IBM 2006 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT DISCUSSION

INTERNATIONAL BUSINESS MACHIN ES CORPORATION AND SUBSI DIARY COMPANIES

43

The amount of IP and custom development income has been

declining in recent years, down 5 percent in 2006 and 19 percent in

2005. A moderate declining trend may continue as the company does

not expect IP income to be a contributor to growth. The overall level

of IP income is dependent on several factors: divestitures, industry

consolidation, economic conditions and the timing of new patents and

know-how development.

The company’s business is designed to be measured over the long

term. The strategies that the company deploys, investments and any

other actions are implemented with an objective of optimizing the

company’s long-term performance. In the coming year, the company

expects to take actions to continue its transformation and improve the

business. These actions are done within the framework of managing

the business for sustainability and to deliver the company’s long-term

objective of 10 to 12 percent earnings per share growth.

Income Taxes

The company expects that its effective tax rate in 2007 will be

approximately 28.5 percent. This rate is lower than the company’s

historical expected tax rate of 30 percent due to an expectation of a

more favorable mix of income in lower tax jurisdictions. The rate will

change year to year based on non-recurring events, such as the settle-

ment of income tax audits, as well as recurring factors including the

geographic mix of income before taxes, the timing and amount of

foreign dividend repatriation, state and local taxes and the effects of

various global income tax strategies.

In 2006 and 2005, the company’s cash tax rate was approximately

16 percent.

The company’s cash tax rate represents the amount of income taxes

paid during the year over Income from continuing operations before

income taxes. The cash tax rate differs from the company’s effective tax

rate due to a number of variables including, but not limited to, certain

items of income and expense that are recognized in different years for

financial reporting purposes than for income tax purposes, differences

in currency rates used in the translation of the non-U.S. income tax

provision and income tax payments and current year cash tax payments

or refunds that are related to prior years. The company anticipates that

its cash tax rate will increase in the near term as the company has now

fully utilized its U.S. federal tax credit carryforwards.

LIQUIDITY AND CAPITAL RESOURCES

The company has consistently generated strong cash flow from

operations, providing a source of funds ranging between $13.8

billion and $15.3 billion per year over the past five years. The company

provides for additional liquidity through several sources; maintaining

a sizable cash balance, access to global funding sources and a commit-

ted global credit facility. The following table provides a summary of

these major sources of liquidity for the years ended December 31,

2002 through 2006.

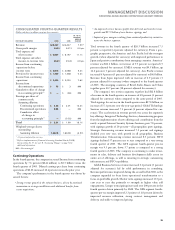

Cash Flow and Liquidity Trends

(Dollars in billions)

2006 2005 2004 2003 2002

Net cash from

operating activities $. $. $. $. $.

Cash and short-term

marketable securities $. $. $. $ . $ .

Size of global

credit facilities $. $. $. $. $.

Trade receivables

securitization facility $ — $ . $ . $ — $ —

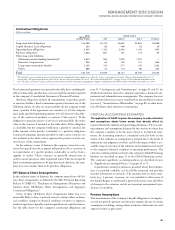

The major rating agencies’ ratings on the company’s debt securities at

December 31, 2006 appear in the following table and remain

unchanged over the past five years. The company has no contractual

arrangements that, in the event of a change in credit rating, would

result in a material adverse effect on its financial position or liquidity.

STANDARD MOODY’S

AND INVESTORS FITCH

POOR’S SERVICE RATINGS

Senior long-term debt A+ A AA-

Commercial paper A- Prime- F+

The company prepares its Consolidated Statement of Cash Flows in

accordance with SFAS No. 95, “Statement of Cash Flows,” on page 58

and highlights causes and events underlying sources and uses of cash in

that format on page 33. For purposes of running its business, the com-

pany manages, monitors and analyzes cash flows in a different format.

As discussed on page 49, one of the company’s two primary objec-

tives of its Global Financing business is to generate strong return on

equity. Increasing receivables is the basis for growth in a financing

business. Accordingly, management considers Global Financing receiv-

ables as a profit-generating investment, not as working capital that

should be minimized for efficiency. After classifying Global Financing

accounts receivables as an investment, the remaining net cash flow is

viewed by the company as the Cash available for investment and for

distribution to shareholders. With respect to the company’s cash flow

analysis for internal management purposes (see the table on page 44),

Global Financing accounts receivables are combined with Global

Financing debt to represent the Net Global Financing debt to accounts

receivable (a profit-generating investment).

From the perspective of how management views cash flows, in

2006, net cash from operating activities, excluding Global Financing

receivables, was $15.3 billion, an increase of $2.2 billion compared to

2005. This cash performance was driven primarily by the growth in

net income from continuing operations, continued focus on working

capital and lower pension funding year over year. The company

returned over 100 percent of net income in 2006 to shareholders in

dividend payments and share repurchases.

Over the past five years, the company generated over $64.3 billion

in Cash available for investment and for distribution to shareholders. As

a result, during that period the company invested $20.5 billion of net

Black

MAC

2718 CG10