IBM 2006 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Black

MAC

390 CG10

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

99

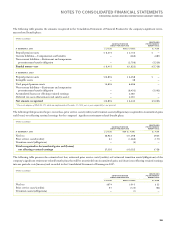

In connection with various acquisition transactions, there were an

additional 3.2 million options outstanding at December 31, 2006, as a

result of the company’s assumption of options granted by the acquired

entities. The weighted-average exercise price of these options was

$77 per share.

Exercises of Employee Stock Options

The total intrinsic value of options exercised during the years ended

December 31, 2006, 2005 and 2004 was $727 million, $470 million

and $651 million, respectively. The total cash received from employ-

ees as a result of employee stock option exercises for the years ended

December 31, 2006, 2005 and 2004 was approximately $1,149 mil-

lion, $550 million and $661 million, respectively. In connection with

these exercises, the tax benefits realized by the company for the years

ended December 31, 2006, 2005 and 2004 were $242 million, $148

million and $225 million, respectively.

The company settles employee stock option exercises primarily

with newly issued common shares and, occasionally, with treasury

shares. Total treasury shares held at December 31, 2006 and 2005

were approximately 502 million and 407 million shares, respectively.

Stock Awards

In addition to stock options, the company grants its employees stock

awards. These awards are made in the form of Restricted Stock

Units ( RSUs) or Performance Stock Units (PSUs). RSUs are stock

awards granted to employees that entitle the holder to shares of

common stock as the award vests, typically over a two- to five-year

period. The fair value of the awards is determined and fixed on the

grant date based on the company’s stock price. During the year

ended December 31, 2006, the company modified its equity com-

pensation plans to increase awards of RSUs compared to stock

options. RSUs awarded during the years ended December 31, 2005

and 2004 were not material when compared to the value of stock

options awarded during the respective years.

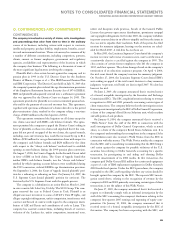

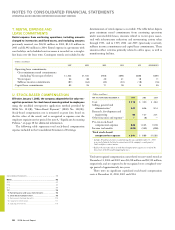

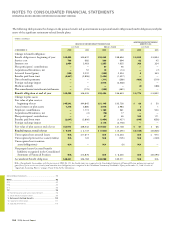

The following table summarizes RSU activity under the Plans

during the year ended December 31, 2006:

WTD. AVG. NUMBER

GRANT PRICE OF UNITS

Balance at January 1 $ ,,

RSUs granted ,,

RSUs released (,,)

RSUs canceled/forfeited (,)

Balance at December 31 $ ,,

The remaining weighted-average contractual term of RSUs at

December 31, 2006 is the same as the period over which the remaining

cost of the awards will be recognized, which is approximately three

years. The fair value of RSUs granted during the year ended

December 31, 2006 was $410 million. The total fair value of RSUs

vested and released during the year ended December 31, 2006 was

$79 million. As of December 31, 2006, there was $501 million of

unrecognized compensation cost related to nonvested RSUs. The

company received no cash from employees as a result of employee

vesting and release of RSUs for the year ended December 31, 2006.

In connection with employee vesting and release of RSUs, the tax

benefit realized by the company for the year ended December 31,

2006 was $59 million.

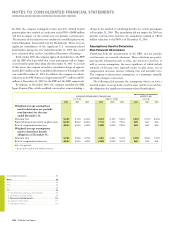

PSUs are stock awards where the number of shares ultimately

received by the employee depends on the company’s performance

against specified targets and typically vest over a three-year period.

The fair value of each PSU is determined on the date of grant, based

on the company’s stock price, and assumes that performance targets

will be achieved. Over the performance period, the number of shares

of stock that will be issued is adjusted upward or downward based

upon the probability of achievement of performance targets. The

ultimate number of shares issued and the related compensation cost

recognized as expense will be based on a comparison of the final per-

formance metrics to the specified targets. The fair value of PSUs

granted during the year ended December 31, 2006 was $104 million.

Total fair value of PSUs vested and released during the year ended

December 31, 2006 was $67 million.

IBM EMPLOYEES STOCK PURCHASE PLAN

The company maintains an Employees Stock Purchase Plan (ESPP).

The ESPP enables eligible participants to purchase full or fractional

shares of IBM common stock through payroll deductions of up to 10

percent of eligible compensation. Eligible compensation includes any

compensation received by the employee during the year. The ESPP

provides for offering periods during which shares may be purchased

and continues as long as shares remain available under the ESPP,

unless terminated earlier at the discretion of the Board of Directors.

Individual ESPP participants are restricted from purchasing more

than $25,000 of common stock in one calendar year or 1,000 shares

in an offering period.

Prior to April 1, 2005, the ESPP was considered compensatory

under the provisions of SFAS No. 123(R). The share price paid by an

employee prior to April 1, 2005 was the lesser of 85 percent of the

average market price on the first business day of each offering period

or 85 percent of the average market price on the last business day of

each pay period. Effective April 1, 2005, the company modified the

terms of the plan whereas eligible participants may purchase full or

fractional shares of IBM common stock under the ESPP at a five

percent discount off the average market price on the day of the pur-

chase. In accordance with the provisions of SFAS No. 123(R), effective

April 1, 2005, the ESPP is not considered compensatory.