IBM 2006 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

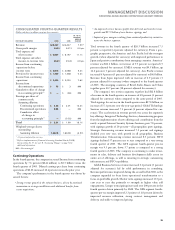

The following is an analysis of the reportable segment results for

Global Services, Hardware and Software. The Global Financing analy-

sis is included in the Global Financing section on pages 49 and 50.

Global Services

Global Services revenue increased 2.4 percent (2.0 percent adjusted

for currency) in 2005 versus 2004.

(Dollars in millions)

YR. TO YR.

FOR THE YEAR ENDED DECEMBER 31: 2005 2004 CHANGE

Global Services

segment revenue: $, $, .%

Global Technology Services $, $, .%

Strategic Outsourcing , , .

Integrated Technology

Services , , .

Business Transformation

Outsourcing , .

Maintenance , , .

Global Business Services $, $, (.)%

Global Technology Services revenue increased 4.7 percent (4 percent

adjusted for currency). Although SO revenue continued to grow

( 3.5 percent), it experienced a slowdown in its revenue growth rate

due to the impact of high levels of backlog erosion experienced in

2004 and the cumulative effect of lower signings, starting in 2004

through the first quarter of 2005. SO revenue growth was driven by

EMEA (10 percent) and Asia Pacific (1 percent), while the Americas

was essentially flat. ITS signings were down 7 percent in 2005 versus

2004. The ITS business is more dependent upon short-term signings

for revenue growth and signings declines in the third and fourth

quarter impacted the overall revenue growth rate (1.3 percent) for

2005. The company began to rebalance its ITS offerings and shift its

business development and delivery capabilities and skills to higher

growth areas in the third quarter of 2005. The company’s BTO busi-

ness continued its strong year-to-year growth (59.2 percent) due to

signings performance in both 2004 and 2005. Revenue growth was

strong across all geographies.

Global Business Services revenue decreased 1.8 percent (2 per-

cent adjusted for currency) in 2005 versus 2004. Revenue declined 10

percent in both Asia Pacific and EMEA and increased in the Americas

by 14 percent. The company’s Consulting and Systems Integration

business had many areas of growth, with strong performance in the

Strategy and Change and Supply Chain Management practices. This

overall growth was mitigated by weakness year to year in Japan,

Germany and the company’s Federal Business in the U.S. However,

across all practices, the company drove improved resource utilization

and pricing trends remained stable to improving.

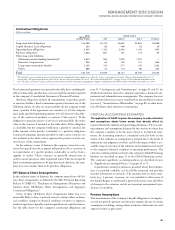

Hardware

(Dollars in millions)

YR. TO YR.

FOR THE YEAR ENDED DECEMBER 31: 2005 2004 CHANGE

Hardware segment revenue: $, $, (.)%

Systems and Technology

Group $, $, .%

System z (.)

System i .

System p .

System x .

System Storage .

Microelectronics .

Engineering &

Technology Services .

Retail Store Solutions (.)

Printing Systems (.)

Personal Computing Division , , NM

NM—Not meaningful

Systems and Technology Group revenue increased 5.0 percent (5

percent adjusted for currency) in 2005 versus 2004. System p server

revenue increased 14.6 percent with double-digit growth in all geog-

raphies as clients continue to recognize the strength and leadership of

the POWER architecture. In October 2005, the company announced

a new POWER5+ processor that included the industry’s first Quad

Core Module, which puts four processor cores on a single piece of

ceramic. System i server revenue increased 0.8 percent driven by

broad demand for the company’s POWER5 based offerings. In 2005,

System i added over 2,500 new clients, reflecting a continued commit-

ment to the platform from ISVs, resellers and clients. Within System x,

server revenue increased 7 percent despite strong competitive pressures

driving lower prices, particularly in EMEA and Asia. The company’s

momentum in Blades remained strong with revenue growth of 65

percent in 2005 versus 2004. Although System z server revenue

declined 7.6 percent versus 2004, MIPS volumes grew 7 percent in

2005. The MIPS growth was driven by the company’s new System z9

which began shipping in late September 2005. System z clients con-

tinued to add new workloads to this platform as they build their on

demand infrastructure. These new workloads have accelerated Java

and Linux adoption on the System z platform.

System Storage revenue growth (15.3 percent) was driven by Total

disk revenue growth of 19 percent, while tape grew 9 percent in 2005

versus 2004. Within External disk, mid-range disk and enterprise

products both had strong revenue growth of approximately 24 per-

cent in 2005 versus 2004.

MANAGEMENT DISCUSSION

INTERNATIONAL BUSINESS MACHIN ES CORPORATION AND SUBSI DIARY COMPANIES

39

Black

MAC

2718 CG10