IBM 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Black

MAC

390 CG10

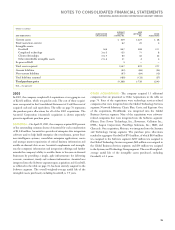

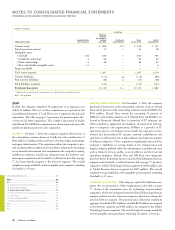

ESTIMATED RESIDUAL VALUES OF LEASE ASSETS

The recorded residual values of the company’s lease assets are

estimated at the inception of the lease to be the expected fair

value of the assets at the end of the lease term. The company periodi-

cally reassesses the realizable value of its lease residual values. Any

anticipated increases in specific future residual values are not recog-

nized before realization through remarketing efforts. Anticipated

decreases in specific future residual values that are considered to be

other-than-temporary are recognized immediately upon identification

and are recorded as an adjustment to the residual-value estimate. For

sales-type and direct financing leases, this reduction lowers the recorded

net investment and is recognized as a loss charged to finance income

in the period in which the estimate is changed, as well as an adjust-

ment to unearned income to reduce future-period finance income.

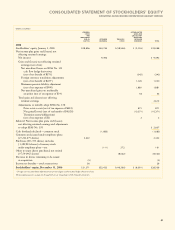

COMMON STOCK

Common stock refers to the $.20 par value capital stock as desig-

nated in the company’s Certificate of Incorporation. Treasury stock

is accounted for using the cost method. When treasury stock is reissued,

the value is computed and recorded using a weighted-average basis.

EARNINGS PER SHARE OF COMMON STOCK

Earnings per share of common stock—basic is computed by divid-

ing Net income by the weighted-average number of common

shares outstanding for the period. Earnings per share of common

stock—assuming dilution, reflects the maximum potential dilution

that could occur if securities or other contracts to issue common stock

were exercised or converted into common stock and would then share

in the net income of the company. See note S, “Earnings Per Share of

Common Stock,” on page 95 for additional information.

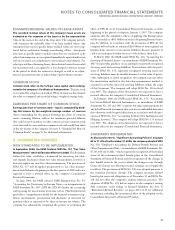

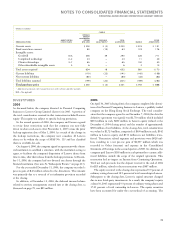

B. ACCOUNTING CHANGES

NEW STANDARDS TO BE IMPLEMENTED

In September 2006, the FASB finalized SFAS No. 157, “Fair Value

Measurements,” which will become effective in 2008. This Statement

defines fair value, establishes a framework for measuring fair value,

and expands disclosures about fair value measurements; however, it

does not require any new fair value measurements. The provisions of

SFAS No. 157 will be applied prospectively to fair value measure-

ments and disclosures beginning in the first quarter of 2008 and is not

expected to have a material effect on the company’s Consolidated

Financial Statements.

In June 2006, the FASB released FASB Interpretation No. 48,

“Accounting for Uncertainty in Income Taxes—an interpretation of

FASB Statement No. 109” ( FIN 48). FIN 48 clarifies the accounting

and reporting for uncertainties in income tax law. This Interpretation

prescribes a comprehensive model for the financial statement recog-

nition, measurement, presentation and disclosure of uncertain tax

positions taken or expected to be taken in income tax returns. The

company has substantially completed the process of evaluating the

effect of FIN 48 on its Consolidated Financial Statements as of the

beginning of the period of adoption, January 1, 2007. The company

estimates that the cumulative effects of applying this Interpretation

will be recorded as a $0.1 billion increase to beginning Retained earn-

ings. In addition, in accordance with the provisions of FIN 48, the

company will reclassify an estimated $2.0 billion of unrecognized tax

benefits from current to non-current liabilities because payment of

cash is not anticipated within one year of the balance sheet date.

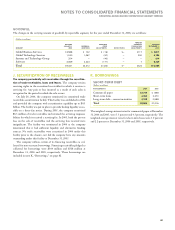

In March 2006, the FASB issued SFAS No. 156, “Accounting for

Servicing of Financial Assets—an amendment of FASB Statement No.

140,” that provides guidance on accounting for separately recognized

servicing assets and servicing liabilities. In accordance with the provi-

sions of SFAS No. 156, separately recognized servicing assets and

servicing liabilities must be initially measured at fair value, if practi-

cable. Subsequent to initial recognition, the company may use either

the amortization method or the fair-value measurement method to

account for servicing assets and servicing liabilities within the scope

of this Statement. The company will adopt SFAS No. 156 in fiscal

year 2007. The adoption of this Statement is not expected to have a

material effect on the company’s Consolidated Financial Statements.

In February 2006, the FASB issued SFAS No. 155, “Accounting

for Certain Hybrid Financial Instruments—an amendment of FASB

Statements No. 133 and 140,” to permit fair value remeasurement for

any hybrid financial instrument that contains an embedded derivative

that otherwise would require bifurcation in accordance with the pro-

visions of SFAS No. 133, “Accounting for Derivative Instruments and

Hedging Activities.” The company will adopt SFAS No. 155 in fiscal

year 2007. The adoption of this Statement is not expected to have a

material effect on the company’s Consolidated Financial Statements.

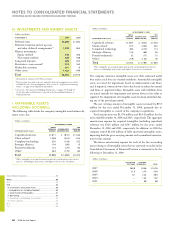

STANDARDS IMPLEMENTED

As discussed in note A, “Significant Accounting Policies,” on pages

62 to 71, effective December 31, 2006, the company adopted SFAS

No. 158, “Employer’s Accounting for Defined Benefit Pension and

Other Postretirement Plans—an amendment of FASB Statements No.

87, 88, 106 and 132(R),” which requires the recognition of the funded

status of the retirement-related benefit plans in the Consolidated

Statement of Financial Position and the recognition of the changes in

that funded status in the year in which the changes occur through

Gains and ( losses) not affecting retained earnings, net of applicable

tax effects. The provisions of SFAS No. 158 were adopted pursuant to

the transition provisions therein. The company measures defined

benefit plan assets and obligations as of December 31 and SFAS No.

158 did not affect the company’s existing valuation practices. The

adoption of SFAS No. 158 had no impact on the company’s existing

debt covenants, credit ratings or financial flexibility. See note V,

“Retirement-Related Benefits,” on pages 100 to 111 for additional

information, including the incremental effect of the adoption on the

Consolidated Statement of Financial Position.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

71