IBM 2006 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Black

MAC

390 CG10

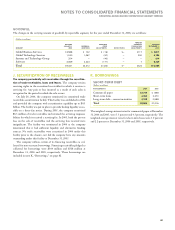

O. CONTINGENCIES AND COMMITMENTS

CONTINGENCIES

The company is involved in a variety of claims, suits, investigations

and proceedings that arise from time to time in the ordinary

course of its business, including actions with respect to contracts,

intellectual property, product liability, employment, benefits, securi-

ties and environmental matters. These actions may be commenced by

a number of different constituents, including competitors, partners,

clients, current or former employees, government and regulatory

agencies, stockholders and representatives of the locations in which

the company does business. The following is a discussion of some of

the more significant legal matters involving the company.

Plaintiffs filed a class-action lawsuit against the company and its

pension plan in 1999 in the U.S. District Court for the Southern

District of Illinois, Cooper et al. v. The IBM Personal Pension Plan

and IBM Corporation. The District Court held on July 31, 2003 that

the company’s pension plan violated the age discrimination provisions

of the Employee Retirement Income Security Act of 1974 (ERISA).

IBM and plaintiffs subsequently entered into a settlement agreement

that was approved by the District Court on August 16, 2005. The

agreement provides for plaintiffs to receive incremental pension ben-

efits and for the payment of costs and attorneys fees. This agreement,

together with a previous settlement of a claim referred to as the partial

plan termination claim, resulted in the company taking a one-time

charge of $320 million in the third quarter of 2004.

This agreement terminated the litigation on all claims except for

two claims associated with IBM’s cash balance formula. The agree-

ment permitted the company to appeal the District Court’s ruling in

favor of plaintiffs on these two claims and stipulated that if the com-

pany did not prevail on appeal of the two claims, the agreed remedy,

including costs and attorneys fees, would be increased by up to $1.4

billion—$780 million for an age discrimination claim with respect to

the company’s cash balance formula and $620 million for the claim

with respect to the “always cash balance” method used to establish

opening account balances during the 1999 pension plan conversion.

On August 7, 2006, the Court of Appeals for the Seventh Circuit ruled

in favor of IBM on both claims. The Court of Appeals found that

neither IBM’s cash balance formula, nor the “always cash balance”

method by which opening account balances were established during

the 1999 conversion, violated ERISA’s age discrimination provision.

On September 1, 2006, the Court of Appeals denied plaintiffs’ peti-

tion for a rehearing or rehearing en banc. On January 16, 2007, the

U.S. Supreme Court denied plaintiffs’ petition for certiorari. The

decision by the U.S. Supreme Court ends the appeals process.

The company is a defendant in an action filed on March 6, 2003

in state court in Salt Lake City, Utah by The SCO Group. The com-

pany removed the case to Federal Court in Utah. Plaintiff is an

alleged successor in interest to some of AT&T’s Unix IP rights, and

alleges copyright infringement, unfair competition, interference with

contract and breach of contract with regard to the company’s distri-

bution of AIX and Dynix and contribution of code to Linux. The

company has asserted counterclaims, including breach of contract,

violation of the Lanham Act, unfair competition, intentional torts,

unfair and deceptive trade practices, breach of the General Public

License that governs open source distributions, promissory estoppel

and copyright infringement. In October 2005, the company withdrew

its patent counterclaims in an effort to simplify and focus the issues in

the case and to expedite their resolution. Each of the parties has filed

motions for summary judgment; hearings on the motions are sched-

uled for March 2007. A trial date has not been set.

In May 2005, the Louisiana Supreme Court denied the company’s

motion to review and reverse a Louisiana state court’s certification of

a nationwide class in a case filed against the company in 1995. The

class consists of certain former employees who left the company in

1992, and their spouses. They claim damages based on the company’s

termination of an education assistance program. On April 4, 2006,

the trial court denied the company’s motion for summary judgment.

On October 27, 2006, the Louisiana Supreme Court denied IBM’s

writ seeking an appeal of the trial court’s decision to deny summary

judgment. At present, trial briefs are due in April 2007. No date has

been set for trial.

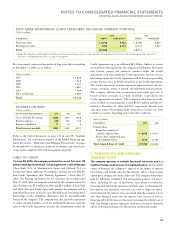

On June 2, 2003, the company announced that it received notice

of a formal, nonpublic investigation by the Securities and Exchange

Commission (SEC). The SEC sought information relating to revenue

recognition in 2000 and 2001 primarily concerning certain types of

client transactions. The company believes that the investigation arises

from a separate investigation by the SEC of Dollar General Corporation,

a client of the company’s Retail Stores Solutions unit, which markets

and sells point-of-sale products.

On January 8, 2004, the company announced that it received a

“Wells Notice” from the staff of the SEC in connection with the

staff’s investigation of Dollar General Corporation, which as noted

above, is a client of the company’s Retail Stores Solutions unit. It is

the company’s understanding that an employee in the company’s Sales

& Distribution unit also received a Wells Notice from the SEC in

connection with this matter. The Wells Notice notifies the company

that the SEC staff is considering recommending that the SEC bring a

civil action against the company for possible violations of the U.S.

securities laws relating to Dollar General’s accounting for a specific

transaction, by participating in and aiding and abetting Dollar

General’s misstatement of its 2000 results. In that transaction, the

company paid Dollar General $11 million for certain used equipment

as part of a sale of IBM replacement equipment in Dollar General’s

2000 fourth fiscal quarter. Under the SEC’s procedures, the company

responded to the SEC staff regarding whether any action should be

brought against the company by the SEC. The separate SEC investi-

gation noted above, relating to the recognition of revenue by the

company in 2000 and 2001 primarily concerning certain types of client

transactions, is not the subject of this Wells Notice.

On June 27, 2005, the company announced that it had received a

request to voluntarily comply with an informal investigation by the

staff of the SEC concerning the company’s disclosures relating to the

company’s first-quarter 2005 earnings and expensing of equity com-

pensation. On January 12, 2006, the company announced that it

received notice of a formal, nonpublic investigation by the SEC of

this matter. The company has been cooperating with the SEC, and

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

89