Berkshire Hathaway 2013 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion (Continued)

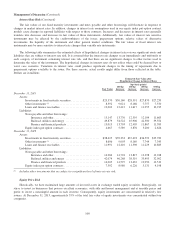

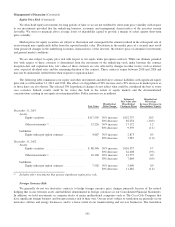

Property and casualty losses (Continued)

General Re and BHRG

Liabilities for unpaid property and casualty losses and loss adjustment expenses of our General Re and BHRG underwriting

units derive primarily from assumed reinsurance. Additional uncertainties are unique to the processes used in estimating such

reinsurance liabilities. The nature, extent, timing and perceived reliability of information received from ceding companies varies

widely depending on the type of coverage, the contractual reporting terms (which are affected by market conditions and

practices) and other factors. Contract terms, conditions and coverages tend to lack standardization and may evolve more rapidly

than under primary insurance policies. We are unable to reliably measure the ongoing economic impact of such uncertainties.

The nature and extent of loss information provided under many facultative, per occurrence excess or retroactive contracts

may not differ significantly from the information received under a primary insurance contract. This occurs when our personnel

either work closely with the ceding company in settling individual claims or manage the claims themselves. However, loss

information related to aggregate excess-of-loss contracts, including catastrophe losses and quota-share treaties, is often less

detailed. Occasionally, loss information is reported in a summary format rather than on an individual claim basis. Loss data is

usually provided through periodic reports and may include the amount of ceded losses paid where reimbursement is sought as

well as case loss reserve estimates. Ceding companies infrequently provide IBNR estimates to reinsurers.

Each of our reinsurance businesses has established practices to identify and gather needed information from clients. These

practices include, for example, comparison of expected premiums to reported premiums to help identify delinquent client

reports and claim reviews to facilitate loss reporting and identify inaccurate or incomplete claim reporting. We periodically

evaluate and modify these practices as conditions, risk factors and unanticipated areas of exposures are identified.

The timing of claim reporting to reinsurers is typically delayed in comparison with claim reporting to primary insurers. In

some instances, multiple reinsurers assume and cede parts of an underlying risk thereby causing multiple contractual

intermediaries between us and the primary insured. In these instances, the claim reporting delays are compounded. The relative

impact of reporting delays on the reinsurer varies depending on the type of coverage, contractual reporting terms and other

factors. Contracts covering casualty losses on a per occurrence excess basis may experience longer delays in reporting due to the

length of the claim-tail as regards to the underlying claim. In addition, ceding companies may not report claims until they

conclude it is reasonably possible that the reinsurer will be affected, usually determined as a function of its estimate of the claim

amount as a percentage of the reinsurance contract retention. However, the timing of reporting large per occurrence excess

property losses or property catastrophe losses may not vary significantly from primary insurance.

Under contracts where periodic premium and claims reports are required from ceding companies, such reports are

generally required at quarterly intervals which in the U.S. range from 30 to 90 days after the end of the accounting period.

Outside the U.S., reinsurance reporting practices vary. In certain countries, clients report annually, often 90 to 180 days after the

end of the annual period. The different client reporting practices generally do not result in a significant increase in risk or

uncertainty as the actuarial reserving methodologies are adjusted to compensate for the delays.

Premium and loss data is provided to us through at least one intermediary (the primary insurer), so there is a risk that the

loss data provided is incomplete, inaccurate or the claim is outside the coverage terms. Information provided by ceding

companies is reviewed for completeness and compliance with the contract terms. Generally, we are permitted under the

contracts to access the cedant’s books and records with respect to the subject business, thus providing us the ability to conduct

audits to determine the accuracy and completeness of information. Audits are conducted as we deem appropriate.

In the normal course of business, disputes with clients occasionally arise concerning whether certain claims are covered

under our reinsurance policies. We resolve most coverage disputes through the involvement of our claims department personnel

93