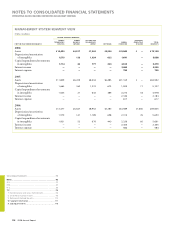

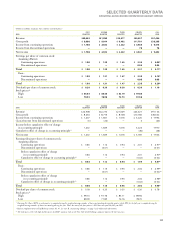

Expected Benefit Payments

DEFINED BENEFIT PENSION PLAN EXPECTED PAYMENTS

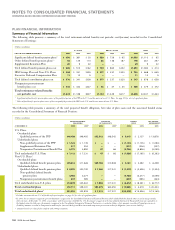

The following table presents the total expected benefit payments to

defined benefit pension plan participants. These payments have been

estimated based on the same assumptions used to measure the plans’

PBO at December 31, 2006 and include benefits attributable to esti-

mated future compensation increases.

(Dollars in millions)

TOTAL

QUALIFIED NON-QUALIFIED QUALIFIED NON-QUALIFIED EXPECTED

U.S. PLAN U.S. PLAN NON-U.S. PLANS NON-U.S. PLANS BENEFIT

PAYMENTS PAYMENTS PAYMENTS PAYMENTS PAYMENTS

2007 $ ,* $ $, $ $ ,

2008 , , ,

2009 , , ,

2010 , , ,

2011 , , ,

2012-2016 , , , ,

* The 2007 total expected benefit payments to defined benefit pension plan participants of the qualified portion of the PPP include approximately $160 million of the $320 million related

to the PPP lawsuit settlement; the remaining settlement amount will be spread over a 10-year period starting in 2007. See note O, “Contingencies and Commitments,” on page 89 for

further information.

The 2007 expected benefit payments to defined benefit pension plan participants not covered by the respective plan assets represent a component

of Compensation and benefits, within Current liabilities, in the Consolidated Statement of Financial Position.