IBM 2006 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Black

MAC

390 CG10

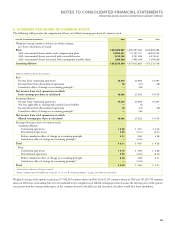

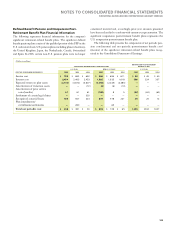

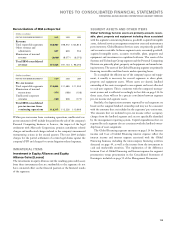

The following table presents the amounts recognized in the Consolidated Statement of Financial Position for the company’s significant retire-

ment-related benefit plans:

(Dollars in millions)

NONPENSION

SIGNIFICANT DEFINED POSTRETIREMENT

BENEFIT PENSION PLANS BENEFIT PLANS

AT DECEMBER 31, 2006: U.S. PLAN NON-U.S. PLANS U.S. PLAN

Prepaid pension assets $ , $ , $ —

Current liabilities—Compensation and benefits — () ()

Non-current liabilities—Retirement and nonpension

postretirement benefit obligation — (,) (,)

Funded status—net $ , $(,) $(,)

AT DECEMBER 31, 2005*:

Prepaid pension assets $, $ , $ —

Intangible assets — —

Total prepaid pension assets , , —

Non-current liabilities—Retirement and nonpension

postretirement benefit obligation — (,) (,)

Accumulated losses not affecting retained earnings — , —

Deferred tax assets (Investments and sundry assets) — , —

Net amount recognized $, $ , $(,)

* Due to the adoption of SFAS No. 158, which was implemented at December 31, 2006, year-to-year comparibility is not practical.

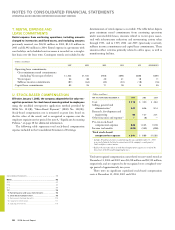

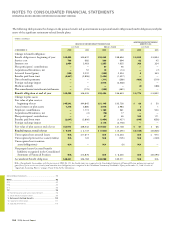

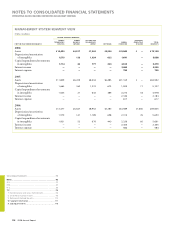

The following table presents the pre-tax net loss, prior service costs/(credits) and transition assets/(obligations) recognized in Accumulated gains

and (losses) not affecting retained earnings for the company’s significant retirement-related benefit plans:

(Dollars in millions)

NONPENSION

SIGNIFICANT DEFINED POSTRETIREMENT

BENEFIT PENSION PLANS BENEFIT PLANS

AT DECEMBER 31, 2006: U.S. PLAN NON-U.S. PLANS U.S. PLAN

Net loss $, $, $

Prior service costs/(credits) (,) ()

Transition assets/(obligations) — () —

Total recognized in Accumulated gains and (losses)

not affecting retained earnings $, $, $

The following table presents the estimated net loss, estimated prior service costs/(credits) and estimated transition assets/(obligations) of the

company’s significant retirement-related benefit plans that will be amortized from Accumulated gains and (losses) not affecting retained earnings

into net periodic cost/(income) and recorded in the Consolidated Statement of Earnings in 2007:

(Dollars in millions)

NONPENSION

SIGNIFICANT DEFINED POSTRETIREMENT

BENEFIT PENSION PLANS BENEFIT PLANS

U.S. PLAN NON-U.S. PLANS U.S. PLAN

Net loss $ $ $

Prior service costs/(credits) () ()

Transition assets/(obligations) — () —

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

105